Farm Exemption Kentucky Form

What is the Farm Exemption Kentucky

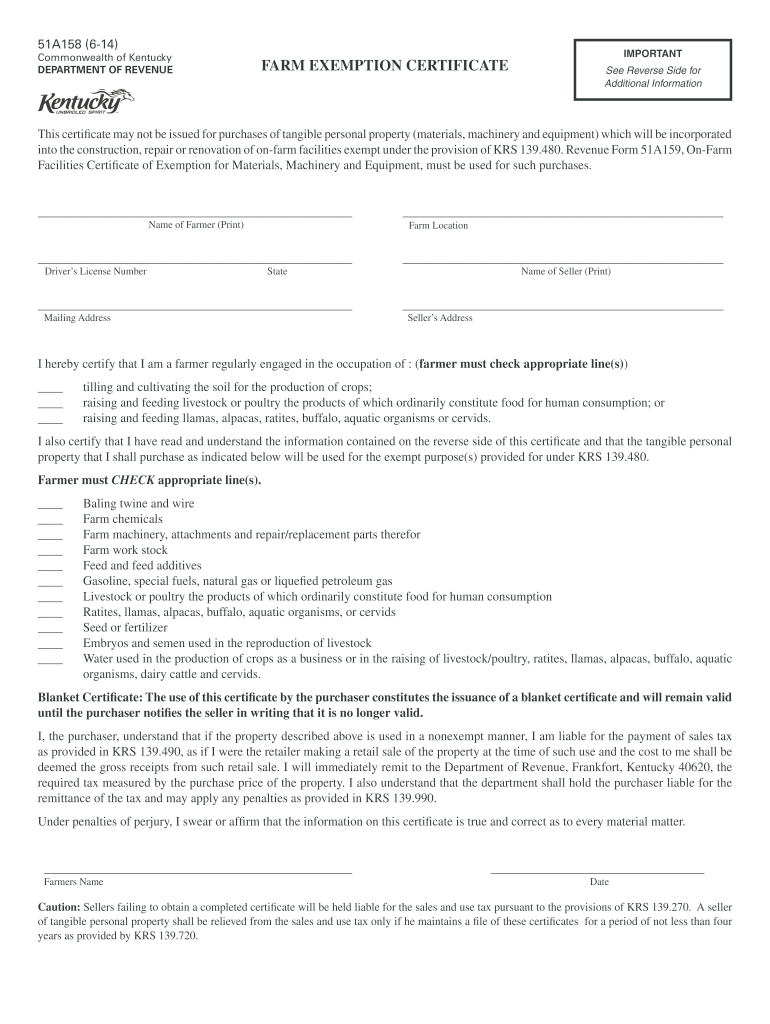

The Kentucky sales tax exemption for farmers allows eligible agricultural producers to purchase certain items without paying sales tax. This exemption is designed to support the farming community by reducing the financial burden associated with purchasing necessary supplies and equipment. The exemption applies to items used directly in agricultural production, such as seeds, fertilizers, and farming equipment. Understanding the specifics of this exemption can help farmers maximize their resources and ensure compliance with state regulations.

How to Obtain the Farm Exemption Kentucky

To obtain the Kentucky farm exemption, farmers must complete a specific application process. This involves filling out the Kentucky tax exempt form, which requires information about the applicant's farming operations and the types of purchases they intend to make. Farmers may need to provide documentation proving their eligibility, such as proof of farming income or a description of their farming activities. Once the form is completed, it should be submitted to the appropriate state tax authority for approval.

Steps to Complete the Farm Exemption Kentucky

Completing the Kentucky farm exemption form involves several key steps:

- Gather necessary documentation, including proof of farming operations and income.

- Fill out the Kentucky tax exempt form accurately, ensuring all required information is included.

- Review the form for any errors or missing information.

- Submit the completed form to the Kentucky Department of Revenue.

- Await confirmation of approval or any additional requests for information.

Key Elements of the Farm Exemption Kentucky

Several key elements define the Kentucky sales tax exemption for farmers. Firstly, the exemption applies to specific agricultural items, including equipment and supplies directly used in farming. Secondly, eligibility is typically limited to individuals or entities engaged in agricultural production. Lastly, proper documentation is crucial for maintaining compliance and ensuring that purchases qualify for the exemption. Farmers should keep detailed records of their transactions to support their claims.

Eligibility Criteria

Eligibility for the Kentucky farm exemption is primarily based on the nature of the farming operations. Farmers must demonstrate that they are actively engaged in agricultural production and that their purchases are necessary for this purpose. This may include individuals who operate farms, ranches, or other agricultural enterprises. Additionally, the exemption may not apply to items used for personal, non-agricultural purposes. Understanding these criteria is essential for farmers to take full advantage of the exemption.

Required Documents

When applying for the Kentucky farm exemption, farmers must prepare several required documents. These typically include:

- The completed Kentucky tax exempt form.

- Proof of farming operations, such as tax returns or business licenses.

- Documentation of purchases intended for agricultural use.

Having these documents ready can streamline the application process and improve the chances of approval.

Form Submission Methods

Farmers can submit the Kentucky farm exemption form through various methods. The options typically include:

- Online submission through the Kentucky Department of Revenue's website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can depend on the farmer's preference and the urgency of the application.

Quick guide on how to complete farm exemption kentucky

Prepare Farm Exemption Kentucky effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents since you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Farm Exemption Kentucky on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to modify and eSign Farm Exemption Kentucky with ease

- Retrieve Farm Exemption Kentucky and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Modify and eSign Farm Exemption Kentucky and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the farm exemption kentucky

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kentucky sales tax exemption for farmers?

The Kentucky sales tax exemption for farmers allows qualifying agricultural producers to purchase certain goods and services without paying sales tax. This exemption helps reduce the financial burden on farmers, enabling them to invest more in their operations. It’s essential for farmers to understand the specific criteria required to qualify for this exemption.

-

How can airSlate SignNow help with the sales tax exemption process for farmers in Kentucky?

airSlate SignNow streamlines the process for farmers by allowing them to easily sign and manage documents related to the Kentucky sales tax exemption. With its intuitive interface, farmers can quickly send, receive, and track exemption certificates electronically, saving both time and resources. This efficiency is vital for ensuring compliance with tax regulations.

-

Are there any costs associated with using airSlate SignNow to process Kentucky sales tax exemption documentation?

There may be subscription fees when using airSlate SignNow, but it offers various pricing plans tailored to different business sizes and needs. The cost-effectiveness of the platform provides signNow savings for farmers handling multiple exemption documents. Overall, the benefits of time savings and increased productivity often outweigh the nominal costs.

-

What features does airSlate SignNow provide for managing Kentucky sales tax exemption forms?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage that enhance the management of Kentucky sales tax exemption forms. Farmers can easily create, send, and store exemption certificates, ensuring they remain compliant with state regulations. These features contribute signNowly to efficient document handling.

-

Is airSlate SignNow easy to integrate with other tools used by farmers?

Yes, airSlate SignNow offers seamless integrations with a variety of popular business applications, making it easy for farmers to sync their existing tools with the Kentucky sales tax exemption process. Integrating these tools simplifies workflows and enhances overall productivity. Farmers can ensure a smooth transition and operation by linking to their current systems.

-

What benefits do farmers gain from using airSlate SignNow for Kentucky sales tax exemption?

Farmers benefit from increased efficiency, reduced paperwork, and better organization when using airSlate SignNow for Kentucky sales tax exemption. The platform helps mitigate errors in documentation and accelerates the approval process for exemptions. Ultimately, this can lead to signNow time savings and improved cash flow management for farmers.

-

How secure is the documentation process with airSlate SignNow for Kentucky sales tax exemption?

The security of documentation processed through airSlate SignNow is a top priority, especially for sensitive materials like Kentucky sales tax exemption forms. The platform utilizes advanced encryption methods and secure cloud storage to protect users' data. Farmers can trust that their documents are managed securely and are accessible only to authorized personnel.

Get more for Farm Exemption Kentucky

- Legal last will and testament for married person with minor children from prior marriage nebraska form

- Legal last will and testament form for married person with adult children from prior marriage nebraska

- Legal last will and testament form for divorced person not remarried with adult children nebraska

- Legal last will and testament form for divorced person not remarried with no children nebraska

- Legal last will and testament form for divorced person not remarried with minor children nebraska

- Legal last will and testament form for divorced person not remarried with adult and minor children nebraska

- Mutual wills package with last wills and testaments for married couple with adult children nebraska form

- Mutual wills package with last wills and testaments for married couple with no children nebraska form

Find out other Farm Exemption Kentucky

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe