Marriott W2 Former Employee

What is the Marriott W2 Former Employee

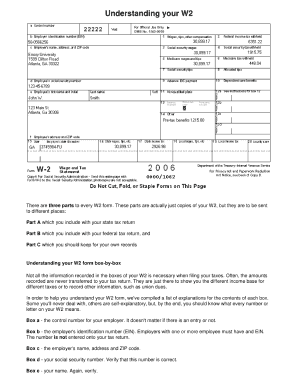

The Marriott W2 for former employees is a tax document that reports an individual's annual wages and the taxes withheld during their employment with Marriott International. This form is essential for former employees to accurately file their income tax returns. It includes information such as the employee's total earnings, Social Security wages, Medicare wages, and federal and state tax withholdings. Understanding this document is crucial for ensuring compliance with tax regulations and for maximizing potential tax refunds.

How to Obtain the Marriott W2 Former Employee

To obtain the Marriott W2 as a former employee, individuals can access it through the Marriott employee portal or request it directly from the human resources department. The process typically involves logging into the designated online platform, where employees can view and download their W2 forms. If online access is not available, a request can be made via phone or email to the HR team, who can provide the necessary documentation by mail or electronically.

Steps to Complete the Marriott W2 Former Employee

Completing the Marriott W2 as a former employee involves several key steps:

- Log into the Marriott employee portal using your credentials.

- Navigate to the tax documents section to locate your W2 form.

- Download or print the W2 for your records.

- Review the information for accuracy, ensuring all earnings and withholdings are correctly reported.

- Use the completed W2 to file your federal and state tax returns.

Legal Use of the Marriott W2 Former Employee

The Marriott W2 for former employees is a legally binding document used for tax reporting purposes. It must be filled out accurately to comply with IRS regulations. The document serves as proof of income and tax withholdings, which is necessary for filing income tax returns. Failure to provide accurate information on the W2 can result in penalties or delays in tax processing.

Filing Deadlines / Important Dates

Filing deadlines for tax returns using the Marriott W2 are crucial to remember. Typically, the IRS requires individual tax returns to be filed by April 15 of each year. Former employees should ensure they receive their W2 forms by the end of January to allow adequate time for review and filing. Additionally, any extensions for filing must be requested prior to the deadline to avoid penalties.

Who Issues the Form

The Marriott W2 form is issued by Marriott International's payroll department. This department is responsible for generating and distributing W2 forms to all employees, including former employees, by the required deadline. It is important for former employees to ensure their contact information is up to date with HR to receive their W2 promptly.

Quick guide on how to complete marriott w2 former employee

Easily Prepare Marriott W2 Former Employee on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly option to traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Handle Marriott W2 Former Employee on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-related workflow today.

Edit and eSign Marriott W2 Former Employee with Ease

- Locate Marriott W2 Former Employee and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Mark essential parts of the documents or cover sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and has the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to finalize your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require printing fresh document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Marriott W2 Former Employee to ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the marriott w2 former employee

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Marriott W2 form?

The Marriott W2 form is a tax document that reports an employee's annual earnings and withheld taxes. It is essential for employees to accurately file their tax returns. If you are a Marriott employee, you can access your Marriott W2 online through the company's HR portal.

-

How can I obtain my Marriott W2 electronically?

You can access your Marriott W2 electronically by logging into the Marriott employee portal. Once logged in, navigate to the tax documents section to view and download your Marriott W2 form. This convenient method ensures you have your documents ready for tax season.

-

What should I do if I can't find my Marriott W2 form?

If you are unable to find your Marriott W2 form, first check your email and Marriott’s HR portal. If it is still missing, contact your local HR department for assistance. They can provide you with a copy or guide you in retrieving it online.

-

Are there any fees associated with accessing my Marriott W2?

No, accessing your Marriott W2 through the employee portal is free of charge. Marriott employees can easily retrieve their documents without incurring any fees. This efficient system is designed to make tax season stress-free.

-

Can I use airSlate SignNow to eSign my Marriott W2?

Yes, airSlate SignNow allows you to securely eSign your Marriott W2 form. This feature simplifies the process, ensuring your signed documents are legally binding and easily sharable. With airSlate SignNow, managing your tax documents becomes effortless.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a range of features including easy eSigning, document templates, and secure storage options. These tools are designed to streamline the document signing process, making it ideal for handling important forms like the Marriott W2. You can also track the status of your signed documents in real-time.

-

Is airSlate SignNow compatible with other applications?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and Microsoft Office. This compatibility enhances your workflow, allowing you to manage your Marriott W2 and other documents efficiently across different platforms. It makes document management easier than ever before.

Get more for Marriott W2 Former Employee

Find out other Marriott W2 Former Employee

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure