Fill Out Tax Lien Answer Land Form 2013-2026

What is the Fill Out Tax Lien Answer Land Form

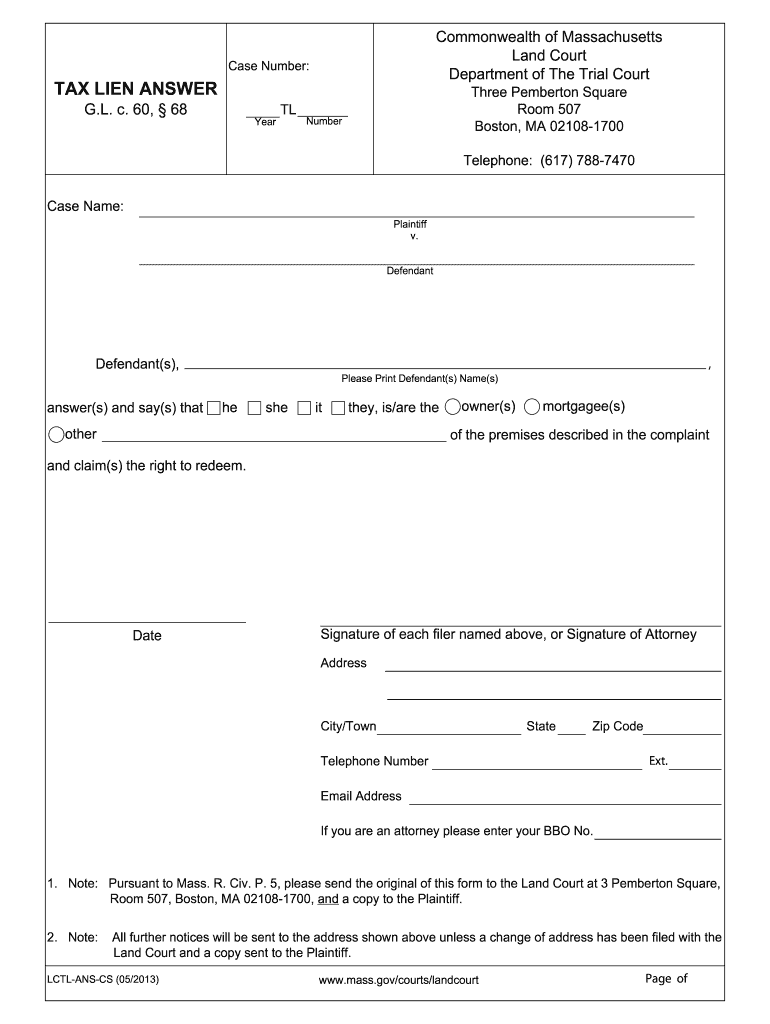

The Fill Out Tax Lien Answer Land Form is a legal document used in the context of tax liens. It allows individuals or entities to respond to a tax lien filed against them, typically in a court setting. This form is crucial for addressing disputes related to tax obligations and provides a structured way to present one's case. Understanding this form is essential for anyone facing a tax lien, as it outlines the necessary information required for a proper response.

How to use the Fill Out Tax Lien Answer Land Form

Using the Fill Out Tax Lien Answer Land Form involves several steps to ensure that all required information is accurately provided. Begin by carefully reading the instructions accompanying the form. Next, gather all relevant documentation that supports your case, such as proof of payment or correspondence with tax authorities. Complete the form by filling in your personal information, details regarding the tax lien, and any defenses you may have. Once completed, review the form for accuracy before submission to the appropriate court or agency.

Steps to complete the Fill Out Tax Lien Answer Land Form

Completing the Fill Out Tax Lien Answer Land Form requires attention to detail. Follow these steps:

- Read the instructions thoroughly to understand the requirements.

- Collect necessary documents that relate to the tax lien.

- Fill in your name, address, and contact information at the top of the form.

- Provide details about the tax lien, including the date it was filed and the amount owed.

- State your position regarding the lien and any supporting arguments.

- Sign and date the form to validate your submission.

Legal use of the Fill Out Tax Lien Answer Land Form

The Fill Out Tax Lien Answer Land Form serves a legal purpose in the tax dispute process. It is used to formally contest a tax lien, providing a platform for individuals to present their case in court. Proper completion and submission of this form can influence the outcome of a tax lien dispute. It is essential to comply with all legal requirements and deadlines associated with this form to ensure that your rights are protected.

Required Documents

When completing the Fill Out Tax Lien Answer Land Form, certain documents may be required to support your response. These documents can include:

- Proof of payment of the tax owed.

- Correspondence with tax authorities.

- Financial statements that demonstrate your ability to pay.

- Any other relevant evidence that supports your case.

Form Submission Methods (Online / Mail / In-Person)

The Fill Out Tax Lien Answer Land Form can typically be submitted through various methods, depending on the jurisdiction. Common submission methods include:

- Online submission via the appropriate court or agency website.

- Mailing the completed form to the designated address.

- In-person delivery to the court or agency handling the tax lien.

Quick guide on how to complete tax lien answer with certificate of service massgov mass

Complete and submit your Fill Out Tax Lien Answer Land Form swiftly

Robust tools for electronic document interchange and endorsement are essential for process enhancement and the continuous advancement of your forms. When managing legal documents and signing a Fill Out Tax Lien Answer Land Form, the appropriate signature solution can conserve signNow time and reduce paper usage with each submission.

Search, complete, modify, endorse, and distribute your legal documents with airSlate SignNow. This platform offers everything necessary to create streamlined paper submission workflows. Its extensive legal forms repository and intuitive navigation can assist you in obtaining your Fill Out Tax Lien Answer Land Form promptly, and the editor equipped with our signature capability will enable you to finalize and authorize it instantly.

Endorse your Fill Out Tax Lien Answer Land Form in a few straightforward steps

- Locate the Fill Out Tax Lien Answer Land Form you need in our repository using the search function or catalog pages.

- Review the form details and preview it to ensure it meets your requirements and state regulations.

- Click Get form to access it for modification.

- Complete the form using the extensive toolbar.

- Examine the information you entered and click the Sign feature to validate your document.

- Select one of three options to affix your signature.

- Conclude editing and save the document in your files, then download it to your device or share it directly.

Streamline every phase of your document preparation and endorsement with airSlate SignNow. Explore a more effective online solution that encompasses all aspects of managing your documents.

Create this form in 5 minutes or less

FAQs

-

What is the cause of gravity? Could it be how objects with more mass attract other objects to try to distribute their energy even out the tension, like how water fills its capacity?

Gravity in Newton physics is due to the presence of mass,just like the charge is the cause of electrical field ,and then electric force,so ,the presence of mass causes a gravitational field,which has a force,it affects any other mass within its domain,its moderator is a postulated boson, encoded as graviton,not detected yet.This is a classical concept to gravity , it is a limit ,or an approximation ,to the gravity defined by the general relativity(as spacetime curvature),when the energy-momentum tensor in Einstein equation approches the mass density.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

A radiator made out of iron has a mass of 45.0 kg. It is filled with 23.0 kg of water. What is the heat capacity of the water-filled radiator? How long will it take for the temperature to increase by 20 °C if thermal energy is provided to the radiator at the rate of 450 W?

On questions like this, it’s better to write the formulas relating given quantities and considering what to equate…The temperature of the composite mass will be contributed by both Iron and MassEnergy = Power x TimeBoth water and iron will increase the energy, separately.Specific heat capacities should known/givenE water + E iron = 450 x T45 x 430 x 20 + 23 x 4200 x 20 = 450 x TT= 5153 s

Create this form in 5 minutes!

How to create an eSignature for the tax lien answer with certificate of service massgov mass

How to generate an electronic signature for the Tax Lien Answer With Certificate Of Service Massgov Mass online

How to make an eSignature for your Tax Lien Answer With Certificate Of Service Massgov Mass in Google Chrome

How to generate an electronic signature for signing the Tax Lien Answer With Certificate Of Service Massgov Mass in Gmail

How to create an eSignature for the Tax Lien Answer With Certificate Of Service Massgov Mass straight from your smart phone

How to create an eSignature for the Tax Lien Answer With Certificate Of Service Massgov Mass on iOS

How to create an eSignature for the Tax Lien Answer With Certificate Of Service Massgov Mass on Android devices

People also ask

-

What is findmassmoney and how can it benefit my business?

Findmassmoney is an innovative tool designed to help businesses identify potential funds or recover lost payments. By using findmassmoney, you can enhance your financial efficiency, making it easier to manage resources. It simplifies the process of tracking down funds, ensuring you don't miss out on any financial opportunities.

-

How does airSlate SignNow integrate with findmassmoney?

AirSlate SignNow seamlessly integrates with findmassmoney to streamline your document signing process. By linking these tools, you can easily send and eSign documents related to your financial recovery efforts. This integration ensures that your transactions are both efficient and secure, enhancing your overall business operation.

-

What is the pricing structure for using findmassmoney with airSlate SignNow?

The pricing for using findmassmoney with airSlate SignNow is designed to provide great value for businesses of all sizes. With flexible subscription plans, you can choose an option that best fits your budget and needs. Investing in this integration allows you to maximize your productivity while keeping costs manageable.

-

What features does findmassmoney offer to enhance document signing?

Findmassmoney offers features like automated document tracking, easy access to funds, and robust reporting tools that enhance the eSigning process. These features work harmoniously with airSlate SignNow to provide a comprehensive solution for managing your documents efficiently. You'll benefit from a streamlined workflow that saves time and reduces errors.

-

How secure is the information processed through findmassmoney and airSlate SignNow?

Both findmassmoney and airSlate SignNow prioritize security to protect your sensitive information. They implement industry-standard encryption and secure data storage protocols, ensuring that your documents and financial details remain safe. You can confidently manage your financial operations without compromising data security.

-

Is findmassmoney suitable for small businesses?

Absolutely, findmassmoney is specifically designed to cater to businesses of all sizes, including small enterprises. It provides an affordable way for smaller operations to locate and manage funds effectively. With user-friendly features, small businesses can benefit greatly from the efficiencies offered by findmassmoney.

-

Can I access findmassmoney on mobile devices?

Yes, findmassmoney is accessible on mobile devices for on-the-go fund-recovery solutions. This flexibility allows you to manage your documents and eSign transactions anytime, anywhere, enhancing productivity. The mobile compatibility ensures that you won't miss out on crucial financial opportunities, regardless of your location.

Get more for Fill Out Tax Lien Answer Land Form

Find out other Fill Out Tax Lien Answer Land Form

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF