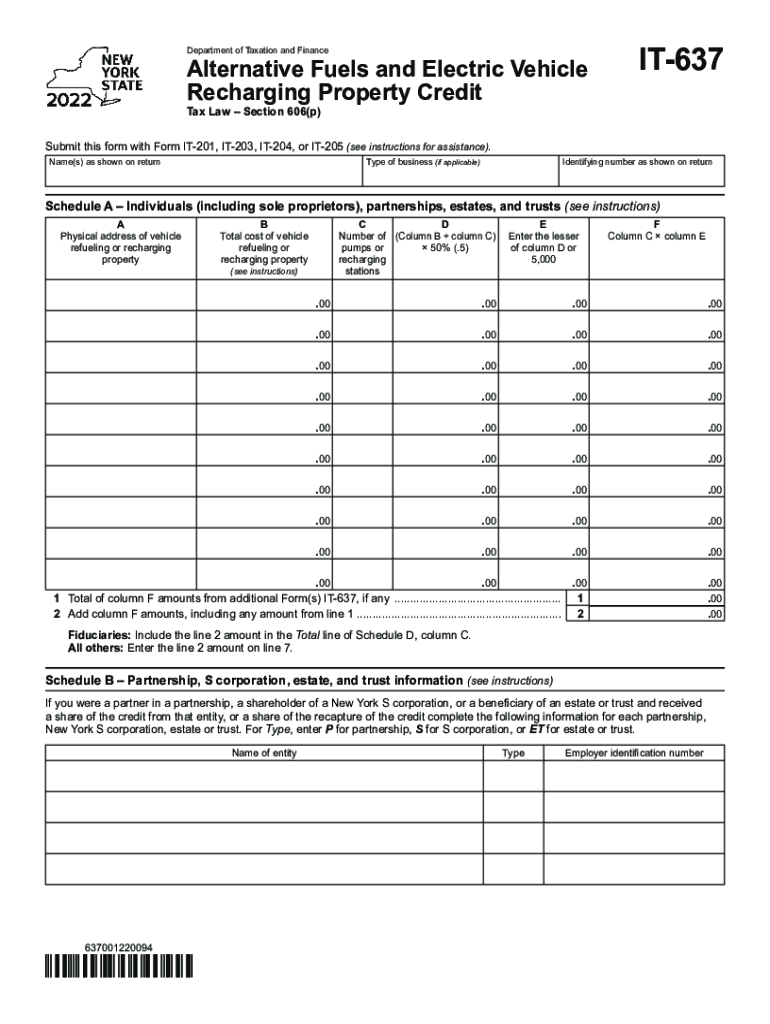

Form it 637 Alternative Fuels and Electric Vehicle Recharging 2022-2026

What is the Form 8911 for Alternative Fuels and Electric Vehicle Recharging?

The Form 8911 is a tax form used in the United States to claim a credit for alternative fuel vehicle refueling property. Specifically, this form is designed for individuals and businesses that have installed equipment for recharging electric vehicles or for fueling alternative fuel vehicles. This includes facilities that support the use of electric vehicles, such as charging stations, which can be beneficial for both environmental sustainability and financial incentives through tax credits.

Steps to Complete the Form 8911

Filling out the Form 8911 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation regarding the installation of the refueling property, including receipts and invoices. Next, complete the form by providing your personal information, details about the property, and the amount of credit you are claiming. It is essential to follow the specific instructions outlined in the form, as any inaccuracies may delay processing or lead to rejection. Finally, ensure that you sign and date the form before submission.

Eligibility Criteria for Form 8911

To qualify for the tax credit claimed on Form 8911, certain eligibility criteria must be met. The property must be used for recharging electric vehicles or fueling alternative fuel vehicles, and it must be installed at a location that is accessible to the public or used in a trade or business. Additionally, the installation must comply with local regulations and safety standards. It's important to verify that the property meets all requirements outlined by the IRS to avoid complications during the filing process.

Legal Use of Form 8911

The legal use of Form 8911 requires adherence to IRS guidelines and regulations governing tax credits for alternative fuel vehicle refueling property. Taxpayers must ensure that the equipment qualifies under the current tax law, and that they maintain proper records of the installation and usage of the refueling property. This form must be filed with your federal tax return to claim the credit, and failure to comply with the legal requirements can result in penalties or denial of the credit.

Filing Deadlines for Form 8911

Filing deadlines for Form 8911 align with the general tax filing deadlines for individuals and businesses. Typically, individual taxpayers must file their returns by April 15th of the following tax year. However, if you are filing for an extension, the deadline may be extended to October 15th. It is crucial to submit Form 8911 by these deadlines to ensure that you receive the tax credit for the eligible year.

Examples of Using Form 8911

Form 8911 can be utilized in various scenarios. For instance, a business that installs a charging station for electric vehicles on its premises can claim a credit for the installation costs. Similarly, a homeowner who installs a home charging unit for their electric vehicle may also use this form to receive tax benefits. Each example highlights the versatility of the form in promoting the use of alternative fuels and supporting environmentally friendly practices.

Quick guide on how to complete form it 637 alternative fuels and electric vehicle recharging

Complete Form IT 637 Alternative Fuels And Electric Vehicle Recharging with ease on any device

Digital document management has become favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without any holdups. Handle Form IT 637 Alternative Fuels And Electric Vehicle Recharging on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to edit and eSign Form IT 637 Alternative Fuels And Electric Vehicle Recharging without effort

- Find Form IT 637 Alternative Fuels And Electric Vehicle Recharging and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Edit and eSign Form IT 637 Alternative Fuels And Electric Vehicle Recharging to ensure excellent communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 637 alternative fuels and electric vehicle recharging

Create this form in 5 minutes!

How to create an eSignature for the form it 637 alternative fuels and electric vehicle recharging

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form 8911 instructions pdf?

The form 8911 instructions pdf provides detailed guidelines on how to claim the alternative fuel vehicle refueling property credit. It ensures that taxpayers correctly fill out the form and claim the credit efficiently, maximizing their tax benefits.

-

How can I access the form 8911 instructions pdf?

You can easily download the form 8911 instructions pdf from the IRS website. Simply navigate to the forms section, search for '8911', and you will find the PDF available for download without any fees.

-

Does airSlate SignNow support eSigning the form 8911 instructions pdf?

Yes, airSlate SignNow allows you to eSign the form 8911 instructions pdf seamlessly. With our user-friendly platform, you can upload the PDF, add your signature, and send it securely to recipients with just a few clicks.

-

What features does airSlate SignNow offer in relation to form 8911 instructions pdf?

airSlate SignNow offers advanced features like document templates, in-app comments, and secure cloud storage for managing your form 8911 instructions pdf. These tools help streamline your workflow, making it easier to organize and execute your document signing tasks.

-

Is airSlate SignNow cost-effective for businesses needing to process form 8911 instructions pdf?

Absolutely! airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. By using our service to process the form 8911 instructions pdf, you can save on printing and mailing costs while enhancing efficiency in document management.

-

Can I integrate airSlate SignNow with other applications for processing form 8911 instructions pdf?

Yes, airSlate SignNow easily integrates with various applications such as Google Drive, Dropbox, and CRM systems. This enables smoother handling of the form 8911 instructions pdf, so you can manage all your documents in one centralized location.

-

What are the benefits of using airSlate SignNow for form 8911 instructions pdf?

Using airSlate SignNow for your form 8911 instructions pdf simplifies the signing process, reduces turnaround times, and enhances security. Our platform ensures that your sensitive tax documents are handled with care, giving you peace of mind.

Get more for Form IT 637 Alternative Fuels And Electric Vehicle Recharging

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497325705 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property south carolina form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential south carolina form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property south carolina form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property south form

- Sc workers compensation form

- Termination lease landlord agreement form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497325714 form

Find out other Form IT 637 Alternative Fuels And Electric Vehicle Recharging

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF