Form 8453 LLC California E File Return Authorization for Limited Liability Companies 2022-2026

What is the Form 8453 LLC California E-file Return Authorization for Limited Liability Companies

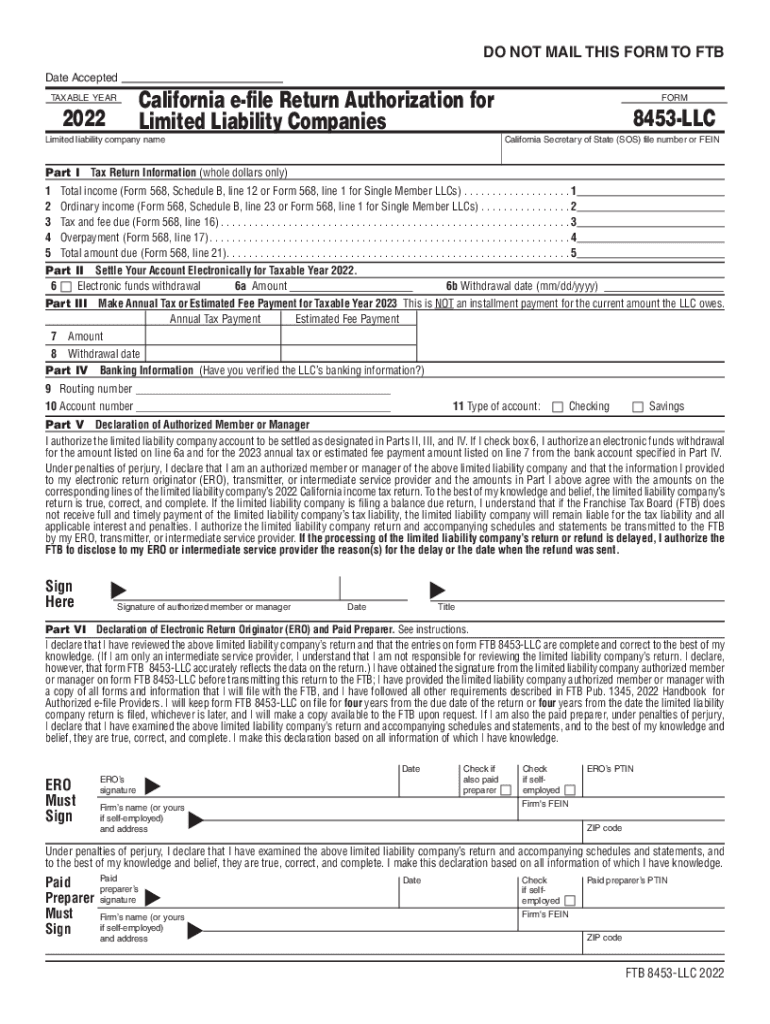

The Form 8453 LLC serves as a return authorization for limited liability companies (LLCs) in California that choose to e-file their tax returns. This form is essential for confirming that the taxpayer authorizes the electronic submission of their tax return to the California Franchise Tax Board. By using this form, LLCs can streamline their filing process while ensuring compliance with state regulations. It effectively acts as a signature for the e-filed return, allowing the tax authority to accept the submission without requiring a physical signature.

How to use the Form 8453 LLC California E-file Return Authorization for Limited Liability Companies

Using the Form 8453 LLC involves several straightforward steps. First, you need to complete your tax return using approved e-filing software. Once your return is ready, you will fill out the Form 8453 LLC to authorize the electronic submission. This form must include your name, address, and other identifying information. After completing the form, you can submit it electronically along with your tax return. Ensure that you retain a copy of the form for your records, as it serves as proof of your authorization.

Steps to complete the Form 8453 LLC California E-file Return Authorization for Limited Liability Companies

Completing the Form 8453 LLC requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary information, including your LLC's name, address, and federal employer identification number (EIN).

- Fill out the form with the required details, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Sign and date the form electronically, if applicable.

- Submit the form along with your e-filed tax return to the California Franchise Tax Board.

Legal use of the Form 8453 LLC California E-file Return Authorization for Limited Liability Companies

The legal use of the Form 8453 LLC is governed by California tax laws and regulations. This form ensures that the electronic submission of tax returns is valid and legally binding. By signing the form, you affirm that the information provided is accurate and complete to the best of your knowledge. It is crucial to comply with all legal requirements to avoid penalties or issues with the Franchise Tax Board. The form must be submitted in conjunction with your e-filed return to maintain its legal standing.

Key elements of the Form 8453 LLC California E-file Return Authorization for Limited Liability Companies

Key elements of the Form 8453 LLC include:

- Taxpayer Information: This includes the name, address, and EIN of the LLC.

- Signature Authorization: A section where the taxpayer authorizes the e-filing of their return.

- Return Information: Details about the specific tax year and type of return being filed.

- Retention of Records: A reminder for taxpayers to keep a copy of the form for their records.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8453 LLC align with the general tax filing deadlines for LLCs in California. Typically, the deadline for submitting your e-filed return, along with the Form 8453 LLC, is the fifteenth day of the fourth month following the end of your tax year. For most LLCs operating on a calendar year, this means the deadline is April 15. It is important to be aware of these dates to avoid late filing penalties and ensure compliance with state tax laws.

Quick guide on how to complete 2022 form 8453 llc california e file return authorization for limited liability companies

Complete Form 8453 LLC California E file Return Authorization For Limited Liability Companies effortlessly on any device

Digital document management has become popular among businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8453 LLC California E file Return Authorization For Limited Liability Companies on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to edit and eSign Form 8453 LLC California E file Return Authorization For Limited Liability Companies without hassle

- Obtain Form 8453 LLC California E file Return Authorization For Limited Liability Companies and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 8453 LLC California E file Return Authorization For Limited Liability Companies to ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 8453 llc california e file return authorization for limited liability companies

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 8453 llc california e file return authorization for limited liability companies

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2019 8453 form used for?

The 2019 8453 form is used for electronic filing of income tax returns. It serves as a declaration that all information submitted is accurate and allows taxpayers to eSign their submissions securely. Utilizing airSlate SignNow, you can easily sign and submit the 2019 8453 form online.

-

How does airSlate SignNow handle the 2019 8453 form processing?

With airSlate SignNow, businesses can effortlessly prepare and send the 2019 8453 form for eSignature. Our platform provides a user-friendly interface, allowing quick processing and secure storage of signed documents. This streamlines tax filing procedures while ensuring compliance with IRS regulations.

-

Is there a cost to use airSlate SignNow for the 2019 8453 form?

AirSlate SignNow offers competitive pricing plans that cater to various business needs when handling the 2019 8453 form. Users can choose from different tiers that provide flexibility and scalability. Our cost-effective solution ensures you get the best value for managing your electronic document processes.

-

What features does airSlate SignNow offer for the 2019 8453 form?

AirSlate SignNow includes features such as templates, customizable workflows, and real-time tracking for the 2019 8453 form. It allows users to add fields for information, ensuring that all necessary details are completed before submission. These features signNowly enhance the efficiency of document management.

-

Can I integrate airSlate SignNow with other applications when managing the 2019 8453 form?

Yes, airSlate SignNow offers seamless integrations with various applications like Google Drive, Salesforce, and Microsoft 365 for managing the 2019 8453 form. This capability allows users to import data and export signed documents easily, streamlining the entire eSigning process.

-

What are the benefits of using airSlate SignNow for the 2019 8453 form?

Using airSlate SignNow for the 2019 8453 form simplifies the eSignature process, reduces paperwork, and speeds up document turnaround time. The platform enhances collaboration among team members while maintaining security and compliance. This ultimately helps businesses save time and enhance productivity.

-

Is airSlate SignNow secure for signing the 2019 8453 form?

Absolutely, airSlate SignNow prioritizes security for all documents, including the 2019 8453 form. Our platform employs industry-standard encryption and compliance measures to protect sensitive data. This ensures that your tax documents are signed, transmitted, and stored securely.

Get more for Form 8453 LLC California E file Return Authorization For Limited Liability Companies

- Essential legal life documents for new parents south dakota form

- General power of attorney for care and custody of child or children south dakota form

- South dakota business 497326409 form

- Company employment policies and procedures package south dakota form

- Revocation of power of attorney for care of child or children south dakota form

- Newly divorced individuals package south dakota form

- Contractors forms package south dakota

- Power of attorney for sale of motor vehicle south dakota form

Find out other Form 8453 LLC California E file Return Authorization For Limited Liability Companies

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF