Irs Form 4v

What is the IRS Form 4V

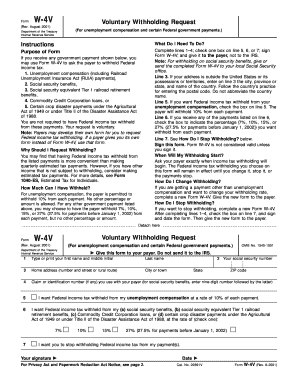

The IRS Form 4V is a document used by taxpayers to request a specific type of tax relief or adjustment. This form is particularly relevant for individuals who need to address discrepancies or seek modifications related to their tax obligations. Understanding the purpose of this form is crucial for ensuring compliance with IRS regulations and making informed decisions regarding tax filings.

How to Obtain the IRS Form 4V

To obtain the IRS Form 4V, taxpayers can visit the official IRS website where forms are made available for download. The form can also be requested by calling the IRS directly or visiting a local IRS office. It is essential to ensure that you are using the most current version of the form to avoid any issues during the submission process.

Steps to Complete the IRS Form 4V

Completing the IRS Form 4V involves several key steps:

- Begin by downloading the form from the IRS website or obtaining a physical copy.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form with accurate information, ensuring that all required fields are completed.

- Double-check your entries for accuracy and completeness to avoid delays.

- Sign and date the form where indicated.

Legal Use of the IRS Form 4V

The IRS Form 4V is legally binding when completed and submitted according to IRS guidelines. It is important to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal repercussions. Utilizing a reliable electronic signature solution can further enhance the legitimacy of the submission.

Form Submission Methods

Taxpayers have multiple options for submitting the IRS Form 4V:

- Online: Some forms can be submitted electronically through the IRS e-file system.

- Mail: The completed form can be printed and mailed to the appropriate IRS address.

- In-Person: Taxpayers may also choose to deliver the form in person at a local IRS office.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the IRS Form 4V. Missing these deadlines can lead to complications, including penalties. Taxpayers should consult the IRS website or their tax professional for specific dates related to their circumstances, ensuring timely submission of the form.

Quick guide on how to complete irs form 4v

Complete Irs Form 4v with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It presents an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Irs Form 4v on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Irs Form 4v effortlessly

- Obtain Irs Form 4v and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Irs Form 4v to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 4v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 4V and how can it help my business?

IRS Form 4V is an essential tax form used for various filing purposes. By utilizing airSlate SignNow, businesses can easily prepare, send, and eSign their IRS Form 4V securely and efficiently, helping to streamline their tax processes.

-

How does airSlate SignNow handle IRS Form 4V eSigning?

With airSlate SignNow, eSigning IRS Form 4V is quick and straightforward. Users can send the form to recipients for signature via email or link, enabling efficient collaboration while ensuring that all signatures are legally binding.

-

Are there any additional fees when using airSlate SignNow for IRS Form 4V?

airSlate SignNow offers a transparent pricing model, so you pay for the features you need without hidden fees. Plans start at an affordable rate, and you can eSign documents like the IRS Form 4V without incurring extra charges.

-

What features does airSlate SignNow provide for IRS Form 4V processing?

AirSlate SignNow provides several features for processing IRS Form 4V, including templates, automated reminders, and real-time notifications. These features enhance efficiency and ensure your documents are processed promptly and accurately.

-

Can I integrate airSlate SignNow with other applications when working with IRS Form 4V?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflows while managing IRS Form 4V. Whether you use CRM systems or project management tools, you can connect with ease to optimize your document management.

-

Is airSlate SignNow compliant with IRS regulations regarding IRS Form 4V?

Absolutely! airSlate SignNow complies with all IRS regulations, ensuring that your IRS Form 4V and other documents are managed securely. You can trust our solution to keep your data safe while providing the necessary compliance.

-

What devices can I use to fill out and eSign IRS Form 4V?

You can access airSlate SignNow and work on your IRS Form 4V from any device, including desktops, tablets, and smartphones. This flexibility allows you to manage your documents on-the-go, making eSigning convenient and efficient.

Get more for Irs Form 4v

- Bill dispute template form

- Lien document sample form

- Agreed order form

- Agreement broker property 497330296 form

- Petition for forfeiture 497330297 form

- Bailment form

- Agreed judgment 497330299 form

- Rental release and indemnity agreement given by customer in favor of equipment supplier for pole dancing parties form

Find out other Irs Form 4v

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy