Delaware Income Taxes and DE State Tax Forms EFile 2022-2026

What is the NYS DTF PIT?

The New York State Department of Taxation and Finance (NYS DTF) Personal Income Tax (PIT) is a tax that residents of New York State must pay on their income. This tax applies to various forms of income, including wages, salaries, and business earnings. The PIT is calculated based on a progressive tax rate structure, meaning that higher income levels are taxed at higher rates. Understanding the NYS DTF PIT is essential for compliance with state tax laws and for ensuring accurate tax filings.

Key Elements of the NYS DTF PIT Tax Payment

When making a NYS DTF PIT tax payment, several key elements must be considered. These include the amount owed, the due date for payment, and the method of payment. Taxpayers can pay their PIT through various methods, including online payments, checks, or money orders. Additionally, it is important to keep records of all payments made for future reference and potential audits.

Steps to Complete the NYS DTF PIT Tax Payment

Completing a NYS DTF PIT tax payment involves several steps. First, gather all necessary documentation, including income statements and previous tax returns. Next, calculate the total amount owed using the appropriate tax forms, such as the IT-201 for residents or IT-203 for non-residents. Once the amount is determined, choose a payment method and complete the payment process. Ensure that you keep a confirmation of the payment for your records.

Legal Use of the NYS DTF PIT Tax Payment

The NYS DTF PIT tax payment is legally binding once submitted. Taxpayers must ensure that their payments comply with the guidelines set forth by the New York State Department of Taxation and Finance. This includes adhering to deadlines and accurately reporting income. Failure to comply can result in penalties, interest charges, or legal action from the state.

Filing Deadlines for NYS DTF PIT Tax Payments

Filing deadlines for the NYS DTF PIT tax payments typically align with the federal tax deadlines. For most individuals, the due date is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these deadlines to avoid late fees and ensure timely compliance with state tax obligations.

Required Documents for NYS DTF PIT Tax Payment

To successfully complete a NYS DTF PIT tax payment, certain documents are required. These include W-2 forms from employers, 1099 forms for other income, and any relevant deductions or credits documentation. Having these documents organized and ready will facilitate a smoother filing process and help ensure accuracy in the tax payment.

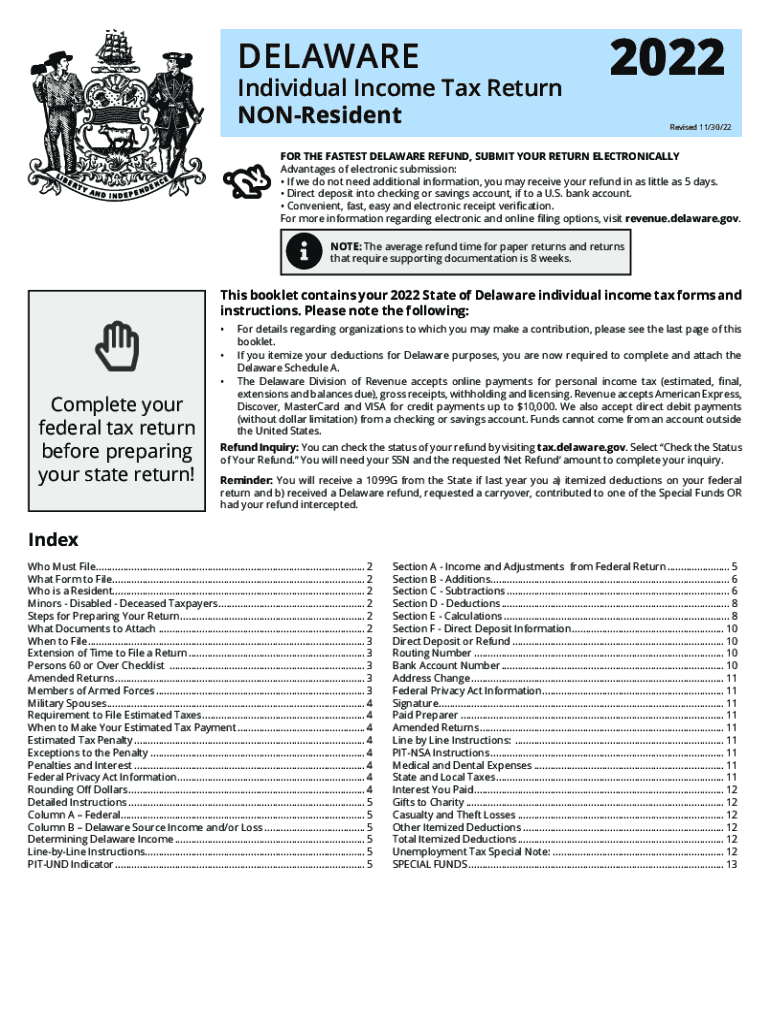

Quick guide on how to complete delaware income taxes and de state tax forms efile

Easily Prepare Delaware Income Taxes And DE State Tax Forms EFile on Any Device

The management of documents online has gained traction among both businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can obtain the appropriate form and securely store it digitally. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Delaware Income Taxes And DE State Tax Forms EFile on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Optimal Method to Modify and eSign Delaware Income Taxes And DE State Tax Forms EFile Effortlessly

- Locate Delaware Income Taxes And DE State Tax Forms EFile and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools provided specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal value as a traditional handwritten signature.

- Verify all the information and then click the Done button to confirm your changes.

- Select your preferred method for submitting your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about misplaced or lost documents, tiresome form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Delaware Income Taxes And DE State Tax Forms EFile and guarantee efficient communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delaware income taxes and de state tax forms efile

Create this form in 5 minutes!

How to create an eSignature for the delaware income taxes and de state tax forms efile

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NYS DTF PIT Tax Payment?

The NYS DTF PIT tax payment refers to the Personal Income Tax payment processed through the New York State Department of Taxation and Finance. It is crucial for residents and businesses to stay compliant with state tax obligations. Using airSlate SignNow, you can easily manage and eSign documents related to your NYS DTF PIT tax payment efficiently.

-

How can airSlate SignNow help with NYS DTF PIT Tax Payments?

airSlate SignNow streamlines the process of handling your NYS DTF PIT tax payment documents by allowing you to send, receive, and eSign forms securely. This eliminates the hassle of printing and mailing documents, ensuring that your tax payments are processed on time. With its user-friendly interface, you can focus more on your finances instead of paperwork.

-

Is there a cost associated with using airSlate SignNow for NYS DTF PIT Tax Payments?

Yes, there is a cost associated with using airSlate SignNow, but it offers a range of pricing plans that cater to individual users and businesses alike. By utilizing airSlate SignNow for your NYS DTF PIT tax payment needs, you are investing in a valuable, time-saving tool that enhances productivity and ensures compliance with state tax regulations.

-

What features does airSlate SignNow offer for managing NYS DTF PIT Tax Payments?

airSlate SignNow offers various features such as secure document sharing, eSignature capabilities, and templates designed specifically for tax forms. These features streamline the NYS DTF PIT tax payment process, making it easier to collect signatures and manage submissions electronically. The platform also provides a tracking system to monitor the status of your documents.

-

Can airSlate SignNow integrate with other tax software for NYS DTF PIT Tax Payments?

Yes, airSlate SignNow offers integrations with popular tax preparation software, which can simplify the process of handling your NYS DTF PIT tax payments. This compatibility allows you to transfer information seamlessly between platforms, ensuring accuracy and efficiency. By integrating with your existing systems, you can enhance your overall workflow.

-

How does eSigning a NYS DTF PIT Tax Payment document work with airSlate SignNow?

eSigning a NYS DTF PIT tax payment document with airSlate SignNow is straightforward. You upload your document, add the necessary fields for signatures, and then send it to the required signatories. Once signed, all parties receive a copy, and the document is securely stored, keeping your tax payment process organized and compliant.

-

What are the benefits of using airSlate SignNow for NYS DTF PIT Tax Payments?

Using airSlate SignNow for NYS DTF PIT tax payments provides numerous benefits, including faster processing times, increased security, and reduced paperwork. The ability to eSign documents eliminates the delays associated with traditional mail, ensuring that your tax payments are submitted promptly. Moreover, the platform's user-friendly features make managing your tax obligations easier.

Get more for Delaware Income Taxes And DE State Tax Forms EFile

- Flooring contract for contractor rhode island form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract rhode island form

- Notice of intent to enforce forfeiture provisions of contact for deed rhode island form

- Final notice of forfeiture and request to vacate property under contract for deed rhode island form

- Buyers request for accounting from seller under contract for deed rhode island form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed rhode island form

- General notice of default for contract for deed rhode island form

- Ri disclosure form

Find out other Delaware Income Taxes And DE State Tax Forms EFile

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter