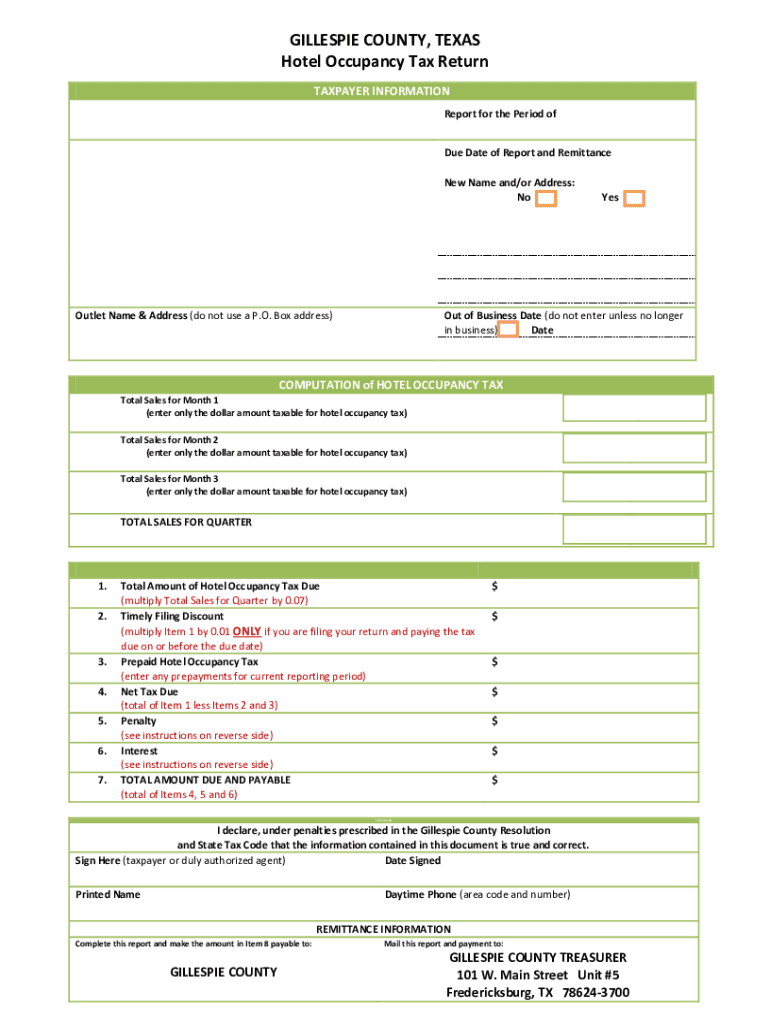

GILLESPIE COUNTY, TEXAS Hotel Occupancy Tax Return TAXPAYER INFORMATION

Understanding the Hotel Occupancy Tax Return in Gillespie County, Texas

The hotel occupancy tax return in Gillespie County is a crucial document for businesses in the hospitality sector. This tax applies to the rental of rooms in hotels, motels, and similar establishments. The revenue generated from this tax is typically used to promote tourism and support local infrastructure. It is essential for taxpayers to understand their obligations regarding this tax to ensure compliance and avoid potential penalties.

Steps to Complete the Hotel Occupancy Tax Return

Completing the hotel occupancy tax return involves several key steps. First, gather all necessary information, including revenue figures and the number of rooms rented. Next, accurately fill out the form, ensuring that all calculations are correct. After completing the form, review it for any errors before submission. Finally, submit the form by the designated deadline to avoid late fees.

Filing Deadlines and Important Dates

Timely filing of the hotel occupancy tax return is essential to avoid penalties. Generally, returns are due on a monthly or quarterly basis, depending on the volume of business. It's important to check the specific deadlines set by Gillespie County to ensure compliance. Missing these deadlines can result in fines or additional interest on unpaid taxes.

Required Documents for Submission

When submitting the hotel occupancy tax return, certain documents may be required. These typically include proof of sales, such as receipts or invoices, and any relevant financial records that support the reported figures. Having these documents ready can facilitate a smoother filing process and provide necessary evidence in case of an audit.

Penalties for Non-Compliance

Failure to comply with the hotel occupancy tax regulations can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is vital for businesses to stay informed about their tax obligations and ensure that all returns are filed accurately and on time to avoid these consequences.

Digital vs. Paper Version of the Tax Return

Businesses have the option to file the hotel occupancy tax return either digitally or via paper. Digital submissions can streamline the process, allowing for easier tracking and quicker processing times. In contrast, paper submissions may take longer to process and can be prone to delays. Choosing the right method depends on the business's needs and preferences.

Quick guide on how to complete gillespie county texas hotel occupancy tax return taxpayer information

Complete GILLESPIE COUNTY, TEXAS Hotel Occupancy Tax Return TAXPAYER INFORMATION effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage GILLESPIE COUNTY, TEXAS Hotel Occupancy Tax Return TAXPAYER INFORMATION on any device using airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to alter and eSign GILLESPIE COUNTY, TEXAS Hotel Occupancy Tax Return TAXPAYER INFORMATION with ease

- Locate GILLESPIE COUNTY, TEXAS Hotel Occupancy Tax Return TAXPAYER INFORMATION and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to retain your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign GILLESPIE COUNTY, TEXAS Hotel Occupancy Tax Return TAXPAYER INFORMATION and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What factors influence hotel occupancy in Gillespie County?

Hotel occupancy in Gillespie County can be influenced by various factors including seasonal tourist attractions, local events, and overall travel trends. Understanding these factors can help hotel managers optimize their pricing strategies and improve their occupancy rates. Additionally, being aware of peak seasons and local activities can signNowly impact bookings.

-

How can I improve hotel occupancy in Gillespie County?

To improve hotel occupancy in Gillespie County, consider investing in online marketing strategies, optimizing your presence on travel websites, and offering competitive pricing. Additionally, enhancing guest experience through excellent service and amenities can lead to positive reviews, which further drive booking rates. Promotional offers during off-peak seasons can also attract more guests.

-

What is the average hotel occupancy rate in Gillespie County?

The average hotel occupancy rate in Gillespie County can vary based on time of year and local attractions. Typically, during peak tourist seasons, occupancy rates may exceed 75%, while off-peak times may see lower rates. Monitoring these metrics helps managers forecast and strategize accordingly.

-

What amenities should I offer to increase hotel occupancy in Gillespie County?

Offering amenities such as free Wi-Fi, complimentary breakfast, and shuttle services can signNowly enhance the attractiveness of your hotel in Gillespie County. Additional features like pools, fitness centers, and pet-friendly policies often appeal to a wider audience. Tailoring amenities to meet the needs of your target market can boost occupancy rates substantially.

-

How do seasonal events affect hotel occupancy in Gillespie County?

Seasonal events can dramatically impact hotel occupancy in Gillespie County. Events such as festivals, farmers’ markets, and cultural fairs draw many visitors, leading to increased bookings during these times. Hotels can leverage these events by offering packages and promotions to attract guests.

-

What pricing strategies can I use to optimize hotel occupancy in Gillespie County?

To optimize hotel occupancy in Gillespie County, consider dynamic pricing strategies that adjust rates based on demand and local events. Offering discounts for extended stays and last-minute bookings can also entice travelers. Regularly analyzing competitor pricing can further assist in setting competitive rates.

-

Are there integration options available for hotel management systems in Gillespie County?

Yes, there are various integration options available for hotel management systems in Gillespie County. Many software solutions offer integrations with popular travel booking platforms and payment processors, which streamline operations and enhance customer experience. This connectivity helps hotels manage occupancy rates more effectively.

Get more for GILLESPIE COUNTY, TEXAS Hotel Occupancy Tax Return TAXPAYER INFORMATION

Find out other GILLESPIE COUNTY, TEXAS Hotel Occupancy Tax Return TAXPAYER INFORMATION

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy