SC2210 SC Department of Revenue 2022

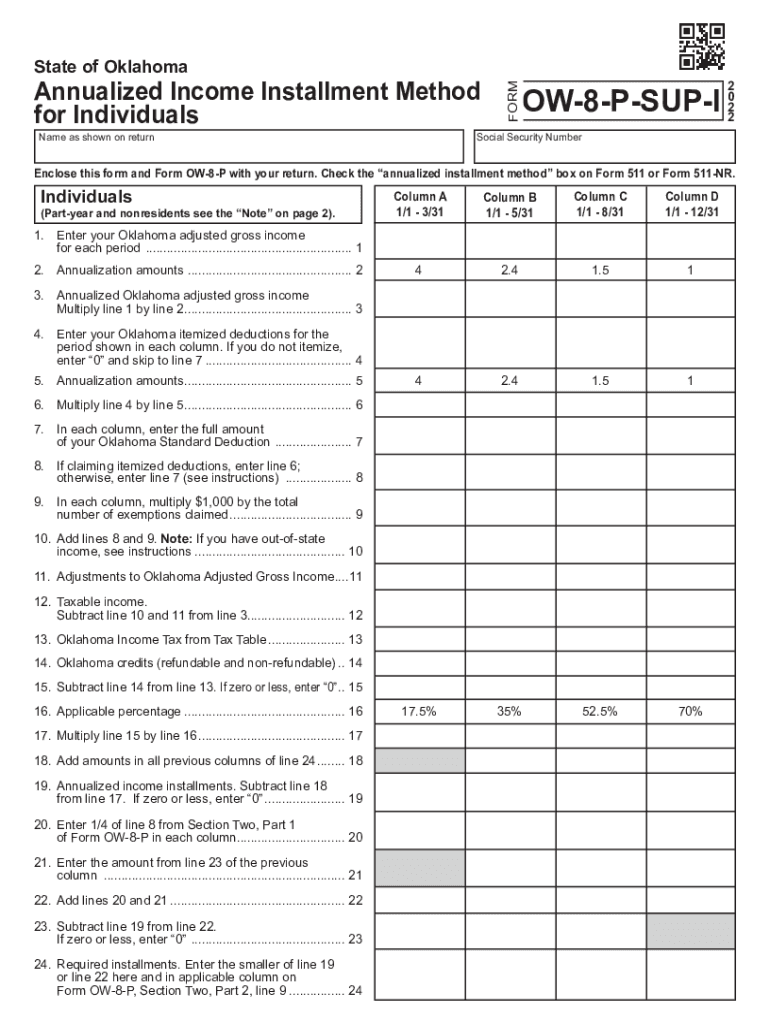

What is the OW 8 P Form?

The OW 8 P form is a crucial document used in the state of Oklahoma, primarily related to tax obligations. It is designed for taxpayers who need to report specific income or deductions, ensuring compliance with state tax regulations. This form is essential for individuals and businesses alike, as it helps in accurately calculating tax liabilities and maintaining proper records for state revenue purposes.

Steps to Complete the OW 8 P Form

Completing the OW 8 P form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary documentation, including income statements and deduction records.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your income accurately, ensuring all figures are correct and match your documentation.

- Calculate deductions and credits applicable to your situation, following state guidelines.

- Review the completed form for any errors or omissions before submission.

Legal Use of the OW 8 P Form

The OW 8 P form holds legal significance in the state of Oklahoma. It is recognized as a valid document for tax reporting, and its proper completion is essential to avoid penalties. By submitting this form, taxpayers affirm their compliance with state tax laws, which can protect them in case of audits or disputes with the tax authority.

Filing Deadlines for the OW 8 P Form

Timely submission of the OW 8 P form is critical to avoid penalties. The filing deadlines typically align with the state’s tax calendar. For most taxpayers, the deadline is April fifteenth of each year. However, specific circumstances, such as extensions or particular taxpayer situations, may alter these dates. It is advisable to verify the current year's deadlines with the Oklahoma Department of Revenue to ensure compliance.

Required Documents for the OW 8 P Form

To successfully complete the OW 8 P form, several documents are generally required:

- Income statements, such as W-2s or 1099 forms.

- Records of any deductions or credits you plan to claim.

- Previous tax returns, if applicable, for reference.

- Identification documents, such as a driver's license or Social Security card.

Penalties for Non-Compliance with the OW 8 P Form

Failure to file the OW 8 P form on time or inaccuracies in reporting can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from the state. It is crucial to adhere to all filing requirements and deadlines to mitigate these risks.

Quick guide on how to complete sc2210 sc department of revenue

Complete SC2210 SC Department Of Revenue effortlessly on any device

Web-based document management has gained prominence among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without any hassles. Manage SC2210 SC Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and electronically sign SC2210 SC Department Of Revenue smoothly

- Find SC2210 SC Department Of Revenue and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that reason.

- Generate your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your delivery method for the form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from your preferred device. Modify and electronically sign SC2210 SC Department Of Revenue while ensuring effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc2210 sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the sc2210 sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it utilize ow 8 p?

airSlate SignNow is an eSignature solution that empowers businesses to send and sign documents efficiently. By integrating the ow 8 p approach, users can streamline their document workflows while maintaining compliance and security. This means faster turnaround times and less hassle for businesses leveraging the ow 8 p method.

-

How much does airSlate SignNow cost for users interested in ow 8 p?

airSlate SignNow offers various pricing plans designed to be cost-effective, especially for users looking to utilize the ow 8 p framework. Depending on the features you need, there are flexible options ranging from basic to advanced capabilities. It's best to review the pricing page to find a plan that fits your budget while maximizing the benefits of ow 8 p.

-

What features does airSlate SignNow provide that relate to ow 8 p?

airSlate SignNow offers key features like customizable templates, real-time tracking, and robust security options that complement the ow 8 p strategy. These features enable efficient document management and help ensure all signing processes are quick and reliable. Using these capabilities, businesses can implement ow 8 p successfully within their operations.

-

Can I integrate airSlate SignNow with other tools if I use the ow 8 p solution?

Yes, airSlate SignNow seamlessly integrates with many third-party applications, enhancing the ow 8 p experience. Whether you're using project management tools, CRMs, or cloud storage services, airSlate SignNow can work with your existing systems. This integration flexibility allows for a smoother transition to the ow 8 p process.

-

What are the benefits of using airSlate SignNow with ow 8 p for my business?

Using airSlate SignNow with the ow 8 p approach can signNowly enhance your business's efficiency and productivity. It not only facilitates quick eSigning of documents but also ensures greater accuracy and compliance. By implementing this solution, you reduce operational costs and improve customer satisfaction through faster service.

-

Is airSlate SignNow easy to use for someone new to ow 8 p?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for anyone, even if they're new to the ow 8 p methodology. The intuitive interface and straightforward features allow users to quickly learn how to manage documents effectively. You'll find it easy to adopt and implement the ow 8 p framework in no time.

-

How secure is airSlate SignNow when implementing the ow 8 p process?

airSlate SignNow prioritizes the security of all documents, making it a trusted choice for businesses implementing the ow 8 p process. With encryption, two-factor authentication, and compliance with industry standards, your sensitive information remains protected. You can have peace of mind knowing that the ow 8 p framework operates on a secure platform.

Get more for SC2210 SC Department Of Revenue

- Assignment of mortgage by corporate mortgage holder south carolina form

- 30 day form 497325697

- 30 day notice to terminate month to month lease for nonresidential from landlord to tenant south carolina form

- 20 day notice to terminate tenant of will nonresidential from tenant to landlord south carolina form

- South carolina notice form

- Notice pay rent form

- Sc compensation form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property south carolina form

Find out other SC2210 SC Department Of Revenue

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request