8453120F PDF Louisiana Department of Revenue 2022-2026

What is the 8453120F PDF from the Louisiana Department of Revenue?

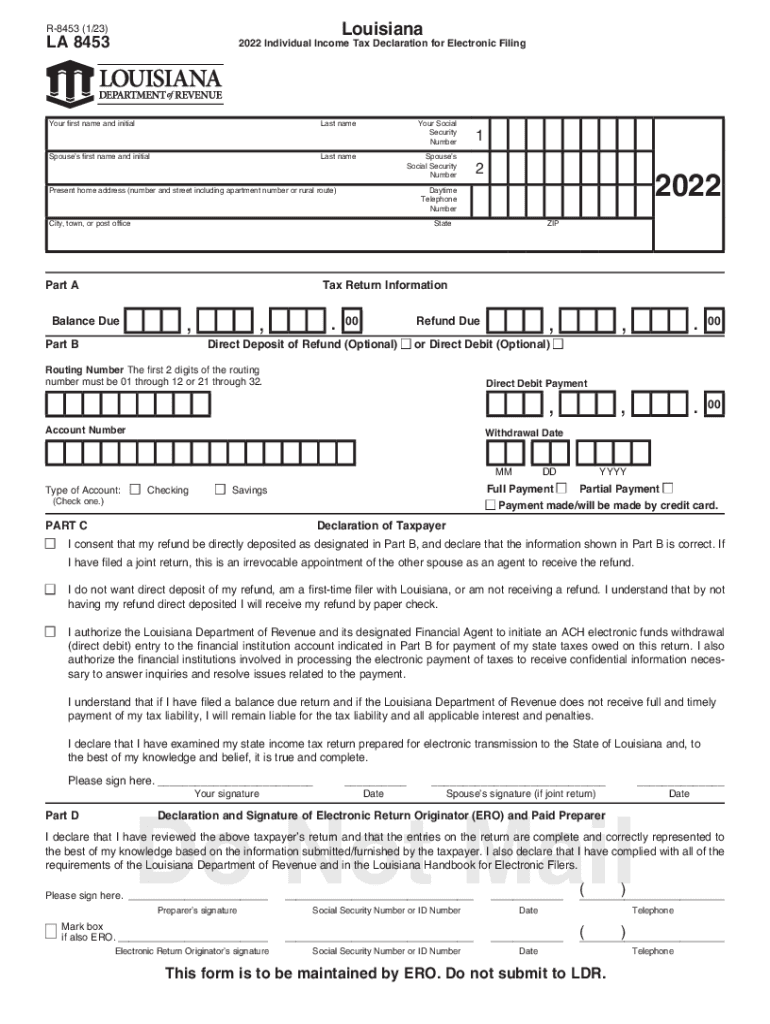

The 8453120F PDF is a specific form used by the Louisiana Department of Revenue for the 2021 revenue individual income tax filing. This form is essential for residents who need to report their income and calculate the taxes owed to the state. It captures various details about the taxpayer's income, deductions, and credits applicable under Louisiana tax law. Understanding the purpose of this form is crucial for ensuring accurate and compliant tax submissions.

Steps to Complete the 8453120F PDF

Completing the 8453120F PDF involves several important steps to ensure that all necessary information is accurately reported. Start by gathering all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the personal information section, which includes your name, address, and Social Security number. Proceed to report your income, deductions, and any applicable credits. It is vital to double-check all entries for accuracy before submission. Finally, sign and date the form to validate your submission.

Filing Deadlines / Important Dates

For the 2021 revenue individual income tax, the filing deadline is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential for taxpayers to be aware of these deadlines to avoid penalties and interest on late payments. Keeping track of important dates, such as the start of the filing season and any extensions, is crucial for timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The 8453120F PDF can be submitted through various methods to accommodate different taxpayer preferences. Taxpayers have the option to file online through the Louisiana Department of Revenue's official website, which offers a streamlined process for electronic submissions. Alternatively, individuals can print the completed form and mail it to the designated address provided by the department. For those who prefer a personal touch, in-person submission is also available at local revenue offices. Each method has its own advantages, and choosing the right one can enhance the filing experience.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the 8453120F PDF can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal repercussions for fraudulent submissions. It is crucial for taxpayers to understand these penalties and take proactive measures to file accurately and on time. Awareness of the consequences of non-compliance can motivate individuals to prioritize their tax responsibilities.

Eligibility Criteria

To file the 8453120F PDF, certain eligibility criteria must be met. Taxpayers must be residents of Louisiana and have earned income during the tax year. Additionally, specific income thresholds may apply, determining whether individuals are required to file. Understanding these criteria is essential for determining if you need to complete the form and ensuring compliance with state tax laws.

Quick guide on how to complete 8453120fpdf louisiana department of revenue

Effortlessly Prepare 8453120F pdf Louisiana Department Of Revenue on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Handle 8453120F pdf Louisiana Department Of Revenue on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign 8453120F pdf Louisiana Department Of Revenue with Ease

- Obtain 8453120F pdf Louisiana Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight key parts of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all information and click on the Done button to finalize your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Modify and eSign 8453120F pdf Louisiana Department Of Revenue and guarantee smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8453120fpdf louisiana department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 2021 revenue individual income tax for businesses?

The 2021 revenue individual income tax is critical for businesses as it determines the tax obligations of self-employed individuals and sole proprietors. Understanding these requirements helps businesses plan better and avoid penalties. Accurate calculations can maximize deductions and optimize tax returns.

-

How can airSlate SignNow assist in managing documents related to the 2021 revenue individual income tax?

airSlate SignNow simplifies the process of managing documents required for the 2021 revenue individual income tax. With our platform, users can easily send, sign, and store necessary tax forms securely. This ensures that all documents are accessible when needed, reducing time spent on paperwork.

-

Are there any features in airSlate SignNow specifically for handling tax documents?

Yes, airSlate SignNow offers features like customizable templates, automated reminders, and secure cloud storage that are beneficial for handling tax documents, including those for the 2021 revenue individual income tax. These tools streamline the process, making it easier to ensure compliance and stay organized.

-

What are the pricing options for using airSlate SignNow for tax-related needs?

airSlate SignNow offers flexible pricing plans that cater to various business sizes, making it cost-effective for managing tax-related needs like the 2021 revenue individual income tax. Users can choose from monthly or annual subscriptions, with options for additional features depending on their requirements.

-

How does airSlate SignNow benefit freelancers and independent contractors regarding the 2021 revenue individual income tax?

For freelancers and independent contractors, understanding the 2021 revenue individual income tax is crucial, and airSlate SignNow aids in organizing their documentation efficiently. The platform allows them to manage contracts and invoices digitally, facilitating easy access and helping them stay compliant with tax obligations.

-

Can airSlate SignNow integrate with accounting software for tax filing purposes?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, enhancing the management of documents related to the 2021 revenue individual income tax. This integration allows users to sync financial data and streamline their tax filing processes, ensuring accuracy and saving time.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow takes security seriously, employing advanced encryption and secure data storage to protect sensitive tax information, such as documents related to the 2021 revenue individual income tax. Users can confidently manage their documents knowing that their data is safe from unauthorized access.

Get more for 8453120F pdf Louisiana Department Of Revenue

- Demolition contractor package texas form

- Security contractor package texas form

- Insulation contractor package texas form

- Paving contractor package texas form

- Site work contractor package texas form

- Siding contractor package texas form

- Refrigeration contractor package texas form

- Drainage contractor package texas form

Find out other 8453120F pdf Louisiana Department Of Revenue

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile