You May Use This Form to Revoke an Appointment of Agent for Property Tax Matters

What is the purpose of the 50-813 form?

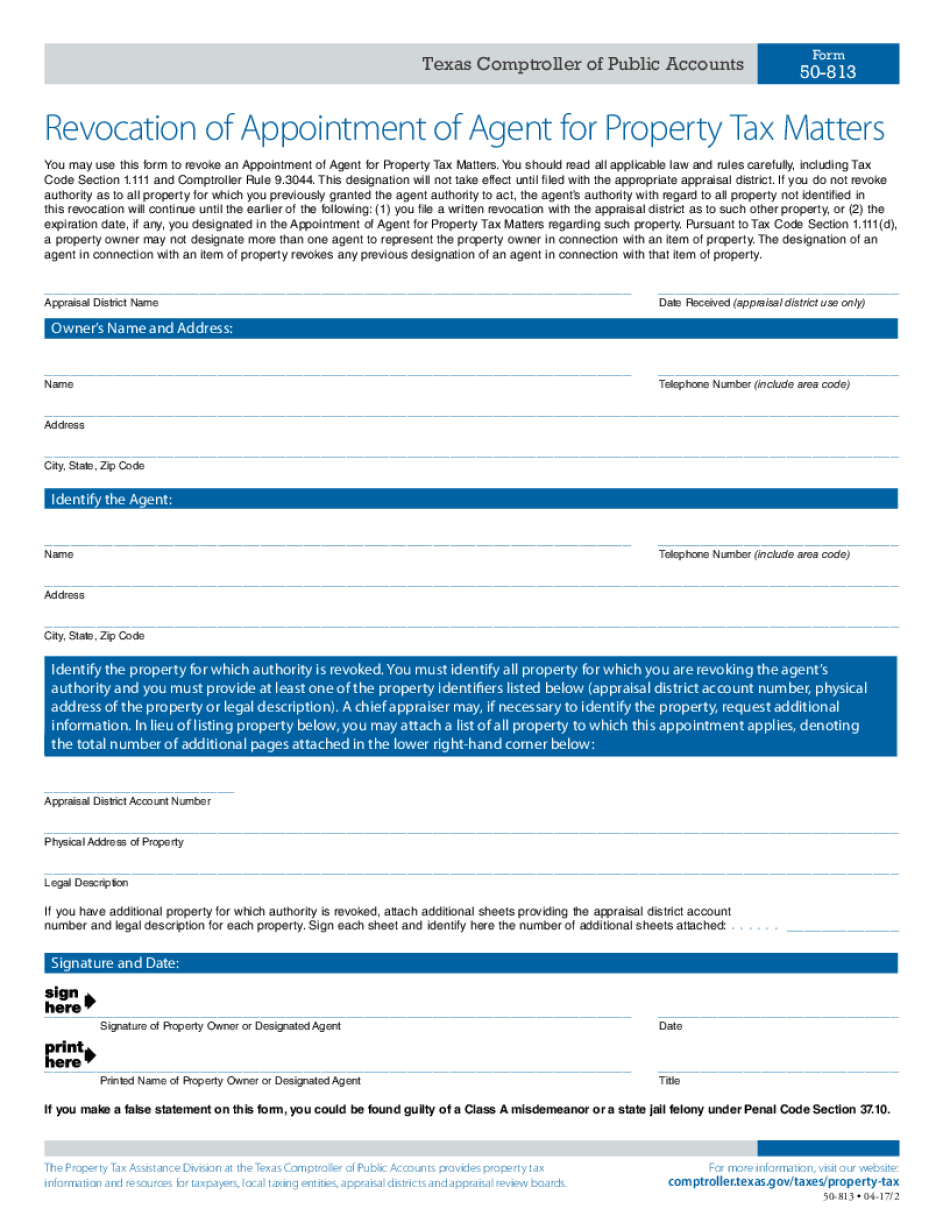

The 50-813 form is designed for individuals in Texas who wish to revoke the appointment of an agent for property tax matters. This form is essential for ensuring that the authority previously granted to an agent to manage property tax responsibilities is officially terminated. By completing this form, property owners can regain control over their tax-related decisions and ensure that their personal interests are prioritized in any dealings with tax authorities.

Steps to complete the 50-813 form

Completing the 50-813 form involves several straightforward steps:

- Obtain the form: The 50-813 form can typically be downloaded from the Texas Comptroller's website or requested from your local appraisal district.

- Fill in your details: Provide your name, address, and any relevant property identification numbers.

- Specify the agent: Clearly indicate the name of the agent whose appointment you are revoking.

- Sign and date the form: Ensure that you sign the document to validate your request.

- Submit the form: Send the completed form to the appropriate appraisal district or tax authority.

Legal use of the 50-813 form

The 50-813 form is legally recognized in Texas as a valid means to revoke an agent's authority concerning property tax matters. It is crucial that the form is filled out completely and accurately to avoid any potential disputes. The legal implications of this form ensure that once submitted, the agent's authority is effectively nullified, protecting the property owner's rights and interests in future tax dealings.

Who issues the 50-813 form?

The 50-813 form is issued by the Texas Comptroller of Public Accounts. This governmental body oversees property tax administration in Texas and provides necessary forms and guidelines for property owners. It is important to use the most current version of the form to ensure compliance with state regulations.

Form submission methods

Property owners can submit the 50-813 form through various methods:

- Online: Some appraisal districts may allow electronic submission through their websites.

- By mail: The completed form can be sent via postal service to the local appraisal district.

- In-person: Property owners can also choose to deliver the form directly to the appraisal district office.

Key elements of the 50-813 form

The 50-813 form includes several key elements that must be addressed:

- Property Owner Information: Name and address of the property owner.

- Agent Information: Name of the agent whose appointment is being revoked.

- Signature: The property owner's signature is required to validate the revocation.

- Date: The date of signing must be included to establish the timeline of the revocation.

Quick guide on how to complete you may use this form to revoke an appointment of agent for property tax matters

Prepare You May Use This Form To Revoke An Appointment Of Agent For Property Tax Matters effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage You May Use This Form To Revoke An Appointment Of Agent For Property Tax Matters on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign You May Use This Form To Revoke An Appointment Of Agent For Property Tax Matters easily

- Obtain You May Use This Form To Revoke An Appointment Of Agent For Property Tax Matters and click on Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow.

- Generate your signature with the Sign feature, which takes just moments and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select your preferred method to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign You May Use This Form To Revoke An Appointment Of Agent For Property Tax Matters to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the significance of the number 50 813 in airSlate SignNow?

The number 50 813 refers to a unique code associated with our service, which helps users identify the specific plan or offer that may suit their business needs. Understanding the features linked to 50 813 can help you choose the right solution for eSigning documents effortlessly.

-

How does airSlate SignNow simplify the eSigning process compared to other options?

AirSlate SignNow streamlines the eSigning process by offering a user-friendly interface and intuitive features under the 50 813 plan. This allows businesses to send and sign documents quickly and legally, reducing turnaround times and improving efficiency without the hassle of complicated procedures.

-

What are the key features included in the 50 813 plan?

The 50 813 plan includes crucial features like document templates, an advanced editing toolkit, and real-time tracking for sent documents. These features enable users to manage their signing processes effectively while maintaining a high level of security and compliance.

-

Is airSlate SignNow cost-effective for small businesses under the 50 813 plan?

Absolutely! The 50 813 plan is designed to be cost-effective for small businesses, offering essential features at a competitive price. By choosing this plan, small businesses can access high-quality eSigning solutions without breaking the bank, streamlining their document workflows signNowly.

-

Can airSlate SignNow integrate with other tools my business uses?

Yes, airSlate SignNow can seamlessly integrate with a variety of tools such as CRM platforms, cloud storage services, and productivity applications. This makes it easier for businesses using the 50 813 plan to incorporate eSigning into their existing workflows, enhancing overall efficiency.

-

What types of documents can I sign using the 50 813 plan?

You can sign a wide range of documents using the 50 813 plan, including contracts, agreements, forms, and more. The versatility of airSlate SignNow allows users to handle various document types, ensuring that critical transactions are executed smoothly and securely.

-

How can I ensure my documents are secure with airSlate SignNow?

AirSlate SignNow prioritizes security by using encryption and secure authentication methods, especially under the 50 813 plan. This ensures that your documents, whether being sent or signed, remain protected against unauthorized access, giving you peace of mind.

Get more for You May Use This Form To Revoke An Appointment Of Agent For Property Tax Matters

- Workers compensation claim form

- Oregon rental 497323863 form

- Apartment lease rental application questionnaire oregon form

- Residential rental lease application oregon form

- Oregon workers form

- Salary verification form for potential lease oregon

- Landlord agreement to allow tenant alterations to premises oregon form

- Notice of default on residential lease oregon form

Find out other You May Use This Form To Revoke An Appointment Of Agent For Property Tax Matters

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later