It 558 Form

What is the IT-558?

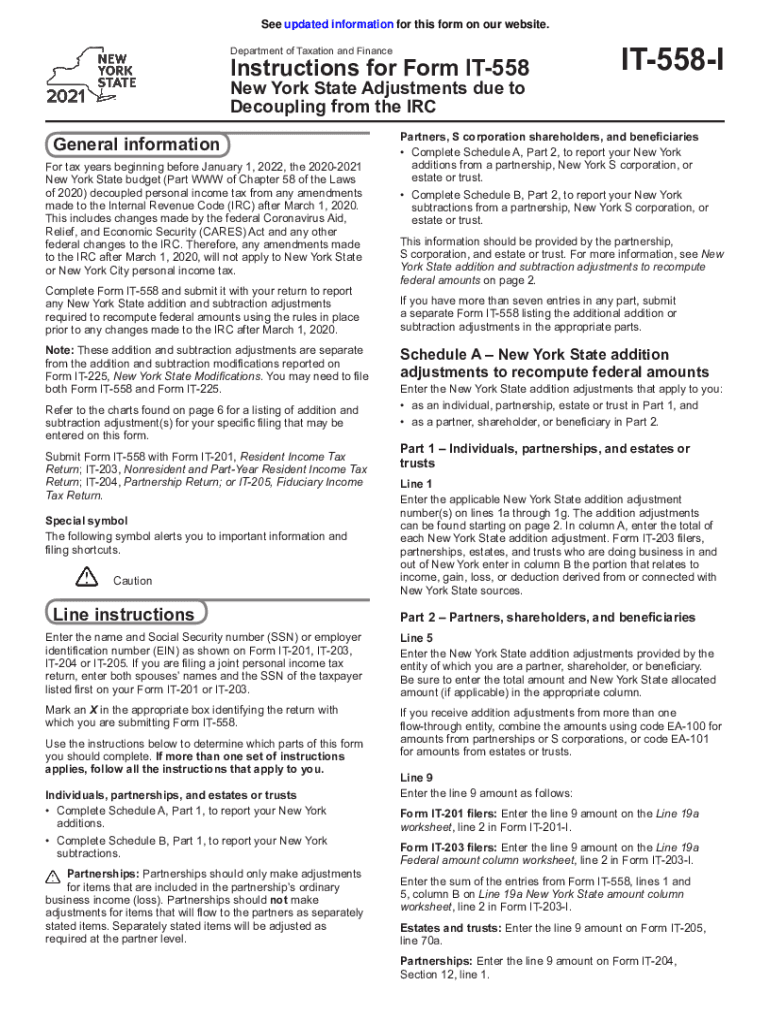

The IT-558 is a New York State tax form used to report adjustments related to the decoupling of the Internal Revenue Code (IRC) for certain tax benefits. This form is essential for taxpayers who need to make specific adjustments to their income tax calculations based on state regulations. It is particularly relevant for individuals and businesses that have made changes to their federal tax filings that affect their state tax obligations.

How to Obtain the IT-558

The IT-558 form can be easily obtained from the New York State Department of Taxation and Finance website. It is available in a downloadable PDF format, allowing taxpayers to print and fill it out manually. Additionally, the form can be accessed through various tax preparation software that supports New York State tax forms, ensuring that users can complete their filings efficiently.

Steps to Complete the IT-558

Completing the IT-558 involves several key steps:

- Begin by downloading the form from the New York State Department of Taxation and Finance website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Follow the instructions carefully to report any adjustments to your federal income, ensuring that all calculations align with the decoupling provisions.

- Review your entries for accuracy before submitting the form.

Legal Use of the IT-558

The IT-558 is legally binding when completed accurately and submitted in accordance with New York State tax laws. To ensure compliance, it is crucial to follow the guidelines set forth by the New York State Department of Taxation and Finance. This includes adhering to deadlines and providing all necessary documentation to support the adjustments being claimed.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the IT-558 to avoid penalties. Typically, the form should be filed by the same deadline as the individual or business income tax return. For most taxpayers, this means submitting the IT-558 by April 15 of the following tax year. However, extensions may apply, so it is advisable to check for specific dates each tax year.

Required Documents

When filling out the IT-558, certain documents may be required to substantiate the adjustments being claimed. These may include:

- Copies of federal tax returns and any relevant schedules.

- Documentation supporting any deductions or credits being claimed.

- Records of any income adjustments that affect state tax calculations.

Form Submission Methods

The IT-558 can be submitted through various methods, including:

- Online submission via the New York State Department of Taxation and Finance e-filing system.

- Mailing a printed copy of the completed form to the appropriate address specified in the form instructions.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete it 558

Effortlessly Prepare It 558 on Any Device

Digital document management has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to quickly create, edit, and electronically sign your documents without delays. Manage It 558 on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

Edit and eSign It 558 with Ease

- Obtain It 558 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with the specific tools offered by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal authenticity as a traditional handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you prefer to submit your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign It 558 to ensure outstanding communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the pricing structure for airSlate SignNow's it 558?

The pricing for airSlate SignNow's it 558 is designed to be affordable for businesses of all sizes. We offer flexible subscription plans that include various tiers, allowing you to choose the features that best meet your needs. Whether you're a small startup or a large enterprise, our it 558 solution provides cost-effective options without compromising quality.

-

What key features does the it 558 offer?

The it 558 from airSlate SignNow includes essential features such as customizable templates, secure e-signatures, and real-time tracking of document statuses. These features enhance the efficiency of your document workflows and ensure compliance with legal standards. By utilizing the it 558, businesses can streamline their signing processes signNowly.

-

How can the it 558 benefit my business?

By implementing the it 558 solution, your business can reduce the turnaround time for document approvals and improve overall productivity. It also minimizes paper usage, contributing to a more sustainable approach to business operations. Additionally, the intuitive interface of it 558 ensures that your team can adopt the system with ease.

-

Does airSlate SignNow's it 558 integrate with other software?

Yes, the it 558 seamlessly integrates with a variety of popular third-party applications, including CRM systems, cloud storage services, and productivity tools. This interoperability ensures that your existing workflows are enhanced rather than disrupted. You can connect the it 558 with your tools to simplify your document management processes.

-

Is the it 558 secure for sensitive documents?

Absolutely, security is a top priority for airSlate SignNow's it 558 solution. We employ advanced encryption methods and comply with industry standards to safeguard your sensitive documents. With features such as audit trails and authentication settings, you can trust that your data remains protected while using the it 558.

-

Can I customize templates with it 558?

Yes, the it 558 allows you to customize document templates to fit your business's unique needs. You can easily add fields, logos, and personalized messaging to ensure that your documents reflect your brand identity. This level of customization helps create a professional appearance while simplifying the signing process.

-

How does the it 558 support mobile users?

The it 558 solution is designed with mobile functionality in mind, allowing users to send and sign documents from their smartphones or tablets. This flexibility ensures that your team can manage document workflows on the go, enhancing accessibility and responsiveness. The mobile-friendly design of the it 558 makes it easier for everyone to participate in the signing process.

Get more for It 558

- Living trust for husband and wife with no children oklahoma form

- Living trust for individual as single divorced or widow or widower with no children oklahoma form

- Living trust for individual as single divorced or widow or widower with children oklahoma form

- Living trust for husband and wife with one child oklahoma form

- Living trust for husband and wife with minor and or adult children oklahoma form

- Amendment to living trust oklahoma form

- 497323248 form

- Financial account transfer to living trust oklahoma form

Find out other It 558

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors