BANK DEPOSITS TAX RETURN Formalu 2022

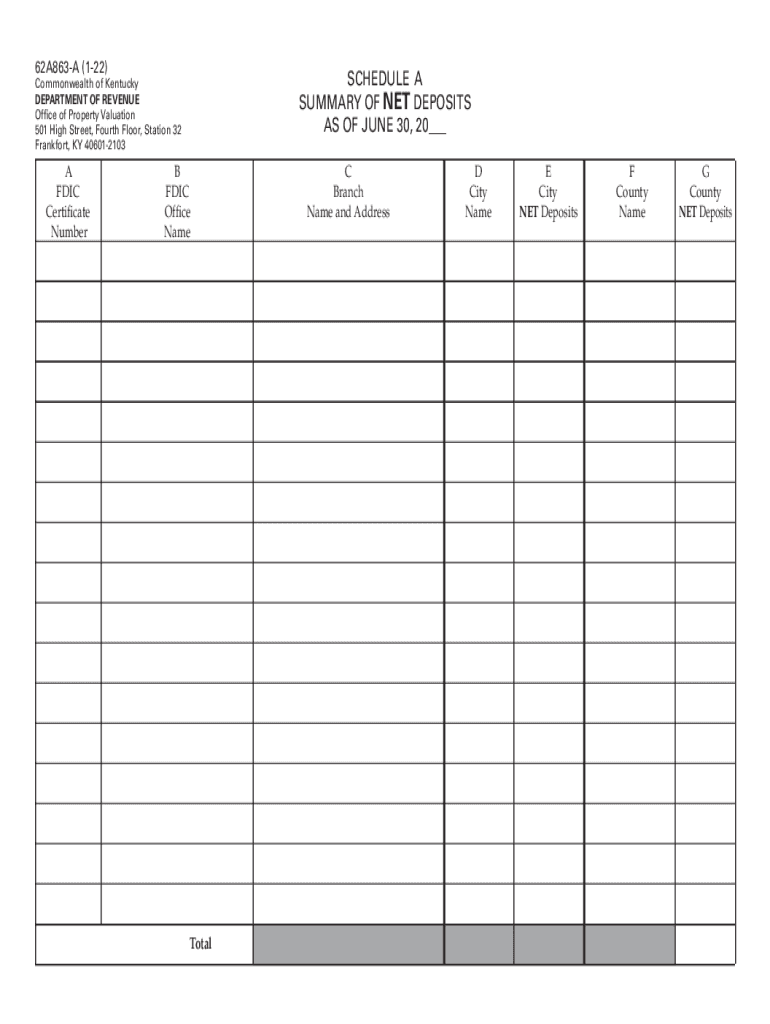

What is the 62a863 local deposit summary report?

The 62a863 local deposit summary report is a crucial document used primarily for tracking and summarizing local bank deposits. This report provides a comprehensive overview of all deposits made within a specific timeframe, detailing the amounts, dates, and sources of funds. It is particularly important for businesses and organizations that need to maintain accurate financial records and ensure compliance with local regulations.

How to use the 62a863 local deposit summary report

Using the 62a863 local deposit summary report involves several key steps. First, gather all relevant deposit information, including transaction dates and amounts. Next, input this data into the report template, ensuring that each entry is accurate and complete. Once the report is filled out, it can be reviewed for any discrepancies and finalized for submission to relevant stakeholders or regulatory bodies.

Steps to complete the 62a863 local deposit summary report

Completing the 62a863 local deposit summary report requires careful attention to detail. Follow these steps:

- Collect all deposit records for the reporting period.

- Organize the data by date and source of funds.

- Input the collected data into the report format, ensuring accuracy.

- Review the report for any errors or missing information.

- Finalize the report and prepare it for submission.

Key elements of the 62a863 local deposit summary report

The 62a863 local deposit summary report includes several key elements that are essential for its effectiveness. These elements typically consist of:

- Transaction date: The date when the deposit was made.

- Deposit amount: The total amount deposited.

- Source of funds: Information about where the funds originated.

- Account details: The bank account into which the funds were deposited.

- Summary totals: A section that aggregates total deposits for the reporting period.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of deposits for tax purposes. It is essential to adhere to these guidelines to ensure compliance and avoid potential penalties. Businesses should maintain accurate records of all deposits and be prepared to provide documentation if requested by the IRS. Familiarizing oneself with these guidelines can help in accurately completing the 62a863 local deposit summary report.

Required Documents

To complete the 62a863 local deposit summary report, several documents may be required. These typically include:

- Bank statements: To verify deposit amounts and dates.

- Transaction receipts: For detailed records of each deposit.

- Previous reports: To ensure consistency and accuracy in reporting.

Penalties for Non-Compliance

Failure to accurately complete and submit the 62a863 local deposit summary report can result in various penalties. These may include fines, increased scrutiny from regulatory bodies, and potential legal repercussions. It is crucial for businesses to understand the importance of compliance and to ensure that all reports are submitted in a timely and accurate manner.

Quick guide on how to complete bank deposits tax return formalu

Complete BANK DEPOSITS TAX RETURN Formalu effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any holdups. Manage BANK DEPOSITS TAX RETURN Formalu on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and eSign BANK DEPOSITS TAX RETURN Formalu with ease

- Obtain BANK DEPOSITS TAX RETURN Formalu and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize crucial parts of your documents or redact sensitive information with tools specifically designed for that purpose provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal weight as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Select your preferred method for submitting your form, whether by email, text (SMS), invite link, or downloading it directly to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, and errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign BANK DEPOSITS TAX RETURN Formalu and facilitate effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bank deposits tax return formalu

Create this form in 5 minutes!

How to create an eSignature for the bank deposits tax return formalu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 62a863 local deposit summary report?

The 62a863 local deposit summary report is a comprehensive document that summarizes local deposit transactions for businesses. This report helps organizations keep track of their financial data, ensuring accuracy and compliance with reporting standards. Utilizing the airSlate SignNow platform, creating and managing this report becomes streamlined and efficient.

-

How can I access the 62a863 local deposit summary report?

You can access the 62a863 local deposit summary report through the airSlate SignNow application. Here, you can easily generate, customize, and download your report to meet specific business needs. The intuitive interface ensures that even those with minimal technical expertise can navigate and obtain their reports seamlessly.

-

What features does airSlate SignNow offer for generating the 62a863 local deposit summary report?

AirSlate SignNow provides a variety of features designed to assist users in generating the 62a863 local deposit summary report. These include customizable templates, automated data entry, advanced analytics, and secure eSigning capabilities. This functionality enhances the overall efficiency of financial reporting for businesses.

-

Is airSlate SignNow cost-effective for small businesses needing the 62a863 local deposit summary report?

Yes, airSlate SignNow offers competitive pricing that is budget-friendly for small businesses looking to generate the 62a863 local deposit summary report. With various subscription plans, companies can choose a package that fits their needs without stretching their finances. This ensures that even smaller organizations can access essential tools for document management and reporting.

-

Can I integrate airSlate SignNow with other software for the 62a863 local deposit summary report?

Absolutely! AirSlate SignNow allows easy integration with numerous third-party applications, enhancing the functionality of the 62a863 local deposit summary report. Whether you're working with accounting software or CRM systems, integration ensures that your financial data remains synchronized and up to date.

-

What are the benefits of using airSlate SignNow for the 62a863 local deposit summary report?

Using airSlate SignNow for the 62a863 local deposit summary report offers numerous benefits, including improved efficiency, accuracy, and compliance. The ability to electronically sign and share reports quickly also speeds up the decision-making process. Overall, it provides a reliable solution for managing important financial documents.

-

How secure is the 62a863 local deposit summary report with airSlate SignNow?

AirSlate SignNow prioritizes security, ensuring that your 62a863 local deposit summary report is protected with advanced encryption protocols. This guarantees that sensitive financial data remains confidential and safeguarded against unauthorized access. Your peace of mind is crucial while using our platform for your reporting needs.

Get more for BANK DEPOSITS TAX RETURN Formalu

Find out other BANK DEPOSITS TAX RETURN Formalu

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF