Tax Vermont GovfilesdocumentsVermont Department of Taxes *211531100* Schedule in 153 Form

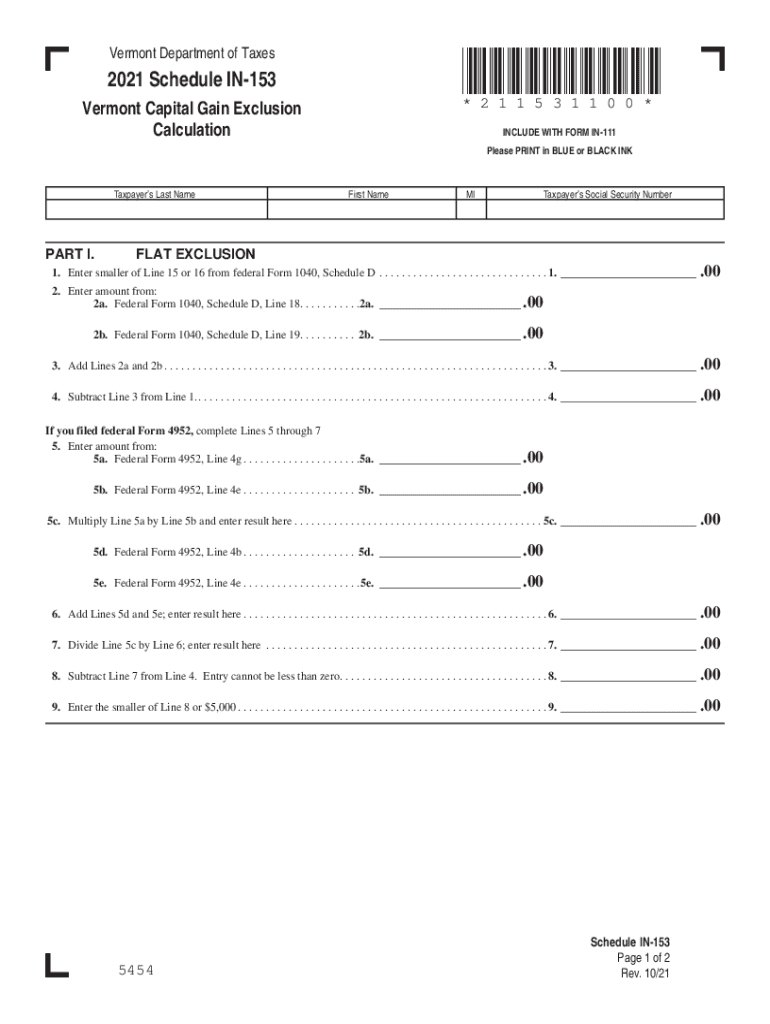

Understanding the Vermont 153 Form

The Vermont 153 form, also known as the Schedule IN 153, is a crucial document for individuals and businesses in Vermont seeking to report their capital gains and losses. This form is essential for calculating the state tax obligations related to capital assets. It is specifically designed to capture information about the sale or exchange of capital assets, ensuring that taxpayers comply with Vermont tax laws.

Steps to Complete the Vermont 153 Form

Completing the Vermont 153 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to your capital assets, including purchase and sale records. Next, fill out the form by entering details such as the date of acquisition, sale price, and any associated costs. It is important to calculate your capital gains or losses accurately, as this will affect your overall tax liability. Finally, review the completed form for any errors before submission.

Legal Use of the Vermont 153 Form

The Vermont 153 form is legally recognized for reporting capital gains and losses in accordance with state tax regulations. To ensure that your submission is valid, it is essential to adhere to the guidelines outlined by the Vermont Department of Taxes. This includes providing accurate information and ensuring that all required fields are completed. Using a reliable eSignature solution can further enhance the legal standing of your submitted form, as it ensures compliance with eSignature laws.

Filing Deadlines and Important Dates

Timely submission of the Vermont 153 form is critical to avoid penalties. The filing deadline typically aligns with the federal tax deadline, which is usually April 15. However, it is advisable to check for any specific state extensions or changes to deadlines. Keeping track of these dates will help ensure that you fulfill your tax obligations without incurring late fees.

Required Documents for the Vermont 153 Form

When preparing to file the Vermont 153 form, certain documents are necessary to support your claims. These may include:

- Purchase and sale agreements for capital assets

- Records of any improvements made to the assets

- Documentation of expenses related to the sale

- Previous tax returns, if applicable

Having these documents on hand will facilitate a smoother filing process and ensure that your information is accurate and complete.

Examples of Using the Vermont 153 Form

There are various scenarios where the Vermont 153 form is applicable. For instance, if an individual sells a piece of real estate, they must report any capital gains or losses from that transaction using this form. Similarly, businesses that sell equipment or other capital assets must also complete the Vermont 153 to report their financial outcomes. Understanding these examples can help taxpayers recognize when they need to utilize this form.

Quick guide on how to complete taxvermontgovfilesdocumentsvermont department of taxes 211531100 2021 schedule in 153

Effortlessly prepare Tax vermont govfilesdocumentsVermont Department Of Taxes *211531100* Schedule IN 153 on any device

Managing documents online has become increasingly popular for businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Tax vermont govfilesdocumentsVermont Department Of Taxes *211531100* Schedule IN 153 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Tax vermont govfilesdocumentsVermont Department Of Taxes *211531100* Schedule IN 153 with ease

- Find Tax vermont govfilesdocumentsVermont Department Of Taxes *211531100* Schedule IN 153 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important parts of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it onto your computer.

Say goodbye to lost or misaligned files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax vermont govfilesdocumentsVermont Department Of Taxes *211531100* Schedule IN 153 to ensure exceptional communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Vermont 153 fill form used for?

The Vermont 153 fill form is primarily used for tax purposes in the state of Vermont. It allows users to report their income, claim deductions, and calculate their tax liabilities efficiently. Utilizing airSlate SignNow for this process streamlines the filing experience, ensuring that the Vermont 153 fill is completed accurately and submitted on time.

-

How can I fill out the Vermont 153 fill form using airSlate SignNow?

To fill out the Vermont 153 fill form using airSlate SignNow, simply upload the form to our platform. Our user-friendly interface allows you to enter information directly into the fields. Once you finish, you can eSign and send the document, making your tax submission fast and secure.

-

Is there a cost associated with using airSlate SignNow for Vermont 153 fill?

Yes, there is a subscription fee for using airSlate SignNow, which offers various pricing plans tailored to meet different needs. These plans provide access to features such as document eSigning and form filling, including the Vermont 153 fill form. It's a cost-effective solution compared to traditional methods of document management.

-

What features does airSlate SignNow offer for completing the Vermont 153 fill?

airSlate SignNow offers features such as template creation, document collaboration, and secure eSigning specifically tailored for forms like the Vermont 153 fill. With these tools, users can efficiently manage their documents, ensuring accuracy and compliance with state requirements while simplifying the overall process.

-

Can I integrate airSlate SignNow with other software for Vermont 153 fill?

Absolutely! airSlate SignNow allows integration with various software solutions, enhancing the ability to manage the Vermont 153 fill efficiently. This means you can connect it with CRM systems, cloud storage options, and other applications to streamline your document workflows and improve productivity.

-

What are the benefits of using airSlate SignNow for Vermont 153 fill?

Using airSlate SignNow for the Vermont 153 fill form provides several benefits, including reduced paperwork and improved turnaround time. The platform guarantees that your documents are secure and compliant with state regulations, while also allowing for easy collaboration and access to signed forms anytime, anywhere.

-

Is airSlate SignNow user-friendly for filling out the Vermont 153 fill?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to fill out the Vermont 153 fill form. Our intuitive interface allows users to navigate the process quickly, even if they are not tech-savvy. You'll find that creating, signing, and managing your form is straightforward and efficient.

Get more for Tax vermont govfilesdocumentsVermont Department Of Taxes *211531100* Schedule IN 153

- Jury grand form

- Oklahoma jury form

- Oklahoma privacy form

- Oklahoma answer form

- Garnishee answer form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497323271 form

- Oklahoma annual file form

- Notices resolutions simple stock ledger and certificate oklahoma form

Find out other Tax vermont govfilesdocumentsVermont Department Of Taxes *211531100* Schedule IN 153

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement