Iht205 Form

What is the IHT205?

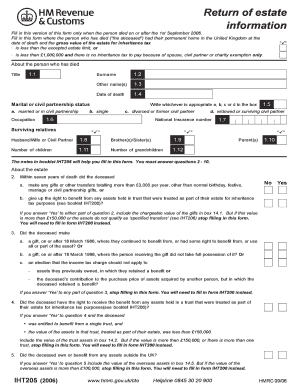

The IHT205 is a probate form used in the United Kingdom to report the value of an estate for inheritance tax purposes. Specifically, it is designed for estates that do not exceed a certain threshold, allowing executors to provide a simplified declaration of the estate's value. This form is essential for ensuring compliance with inheritance tax regulations and is typically required when applying for a grant of probate.

How to obtain the IHT205

The IHT205 can be obtained through the official government website, where it is available in a downloadable format. Users can access the IHT205 printable version in PDF format, making it easy to fill out and submit. Additionally, physical copies may be available at local probate registries or through legal advisors specializing in estate management.

Steps to complete the IHT205

Completing the IHT205 involves several key steps:

- Gather all necessary information about the deceased's assets and liabilities.

- Fill out the form accurately, ensuring that all values are current and reflect the estate's worth.

- Include any relevant documentation that supports the values declared, such as bank statements or property valuations.

- Review the completed form for accuracy and completeness before submission.

Legal use of the IHT205

The IHT205 is legally binding when completed correctly and submitted to the appropriate authorities. It serves as an official declaration of the estate's value and is subject to scrutiny by HM Revenue and Customs (HMRC). Ensuring that the form is filled out accurately is crucial to avoid potential legal issues or penalties related to inheritance tax compliance.

Required Documents

When submitting the IHT205, certain documents may be required to support the information provided. These can include:

- Death certificate of the deceased.

- Proof of ownership for any property or significant assets.

- Bank statements and financial documents that detail the deceased's liabilities.

- Any previous wills or estate planning documents that may affect the estate's value.

Form Submission Methods

The IHT205 can be submitted in various ways, depending on the preferences of the executor and the requirements of the probate registry. Common submission methods include:

- Online submission through the official government portal.

- Mailing a printed version of the completed form to the probate registry.

- In-person submission at the local probate registry office.

Quick guide on how to complete iht205

Complete Iht205 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Iht205 on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Iht205 with ease

- Locate Iht205 and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Iht205 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht205

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the iht205 printable version?

The iht205 printable version is a specific form used in various business processes that enables users to easily print and complete documentation. With airSlate SignNow, you can streamline the process of generating this form electronically and ensure that all necessary fields are filled out correctly before printing.

-

How can I obtain the iht205 printable version through airSlate SignNow?

You can obtain the iht205 printable version by signing up for an airSlate SignNow account, where you can access and customize the form as needed. Our platform makes it simple to generate and manage your documents, ensuring you have the correct version at your fingertips.

-

Is there a fee associated with using the iht205 printable version?

While airSlate SignNow offers various pricing plans, accessing the iht205 printable version typically falls within those plans. You can choose a plan that suits your business needs, ensuring that you get the most value for your document management and eSignature requirements.

-

What features does airSlate SignNow offer for the iht205 printable version?

airSlate SignNow offers features like easy document editing, eSigning, and secure cloud storage for the iht205 printable version. These tools empower users to manage their forms efficiently, making collaboration simpler while ensuring all documents are legally binding.

-

Can I integrate airSlate SignNow with other tools for the iht205 printable version?

Yes, airSlate SignNow allows integration with various third-party applications, enhancing your ability to work with the iht205 printable version. This includes seamless connections with CRM systems, cloud storage services, and productivity tools to optimize document workflows.

-

What are the benefits of using the iht205 printable version with airSlate SignNow?

Using the iht205 printable version with airSlate SignNow offers signNow benefits, including increased efficiency, reduced errors, and improved compliance. Our platform simplifies the document management process, allowing you to focus more on your core business activities without the hassle of manual paperwork.

-

How secure is the iht205 printable version when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The iht205 printable version is protected with advanced encryption and secure access controls, ensuring that your documents remain confidential and compliant with industry regulations and standards.

Get more for Iht205

Find out other Iht205

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document