Vermont Income Tax VT State Tax Calculator Community Tax 2022-2026

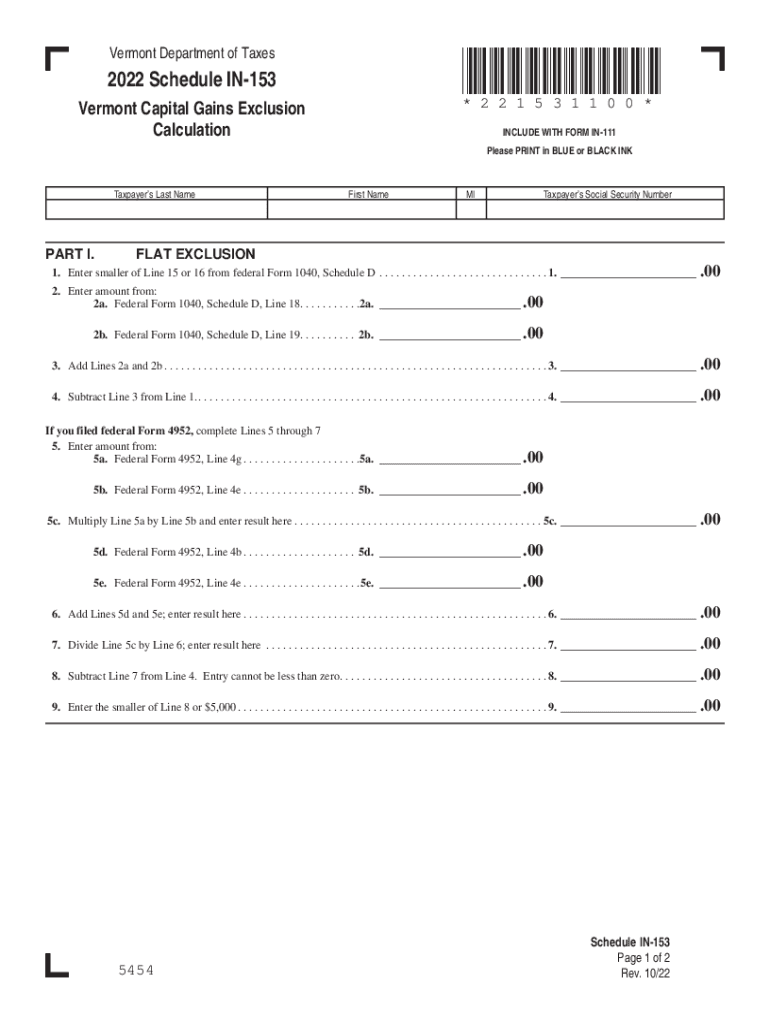

Understanding Vermont Capital Exclusion

The Vermont capital exclusion is a crucial aspect of the state’s tax regulations. It allows taxpayers to exclude certain capital gains from their taxable income, which can significantly reduce their overall tax liability. This exclusion is particularly beneficial for individuals who have realized gains from the sale of assets such as stocks, real estate, or other investments. To qualify for the exclusion, taxpayers must meet specific criteria outlined by the Vermont Department of Taxes.

Steps to Complete the Vermont Capital Exclusion Form

Filling out the Vermont capital exclusion form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including records of the assets sold and any related financial statements. Next, accurately complete the form, ensuring that all required fields are filled out. Pay particular attention to the sections that pertain to the calculation of capital gains and the application of the exclusion. After completing the form, review it thoroughly for any errors before submission.

Key Elements of the Vermont Capital Exclusion

The Vermont capital exclusion comprises several key elements that taxpayers should be aware of. These include the types of assets that qualify for exclusion, the specific calculations required to determine eligible gains, and any applicable limits on the exclusion amount. Additionally, understanding the time frames involved in claiming the exclusion is essential, as it can affect the overall tax filing process. Taxpayers should also be aware of any changes in legislation that may impact the exclusion from year to year.

Required Documents for Vermont Capital Exclusion

To successfully claim the Vermont capital exclusion, taxpayers must provide certain documentation. This typically includes proof of the sale of the asset, such as closing statements, sales contracts, or brokerage statements. Taxpayers may also need to submit documentation that verifies the original purchase price of the asset to accurately calculate the capital gain. Keeping thorough records of all transactions and related documents can streamline the process and ensure compliance with state regulations.

Legal Use of the Vermont Capital Exclusion

The legal framework governing the Vermont capital exclusion is established by state tax law. Taxpayers must adhere to these regulations to ensure that their claims are valid. This includes understanding the eligibility criteria and the specific calculations required to determine the exclusion amount. Failure to comply with these legal requirements can result in penalties or the disallowance of the exclusion, making it imperative for taxpayers to be well-informed about their rights and responsibilities.

Filing Deadlines for Vermont Capital Exclusion

Filing deadlines for the Vermont capital exclusion are critical for taxpayers to observe. Generally, the deadline for submitting tax returns, including claims for capital exclusions, aligns with the federal tax filing deadline. However, Vermont may have specific state deadlines that differ from federal timelines. It is advisable for taxpayers to verify the exact dates each tax year to avoid late penalties and ensure that they can take full advantage of available exclusions.

Quick guide on how to complete vermont income tax vt state tax calculator community tax

Complete Vermont Income Tax VT State Tax Calculator Community Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without issues. Manage Vermont Income Tax VT State Tax Calculator Community Tax on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Vermont Income Tax VT State Tax Calculator Community Tax with ease

- Locate Vermont Income Tax VT State Tax Calculator Community Tax and click Get Form to initiate the process.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Vermont Income Tax VT State Tax Calculator Community Tax and ensure seamless communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vermont income tax vt state tax calculator community tax

Create this form in 5 minutes!

How to create an eSignature for the vermont income tax vt state tax calculator community tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Vermont Capital and how does it relate to airSlate SignNow?

Vermont Capital refers to investment opportunities and financing options available within the state of Vermont. By utilizing airSlate SignNow, businesses in Vermont can streamline their document signing processes, making it easier to manage contracts and agreements related to capital investments.

-

What pricing plans does airSlate SignNow offer for Vermont Capital businesses?

airSlate SignNow provides several pricing plans tailored to meet the needs of businesses in Vermont Capital. These plans vary based on features and volume, ensuring that businesses can choose a cost-effective solution that suits their specific requirements for eSigning documents.

-

What features does airSlate SignNow provide for Vermont Capital clients?

airSlate SignNow offers a range of features ideal for Vermont Capital clients, including customizable templates, in-person signing, and advanced security measures. These features help businesses ensure compliance and efficiency while managing their capital documentation.

-

How can airSlate SignNow benefit businesses seeking Vermont Capital?

By adopting airSlate SignNow, businesses looking for Vermont Capital can enhance their operational efficiency with quick and secure eSigning solutions. This leads to faster deal closures and improves the overall customer experience by facilitating seamless document transactions.

-

Can airSlate SignNow integrate with other tools used by Vermont Capital professionals?

Yes, airSlate SignNow offers integrations with various platforms that Vermont Capital professionals commonly use, such as CRM systems and cloud storage services. These integrations ensure that users can streamline their workflows and maintain a cohesive digital environment.

-

Is airSlate SignNow secure for handling sensitive documents related to Vermont Capital?

Absolutely, airSlate SignNow employs industry-standard security measures, including encryption and audit trails, to protect sensitive documents associated with Vermont Capital. Users can confidently manage their capital agreements knowing that their data is secure and compliant.

-

How does the user experience of airSlate SignNow support Vermont Capital users?

airSlate SignNow is designed with user-friendliness in mind, providing an intuitive interface that simplifies the signing process for Vermont Capital users. This ease of use allows businesses to quickly adapt and incorporate eSignatures into their operations without extensive training.

Get more for Vermont Income Tax VT State Tax Calculator Community Tax

Find out other Vermont Income Tax VT State Tax Calculator Community Tax

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report