Texas Resale Certificate Form

What is the Texas Resale Certificate

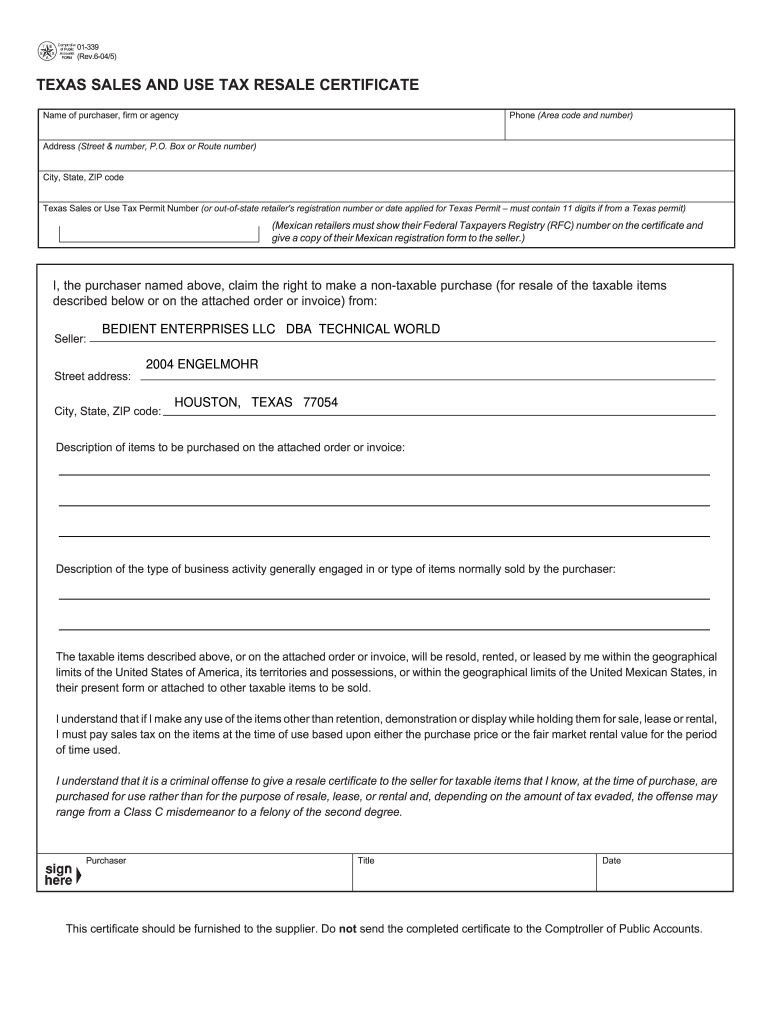

The Texas Resale Certificate is a legal document that allows a buyer to purchase goods without paying sales tax. This certificate is primarily used by businesses that intend to resell the purchased items. By providing this certificate to the seller, the buyer certifies that the items will not be used for personal consumption but rather for resale in the regular course of business. This document is essential for maintaining compliance with state tax regulations and ensuring that businesses do not incur unnecessary tax expenses.

How to use the Texas Resale Certificate

To use the Texas Resale Certificate, a buyer must complete the form accurately and provide it to the seller at the time of purchase. The certificate must include specific information, such as the buyer's name, address, and the seller's name and address. Additionally, it should detail the type of items being purchased for resale. It is crucial for the buyer to retain a copy of the certificate for their records, as it may be required for tax audits or compliance checks by the Texas Comptroller.

Steps to complete the Texas Resale Certificate

Completing the Texas Resale Certificate involves several straightforward steps:

- Obtain the Texas Resale Certificate form from a reliable source or the Texas Comptroller's website.

- Fill in the buyer's name and address accurately.

- Provide the seller's name and address.

- List the type of items being purchased for resale.

- Sign and date the certificate, affirming the information provided is accurate.

Once completed, present the certificate to the seller to finalize the tax-exempt purchase.

Legal use of the Texas Resale Certificate

The legal use of the Texas Resale Certificate is governed by state tax laws. Buyers must ensure that they are eligible to use the certificate, which typically means they must be registered with the Texas Comptroller and have a valid sales tax permit. Misuse of the certificate, such as using it for personal purchases or failing to provide accurate information, can result in penalties, including fines and back taxes owed. It is essential for businesses to understand the legal implications of using the Texas Resale Certificate to avoid any compliance issues.

Key elements of the Texas Resale Certificate

Key elements of the Texas Resale Certificate include:

- Buyer’s name and address

- Seller’s name and address

- Description of the property being purchased for resale

- Signature of the buyer or authorized representative

- Date of completion

Each of these elements plays a crucial role in ensuring the certificate is valid and meets the requirements set forth by the Texas Comptroller.

Examples of using the Texas Resale Certificate

Examples of using the Texas Resale Certificate can include various retail scenarios. For instance, a clothing store purchasing inventory from a wholesaler would present the certificate to avoid paying sales tax on the items. Similarly, a restaurant buying supplies from a food distributor would use the certificate to ensure tax exemption on ingredients intended for resale. These examples illustrate the practical application of the certificate in everyday business transactions.

Who Issues the Form

The Texas Resale Certificate is issued by the Texas Comptroller of Public Accounts. Businesses must apply for a sales tax permit through the Comptroller's office to obtain the authority to use the resale certificate. This process includes providing necessary business information and ensuring compliance with state regulations. Once registered, businesses can utilize the resale certificate for qualifying purchases.

Quick guide on how to complete texas resale certificate

Complete Texas Resale Certificate seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Texas Resale Certificate on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Texas Resale Certificate effortlessly

- Find Texas Resale Certificate and click on Obtain Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Finish button to store your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Texas Resale Certificate and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas resale certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas Resale Certificate?

A Texas Resale Certificate is a legal document that allows businesses in Texas to purchase goods without paying sales tax. This certificate is essential for wholesalers and retailers who intend to resell products. By using the Texas Resale Certificate, you can save on upfront costs and streamline your purchasing process.

-

How can I obtain a Texas Resale Certificate?

To obtain a Texas Resale Certificate, you need to fill out Form 01-339, which is available on the Texas Comptroller's website. Make sure you provide all required information, including your business details and tax ID. Once completed, submit the form to your vendor to facilitate tax-exempt purchases.

-

What are the benefits of using a Texas Resale Certificate?

The primary benefit of using a Texas Resale Certificate is the ability to purchase inventory without incurring sales tax, which can signNowly reduce costs. Additionally, it helps simplify the documentation process when making bulk purchases for your business. Having a Texas Resale Certificate ensures compliance with Texas tax regulations.

-

Is there a cost associated with getting a Texas Resale Certificate?

Obtaining a Texas Resale Certificate is generally free, as there are no direct costs for filling out and submitting the required form. However, you might incur some costs related to legal or accounting services if you choose to seek assistance. The long-term savings from tax exemptions can exceed any initial costs involved.

-

Can a Texas Resale Certificate be used for online purchases?

Yes, a Texas Resale Certificate can be used for online purchases as long as the vendor accepts it. Make sure to provide the certificate to the online retailer before completing your purchase. This ensures that you won’t be charged sales tax on goods intended for resale.

-

How often do I need to renew my Texas Resale Certificate?

A Texas Resale Certificate does not typically expire, but it’s good practice to ensure that the information on file is up to date. If your business information changes, such as your address or ownership, you should issue a new certificate. Always check with vendors for their specific requirements regarding the validity of the Texas Resale Certificate.

-

What types of businesses should apply for a Texas Resale Certificate?

Any business in Texas that resells tangible personal property should apply for a Texas Resale Certificate. This includes retailers, wholesalers, and online businesses selling products. By applying, you can save signNowly on sales tax when purchasing items for resale.

Get more for Texas Resale Certificate

Find out other Texas Resale Certificate

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple