Declaration to Revenue Authorisation Form PAYE A1 PAYE Tax Agency Services 2021-2026

What is the Declaration To Revenue Authorisation Form PAYE A1 PAYE Tax Agency Services

The Declaration To Revenue Authorisation Form PAYE A1 is a crucial document used in the United States for tax purposes. It is primarily utilized by employers to report income tax deductions for employees. This form ensures that the appropriate amount of tax is withheld from an employee's wages, facilitating compliance with federal tax regulations. The PAYE A1 form serves as an official declaration to the tax authorities, providing necessary information about the employee's earnings and tax status.

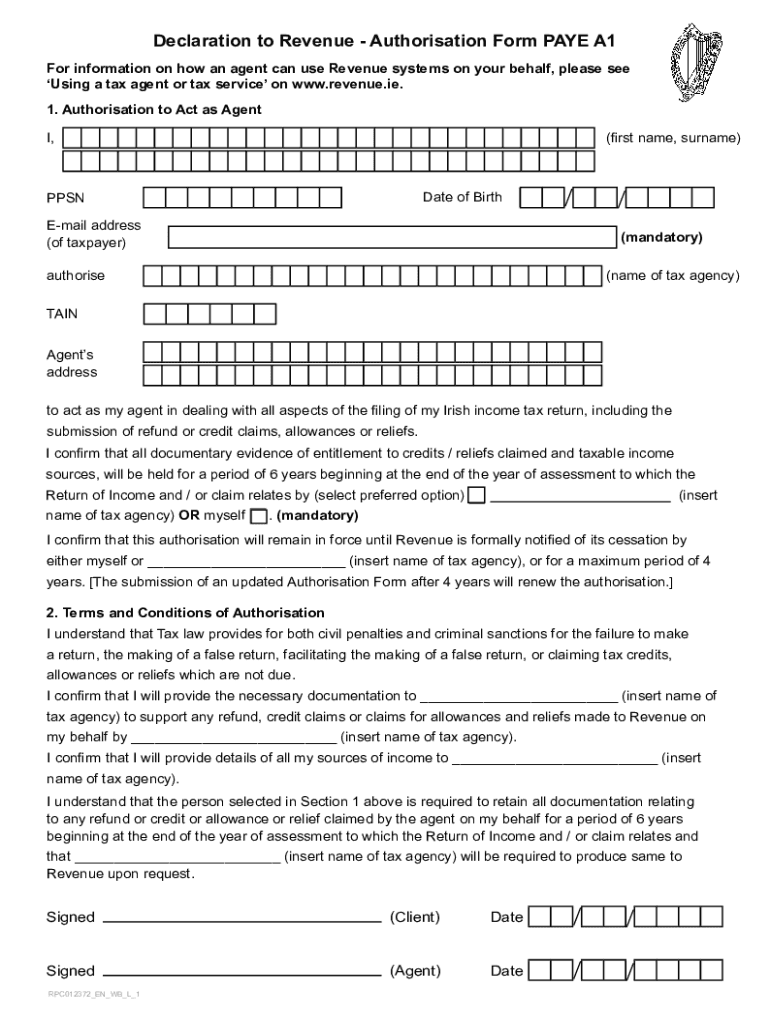

Steps to complete the Declaration To Revenue Authorisation Form PAYE A1 PAYE Tax Agency Services

Completing the PAYE A1 form involves several key steps to ensure accuracy and compliance. First, gather all relevant information, including the employee's personal details, tax identification number, and income details. Next, accurately fill out each section of the form, ensuring that all figures are correct. It is essential to double-check calculations to avoid discrepancies. Once completed, the form should be signed and dated by the employer. Finally, submit the form to the appropriate tax agency either electronically or via mail, following the specific submission guidelines provided by the IRS.

Legal use of the Declaration To Revenue Authorisation Form PAYE A1 PAYE Tax Agency Services

The legal use of the PAYE A1 form is governed by federal tax laws and regulations. This form must be completed accurately to ensure that tax withholdings are legitimate and comply with IRS standards. Failure to adhere to these legal requirements can result in penalties or audits. By using a reliable electronic signature solution, such as signNow, employers can ensure that the form is executed in a legally binding manner. Compliance with the ESIGN Act and other relevant legislation is essential for the form's validity.

Key elements of the Declaration To Revenue Authorisation Form PAYE A1 PAYE Tax Agency Services

Key elements of the PAYE A1 form include the employee's personal information, such as name, address, and Social Security number. The form also requires details about the employer, including the business name and tax identification number. Additionally, it includes sections for reporting the employee's earnings, tax deductions, and any applicable credits. Ensuring that all these elements are accurately filled out is vital for the form's acceptance by tax authorities.

How to use the Declaration To Revenue Authorisation Form PAYE A1 PAYE Tax Agency Services

Using the PAYE A1 form effectively involves understanding its purpose and the information required. Employers should first familiarize themselves with the form's layout and the specific data needed. Once the form is completed, it can be submitted electronically through authorized channels or printed and mailed to the tax agency. It is advisable to keep a copy of the submitted form for record-keeping purposes. This ensures that employers can provide proof of compliance if needed.

Filing Deadlines / Important Dates

Filing deadlines for the PAYE A1 form are critical to ensure compliance with tax regulations. Employers must submit the form by the specified due date to avoid penalties. Typically, the deadline aligns with payroll tax submission schedules, which may vary based on the employer's reporting frequency. It is essential to stay informed about any changes to these deadlines to ensure timely submission.

Quick guide on how to complete declaration to revenue authorisation form paye a1 paye tax agency services

Effortlessly Prepare Declaration To Revenue Authorisation Form PAYE A1 PAYE Tax Agency Services on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, since you can easily locate the necessary form and securely keep it online. airSlate SignNow provides all the features you require to create, modify, and electronically sign your documents swiftly without delays. Manage Declaration To Revenue Authorisation Form PAYE A1 PAYE Tax Agency Services from any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The Easiest Way to Alter and eSign Declaration To Revenue Authorisation Form PAYE A1 PAYE Tax Agency Services Effortlessly

- Locate Declaration To Revenue Authorisation Form PAYE A1 PAYE Tax Agency Services and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize key sections of your documents or redact confidential information with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Declaration To Revenue Authorisation Form PAYE A1 PAYE Tax Agency Services to ensure superb communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct declaration to revenue authorisation form paye a1 paye tax agency services

Create this form in 5 minutes!

How to create an eSignature for the declaration to revenue authorisation form paye a1 paye tax agency services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the revenue a1 form?

The revenue a1 form is a document used to report an employer's social security contributions within the European Union. It serves as proof that the employer is compliant with social security laws and can help businesses avoid double taxation in multiple countries.

-

How can airSlate SignNow help with the revenue a1 form?

airSlate SignNow streamlines the process of filling out, sending, and signing the revenue a1 form. With our user-friendly interface, you can electronically sign this document and ensure it's sent to the proper authorities quickly and securely.

-

What are the pricing options for using airSlate SignNow for the revenue a1 form?

airSlate SignNow offers flexible pricing plans tailored to suit various business needs. Our plans are cost-effective, allowing you to efficiently manage documents like the revenue a1 form without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for managing the revenue a1 form?

Yes, airSlate SignNow seamlessly integrates with various software applications such as CRMs and project management tools. This integration simplifies tracking and managing the revenue a1 form alongside your other business processes.

-

Is the revenue a1 form legally binding when signed with airSlate SignNow?

Absolutely! The revenue a1 form signed with airSlate SignNow is legally binding and compliant with eSignature regulations. Our platform ensures that your signed documents meet legal standards for enforceability.

-

What features does airSlate SignNow offer for managing the revenue a1 form?

airSlate SignNow includes features like customizable templates, real-time tracking, and automated workflows specifically designed for documents like the revenue a1 form. These tools enhance efficiency, making document management smoother.

-

How does airSlate SignNow ensure the security of my revenue a1 form?

airSlate SignNow prioritizes security with advanced encryption and secure cloud storage for your revenue a1 form and other documents. We comply with industry standards to keep your sensitive information safe throughout the signing process.

Get more for Declaration To Revenue Authorisation Form PAYE A1 PAYE Tax Agency Services

Find out other Declaration To Revenue Authorisation Form PAYE A1 PAYE Tax Agency Services

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now