Form it 612 Claim for Remediated Brownfield Credit for Real Property Taxes Tax Year 2022

What is the Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year

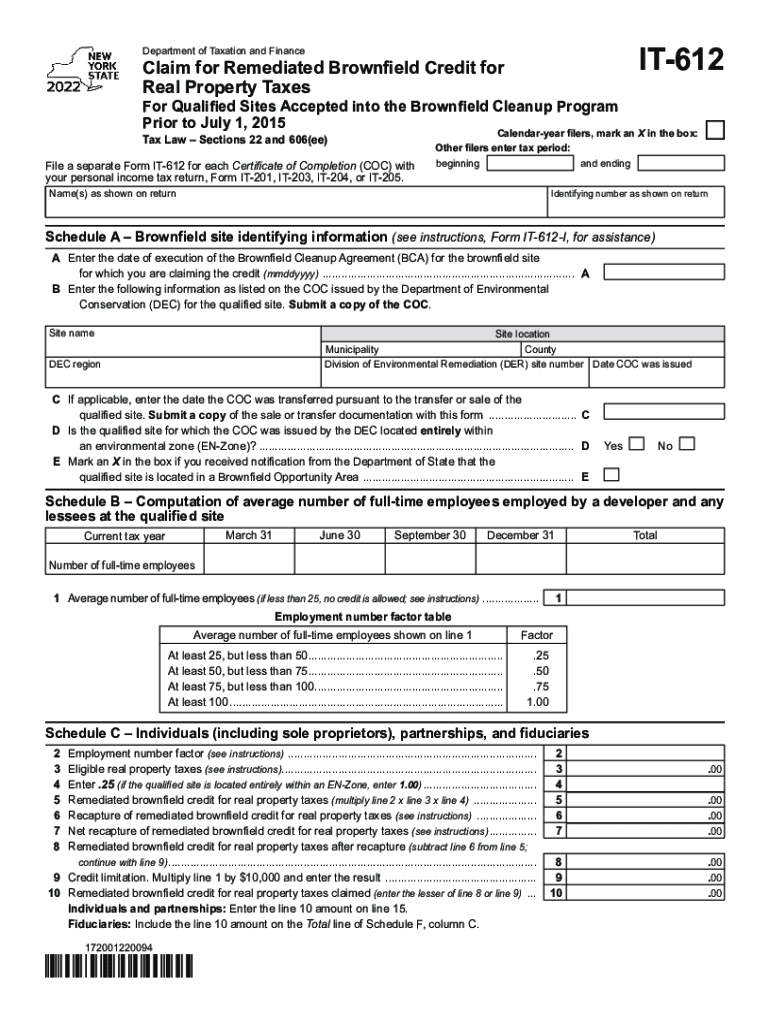

The Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year is a tax form used by property owners in the United States to claim a credit against real property taxes for properties that have undergone remediation. This form is specifically designed for properties that have been cleaned up to meet state and federal environmental standards, allowing owners to receive tax benefits as an incentive for environmental restoration efforts. By completing this form, property owners can potentially reduce their tax liabilities, encouraging further investment in the cleanup of contaminated sites.

How to use the Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year

Using the Form IT 612 involves several steps to ensure that all necessary information is accurately provided. First, gather all relevant documentation regarding the property, including proof of remediation and tax assessments. Next, fill out the form with details such as the property address, the nature of the remediation, and the amount of credit being claimed. It is essential to review the instructions carefully to ensure compliance with all requirements. Once completed, the form can be submitted to the appropriate tax authority for processing.

Steps to complete the Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year

Completing the Form IT 612 involves a systematic approach:

- Gather all necessary documentation, including remediation reports and tax assessments.

- Fill in the property details, including the address and owner information.

- Provide specifics about the remediation process and any relevant dates.

- Calculate the tax credit amount based on the guidelines provided.

- Review the form for accuracy and completeness before submission.

Key elements of the Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year

The key elements of the Form IT 612 include the property owner's details, the property address, the type of remediation performed, and the calculation of the credit amount. Additionally, it requires supporting documentation that verifies the remediation efforts and compliance with environmental standards. Accurate completion of these sections is crucial for the successful processing of the claim.

Eligibility Criteria

To be eligible for the Form IT 612 Claim For Remediated Brownfield Credit, the property must meet specific criteria. The property should have undergone remediation that complies with state and federal environmental guidelines. The owner must also be responsible for the property taxes and have documentation proving that the remediation efforts were completed. Additionally, the property should be classified as a brownfield site, meaning it is contaminated but has potential for redevelopment.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 612 vary by tax year and jurisdiction. Generally, property owners must submit the form by a specified date, often coinciding with local tax filing deadlines. It is essential to check with the local tax authority for the exact dates to ensure timely submission and avoid penalties. Being aware of these deadlines helps property owners maximize their potential tax credits.

Quick guide on how to complete form it 612 claim for remediated brownfield credit for real property taxes tax year 2021

Finish Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year effortlessly on any gadget

Web-based document handling has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to obtain the right format and securely save it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your files swiftly without holdups. Manage Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year on any gadget using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

Steps to alter and eSign Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year with ease

- Obtain Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year and click Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to retain your alterations.

- Select your preferred method of submitting your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 612 claim for remediated brownfield credit for real property taxes tax year 2021

Create this form in 5 minutes!

How to create an eSignature for the form it 612 claim for remediated brownfield credit for real property taxes tax year 2021

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year?

Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year is a tax document used by property owners to claim credits for eligible remediation activities on brownfield properties. This form is crucial for maximizing tax benefits related to environmental cleanup efforts.

-

How can airSlate SignNow help with Form IT 612 submission?

airSlate SignNow provides a streamlined platform for preparing and electronically signing Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year, making the submission process faster and more efficient. With its user-friendly interface, users can easily complete and send their forms.

-

What are the pricing options for airSlate SignNow when filing Form IT 612?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including options for individual and team users. Pricing is designed to be cost-effective, ensuring that businesses can manage the filing of documents like Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year within their budget.

-

Does airSlate SignNow offer any integrations that support Form IT 612?

Yes, airSlate SignNow integrates with various software solutions, allowing users to import data directly into Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year. These integrations help streamline workflow, making the documentation process more efficient.

-

What features does airSlate SignNow provide for document management related to Form IT 612?

airSlate SignNow includes features such as templates, electronic signatures, and document tracking, which are invaluable when managing Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year. These tools enhance organization and ensure compliance throughout the filing process.

-

Is there customer support available for issues related to Form IT 612?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with any queries regarding Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year. Whether you need help with the software or the filing process, our team is here to help.

-

Can airSlate SignNow ensure the security of my Form IT 612 data?

Yes, airSlate SignNow prioritizes the security of your data, providing encryption and secure storage solutions for documents such as Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year. This helps protect sensitive information and ensures compliance with data protection regulations.

Get more for Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year

- Landlord tenant closing statement to reconcile security deposit tennessee form

- Name change form 497326877

- Name change notification form tennessee

- Tn statement property form

- Commercial building or space lease tennessee form

- Tennessee relative caretaker legal documents package tennessee form

- Tennessee standby temporary guardian legal documents package tennessee form

- Tennessee eastern district bankruptcy guide and forms package for chapters 7 or 13 tennessee

Find out other Form IT 612 Claim For Remediated Brownfield Credit For Real Property Taxes Tax Year

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document