Income Tax SubtractionsDepartment of Revenue Taxation 2022-2026

What is the Income Tax Subtractions

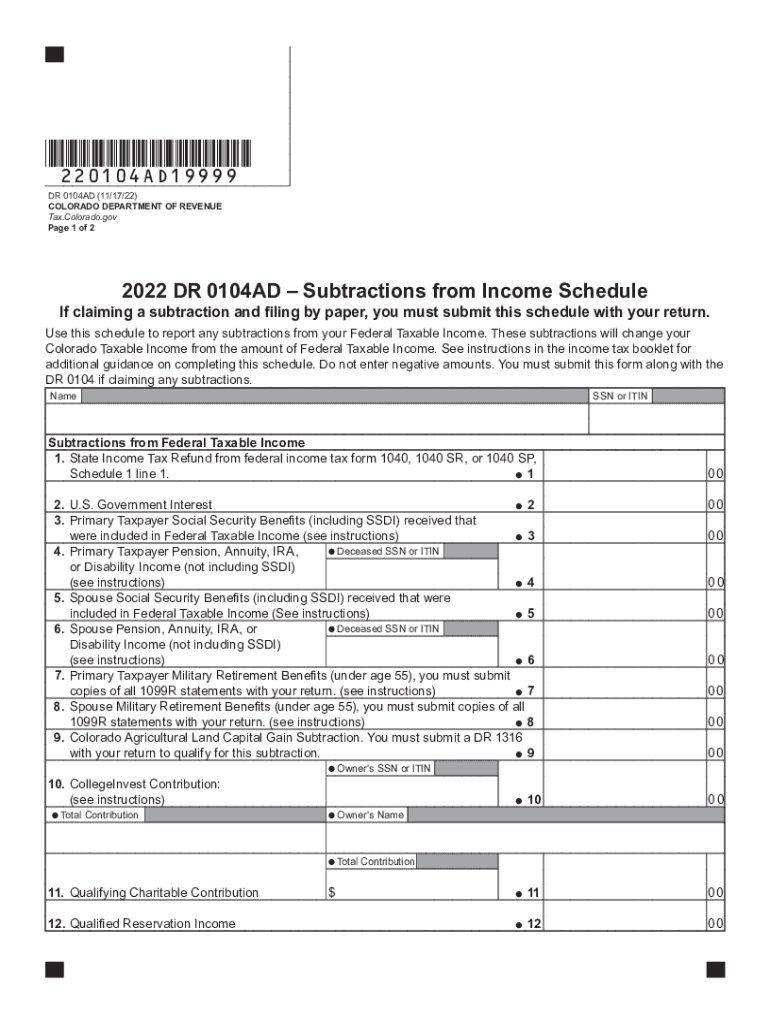

The Income Tax Subtractions refer to specific deductions that taxpayers in Colorado can claim on their state tax returns. These subtractions reduce the total taxable income, ultimately lowering the amount of tax owed. The Colorado Department of Revenue outlines various categories of income that may qualify for subtractions, including certain retirement income, military pay, and other specific exemptions. Understanding these subtractions is essential for accurately completing the Colorado Form DR 0104AD and ensuring compliance with state tax regulations.

Steps to complete the Income Tax Subtractions

Completing the Income Tax Subtractions on the Colorado Form DR 0104AD involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any statements related to income that may qualify for subtractions. Next, review the specific categories of subtractions outlined in the form instructions to determine eligibility. Fill out the relevant sections of the 0104AD form, ensuring that all figures are accurate and supported by documentation. Finally, review the completed form for any errors before submitting it to the Colorado Department of Revenue.

Eligibility Criteria

To qualify for Income Tax Subtractions on the Colorado Form DR 0104AD, taxpayers must meet certain eligibility criteria. These criteria vary depending on the type of income being claimed for subtraction. For instance, retirement income may be eligible if it meets specific age and income thresholds. Additionally, military personnel may qualify for certain exemptions related to their service. It is important to carefully review the instructions for the 0104AD form to ensure all requirements are met before filing.

Required Documents

When completing the Colorado Form DR 0104AD, certain documents are required to support the claims for Income Tax Subtractions. Taxpayers should prepare copies of any relevant income statements, such as W-2 forms or 1099 forms, that detail earnings. Additionally, documentation proving eligibility for specific subtractions, such as retirement account statements or military service records, may be necessary. Having these documents on hand will facilitate the completion of the form and help ensure accuracy in reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado Form DR 0104AD are crucial for taxpayers to observe. Typically, the deadline for submitting state tax returns, including the 0104AD form, aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable for taxpayers to confirm the specific dates for the tax year and plan accordingly to avoid any penalties for late submission.

Form Submission Methods

Taxpayers have several options for submitting the Colorado Form DR 0104AD. The form can be filed electronically through the Colorado Department of Revenue's online portal, which is a convenient method for many. Alternatively, taxpayers may choose to mail a paper copy of the completed form to the appropriate address provided in the instructions. In-person submissions may also be possible at designated state tax offices. Each method has its own processing times, so taxpayers should consider their preferences and timelines when deciding how to submit their forms.

Quick guide on how to complete income tax subtractionsdepartment of revenue taxation

Complete Income Tax SubtractionsDepartment Of Revenue Taxation effortlessly on any device

Digital document management has become highly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Income Tax SubtractionsDepartment Of Revenue Taxation on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The easiest way to modify and eSign Income Tax SubtractionsDepartment Of Revenue Taxation without breaking a sweat

- Obtain Income Tax SubtractionsDepartment Of Revenue Taxation and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Alter and eSign Income Tax SubtractionsDepartment Of Revenue Taxation and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax subtractionsdepartment of revenue taxation

Create this form in 5 minutes!

How to create an eSignature for the income tax subtractionsdepartment of revenue taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 0104ad and how does it relate to airSlate SignNow?

The dr 0104ad is a unique identifier used for regulatory compliance in document management. airSlate SignNow incorporates dr 0104ad to ensure that all eSignatures are valid and legally compliant. Utilizing airSlate SignNow with dr 0104ad helps businesses maintain their integrity while streamlining the signing process.

-

How can airSlate SignNow benefit my business when using dr 0104ad?

By integrating the dr 0104ad into your signing process, airSlate SignNow simplifies compliance with industry regulations. This ensures that your eSigned documents are not only legally binding but also secure and traceable. Businesses using airSlate SignNow experience enhanced efficiency and reduced turnaround times on important documents.

-

What are the pricing options for airSlate SignNow that includes dr 0104ad?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes, including those requiring dr 0104ad compliance. The pricing structures are designed to provide flexibility, ensuring that you only pay for what your business needs. You can choose from monthly or annual billing options, allowing for better budget management.

-

Does airSlate SignNow support integrations with other software solutions concerning dr 0104ad?

Yes, airSlate SignNow supports multiple integrations with CRM systems, document storage solutions, and other software applications. These integrations enhance the value of dr 0104ad by allowing seamless workflows across platforms. With airSlate SignNow, you can enhance productivity while ensuring compliance with regulatory standards related to dr 0104ad.

-

Is airSlate SignNow user-friendly for handling documents involving dr 0104ad?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy to manage documents that include dr 0104ad. The intuitive interface allows users at all experience levels to send, receive, and eSign documents efficiently, enhancing overall productivity in handling compliance needs.

-

What security features does airSlate SignNow provide for dr 0104ad compliant documents?

AirSlate SignNow employs robust security measures to protect documents that require dr 0104ad compliance. This includes encryption, password protection, and audit trails to track document interactions. These features ensure that sensitive information is safeguarded while maintaining the integrity of your eSigned documents.

-

Can I track the status of documents signed with airSlate SignNow using dr 0104ad?

Yes, airSlate SignNow provides comprehensive tracking capabilities for documents signed with dr 0104ad. Users can easily monitor the status of their documents in real-time and receive notifications upon completion. This transparency allows for better management of tasks and improved communication within your business.

Get more for Income Tax SubtractionsDepartment Of Revenue Taxation

- 3 day notice 497327582 form

- Texas pay rent form

- Texas vacate form

- 30 day notice to terminate month to month lease residential from landlord to tenant texas form

- Notice terminate lease form

- 30 day notice to terminate month to month lease for residential from tenant to landlord texas form

- Notice terminate form

- Texas rent pay form

Find out other Income Tax SubtractionsDepartment Of Revenue Taxation

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple