Annuity Insurance Prudential Form

What is the Annuity Insurance Prudential

The Annuity Insurance Prudential refers to a financial product offered by Prudential that provides a steady income stream, typically during retirement. This type of annuity is designed to help individuals manage their financial future by converting a lump sum of money into regular payments over a specified period. It can be beneficial for those looking to secure a reliable source of income while minimizing the risk associated with market fluctuations.

How to use the Annuity Insurance Prudential

Using the Annuity Insurance Prudential involves several steps. First, individuals should assess their financial goals and determine how much income they will need during retirement. Next, they can contact Prudential to discuss their options, including the types of annuities available and the associated benefits. Once a suitable product is chosen, individuals will need to complete the necessary paperwork, which can often be done online for convenience.

Steps to complete the Annuity Insurance Prudential

Completing the Annuity Insurance Prudential typically involves the following steps:

- Evaluate your financial needs and retirement goals.

- Research the different types of annuities offered by Prudential.

- Contact a Prudential representative for guidance and to obtain necessary forms.

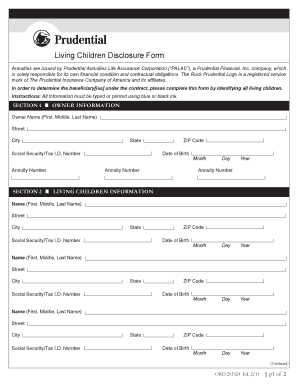

- Fill out the application forms, providing required personal and financial information.

- Submit the completed forms electronically or via mail, depending on your preference.

- Review the terms and conditions of the annuity contract before finalizing.

Legal use of the Annuity Insurance Prudential

The legal use of the Annuity Insurance Prudential is governed by various regulations that ensure the protection of consumers. These regulations stipulate that annuities must be clearly defined and that all terms must be transparent to the policyholder. Compliance with the Insurance Code and other relevant laws is essential to ensure that the annuity is valid and enforceable. Prudential adheres to these regulations, providing customers with the assurance that their contracts are legally binding.

Required Documents

When applying for the Annuity Insurance Prudential, several documents are typically required. These may include:

- Proof of identity, such as a driver's license or passport.

- Financial statements to demonstrate income and assets.

- Completed application forms specific to the annuity product.

- Any additional documentation requested by Prudential based on individual circumstances.

Eligibility Criteria

Eligibility for the Annuity Insurance Prudential may vary based on the specific product and individual circumstances. Generally, applicants must be at least eighteen years old and have a valid Social Security number. Additionally, Prudential may consider factors such as income level, financial goals, and the intended use of the annuity when determining eligibility. It is advisable to consult with a Prudential representative to understand specific requirements.

Quick guide on how to complete annuity insurance prudential

Effortlessly Prepare Annuity Insurance Prudential on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Annuity Insurance Prudential on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

Steps to Modify and Electronically Sign Annuity Insurance Prudential Seamlessly

- Locate Annuity Insurance Prudential and select Get Form to begin.

- Make use of the tools available to complete your document.

- Mark important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides for this specific need.

- Generate your electronic signature with the Sign tool, which takes just a few seconds and carries the same legal authority as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Choose how you would like to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Annuity Insurance Prudential to guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annuity insurance prudential

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an annuity prudential?

An annuity prudential is a financial product that offers a steady income stream for individuals during retirement. It is designed to provide security and peace of mind, ensuring that you can maintain your lifestyle without financial strain. Choosing an annuity prudential can help you plan effectively for your future.

-

How does an annuity prudential compare to other retirement options?

An annuity prudential provides guaranteed income, which sets it apart from other retirement savings options like 401(k)s or IRAs that can fluctuate with market conditions. Unlike these accounts, an annuity prudential ensures that your funds are protected from market volatility, allowing you to enjoy a more stable retirement income. Understanding these differences can help you make informed financial decisions.

-

What are the benefits of investing in an annuity prudential?

Investing in an annuity prudential offers various advantages, including tax-deferred growth and the security of fixed payments. It also allows for customization based on your financial goals, such as choosing your payout options or adding riders for added benefits. An annuity prudential can be an effective tool for financial stability in retirement.

-

Are there fees associated with an annuity prudential?

Yes, there are fees associated with an annuity prudential that may include surrender charges and management fees. These costs vary by provider, so it's important to review the terms and fees thoroughly before investing. Knowing the fee structure will help you assess the long-term value of the annuity prudential.

-

Can I integrate my annuity prudential with other financial planning tools?

Absolutely! An annuity prudential is designed to work alongside other financial planning tools to provide a comprehensive retirement strategy. You can integrate it with investment accounts, life insurance, and estate planning to enhance your overall financial security. This integration can help create a well-rounded approach to managing your retirement funds.

-

How do I choose the right annuity prudential for my needs?

Choosing the right annuity prudential involves evaluating your financial goals, risk tolerance, and income needs. It's essential to compare different products, features, and benefits offered by various providers. Consulting with a financial advisor can help you make an informed decision tailored to your unique situation.

-

What is the typical payout structure for an annuity prudential?

The payout structure of an annuity prudential can vary, but it typically includes options like fixed, variable, or indexed payments. You may choose to receive payments monthly, quarterly, or annually based on your financial needs and preferences. Understanding these structures will allow you to select the option that best aligns with your retirement income strategy.

Get more for Annuity Insurance Prudential

- Contact information form

- 475 l plaza sw room 5300 washington dc stimulus check form

- Fillable record of zoning inquiry form

- Genuine student evaluation form

- Wildlife identification number form

- Equipment acceptance form 429920879

- Application for issue or renewal of driver licence dl1 form

- Generic service agreement template form

Find out other Annuity Insurance Prudential

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors