Form W 4P Combo Fed & State

What is the Form W-4P Combo Fed & State

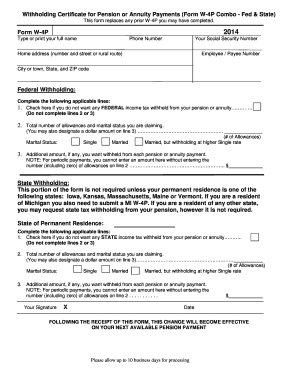

The Form W-4P Combo Fed & State is a tax form used by individuals in the United States to request federal and state tax withholding from certain payments, such as pensions or annuities. This form allows taxpayers to specify the amount of tax to be withheld from their payments, helping them manage their tax liabilities effectively. It combines both federal and state tax withholding instructions, simplifying the process for recipients of retirement benefits or other periodic payments.

How to use the Form W-4P Combo Fed & State

To use the Form W-4P Combo Fed & State, individuals should first obtain the form from the IRS or their state tax authority. After filling out the required information, including personal details and tax withholding preferences, the completed form should be submitted to the payer of the income, such as a retirement plan administrator. It's important to ensure that the information provided is accurate to avoid under-withholding or over-withholding of taxes.

Steps to complete the Form W-4P Combo Fed & State

Completing the Form W-4P Combo Fed & State involves several key steps:

- Obtain the form from the IRS or your state tax authority.

- Provide your name, address, and Social Security number.

- Indicate the type of payment you are receiving.

- Specify your marital status and the number of allowances you are claiming.

- Decide if you want additional amounts withheld.

- Sign and date the form before submitting it to your payer.

Legal use of the Form W-4P Combo Fed & State

The Form W-4P Combo Fed & State is legally valid when completed accurately and submitted to the appropriate payer. It is essential to comply with IRS regulations regarding tax withholding to ensure that the form is accepted. The form serves as a declaration of your withholding preferences and must be signed to be considered legally binding. Failure to provide accurate information may result in penalties or incorrect tax withholding.

Filing Deadlines / Important Dates

When using the Form W-4P Combo Fed & State, it is crucial to be aware of filing deadlines. Generally, the form should be submitted to the payer before the first payment is made. If changes are needed later in the year, the updated form should be submitted as soon as possible to ensure proper withholding for the remainder of the tax year. Keeping track of these deadlines helps avoid unexpected tax liabilities.

Eligibility Criteria

Eligibility to use the Form W-4P Combo Fed & State typically includes individuals receiving pension payments, annuities, or certain other types of income that require tax withholding. Taxpayers should ensure they meet the criteria set forth by the IRS and their state tax authority. It is advisable for individuals to review their specific circumstances, including income sources and tax obligations, to determine if this form is appropriate for their needs.

Quick guide on how to complete form w 4p combo fed amp state

Complete Form W 4P Combo Fed & State effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can locate the required form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly and without interruptions. Handle Form W 4P Combo Fed & State on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The most effective method to modify and eSign Form W 4P Combo Fed & State effortlessly

- Locate Form W 4P Combo Fed & State and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive details with features that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Edit and eSign Form W 4P Combo Fed & State to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 4p combo fed amp state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 4P Combo Fed & State?

The Form W 4P Combo Fed & State is a combined tax form that allows taxpayers to provide their federal and state withholding allowances efficiently. This form streamlines the process for those receiving pensions, annuities, or other similar payments, ensuring accurate tax deductions.

-

How can airSlate SignNow assist with the Form W 4P Combo Fed & State?

airSlate SignNow simplifies the process of filling out and eSigning the Form W 4P Combo Fed & State, making it easy for users to ensure their information is accurate and submitted on time. Our platform offers templates and tools that enhance document management and signature workflows.

-

What are the key features of using airSlate SignNow for Form W 4P Combo Fed & State?

Key features of airSlate SignNow for the Form W 4P Combo Fed & State include customizable templates, secure eSigning, and real-time tracking of document status. These functionalities help users manage their forms efficiently without the hassle of printing and mailing.

-

Is there a cost associated with using airSlate SignNow for the Form W 4P Combo Fed & State?

Yes, there is a cost associated with using airSlate SignNow; however, the pricing is competitive and tailored to meet various business needs. Subscriptions provide access to a range of features that enhance the efficiency of managing forms like the Form W 4P Combo Fed & State.

-

What are the benefits of utilizing airSlate SignNow for tax-related forms?

Utilizing airSlate SignNow for tax-related forms like the Form W 4P Combo Fed & State brings signNow benefits, including reduced processing time, enhanced security, and improved accuracy. Users can also track who signed and when, simplifying compliance.

-

Can I integrate airSlate SignNow with other applications for managing the Form W 4P Combo Fed & State?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enhancing your ability to manage the Form W 4P Combo Fed & State within your preferred workflow. This flexibility ensures that you can maintain productivity across multiple platforms.

-

Is airSlate SignNow easy to use for those unfamiliar with eSigning?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with eSigning. With intuitive navigation and helpful resources, you can easily learn to complete the Form W 4P Combo Fed & State.

Get more for Form W 4P Combo Fed & State

Find out other Form W 4P Combo Fed & State

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe