Form No 16

What is the Form No 16

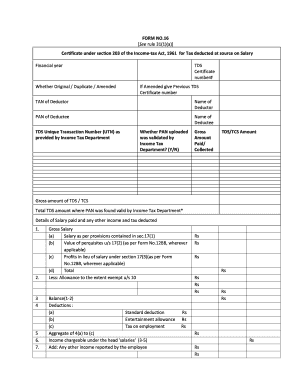

The Form No 16 is a crucial document issued by employers to their employees in the United States, summarizing the tax deducted at source (TDS) on salary. This form provides a detailed account of the income earned and the taxes deducted during a financial year. It serves as a certificate of tax paid and is essential for employees when filing their income tax returns. The information contained in Form No 16 includes details such as the employee's name, salary, TDS amount, and the employer's information.

How to obtain the Form No 16

Employees can obtain Form No 16 from their employers at the end of each financial year. Employers are obligated to provide this form to their employees, typically by the end of May. If an employee does not receive the form, they should request it from their HR or payroll department. Additionally, many companies provide electronic copies of Form No 16, which can be accessed through employee portals or HR management systems.

Steps to complete the Form No 16

Completing Form No 16 involves several key steps. First, gather all relevant income documents, such as salary slips and other income sources. Next, verify your personal information, including your name and Social Security number, to ensure accuracy. Then, review the TDS deductions mentioned in the form to confirm they match your records. If there are discrepancies, address them with your employer. Finally, use the information from Form No 16 to accurately fill out your income tax return.

Key elements of the Form No 16

Form No 16 contains several important elements that are vital for tax filing. These include:

- Employer Information: Name and address of the employer.

- Employee Information: Name, address, and Social Security number of the employee.

- Salary Details: Total salary earned during the financial year.

- TDS Amount: Total tax deducted at source by the employer.

- Taxable Income: The amount of income that is subject to tax after deductions.

Legal use of the Form No 16

Form No 16 is legally recognized as a certificate of tax deduction. It is essential for employees to retain this document for their records and for filing their tax returns. The form serves as proof of income and tax paid, which can be required during audits or tax assessments. Proper use of Form No 16 ensures compliance with tax regulations and protects against potential penalties for underreporting income.

Filing Deadlines / Important Dates

Understanding the deadlines associated with Form No 16 is crucial for timely tax filing. Typically, employers must issue Form No 16 by the end of May following the financial year. Employees should ensure they receive their forms on time to accurately file their income tax returns, which are generally due by April 15 of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes.

Quick guide on how to complete form no 16

Prepare Form No 16 effortlessly on any device

Web-based document management has surged in popularity among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form No 16 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to edit and eSign Form No 16 without stress

- Locate Form No 16 and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and then click on the Done button to secure your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Form No 16 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 16

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form no. in airSlate SignNow?

A form no. in airSlate SignNow refers to the unique identifier assigned to each document or form you create within the platform. This helps you easily track and manage your documents throughout the signing process. Utilizing the form no. streamlines workflows, making it easier to reference and organize your important documents.

-

How does airSlate SignNow help with form no. management?

airSlate SignNow provides robust features for managing form no. that allow you to categorize, search, and sort your documents efficiently. With our intuitive interface, you can easily access all documents based on their form no., which enhances productivity. This ensures your team can quickly locate necessary files when needed.

-

Is there a cost associated with using form no. in airSlate SignNow?

Using form no. as part of your document management strategy is included within airSlate SignNow's competitive pricing plans. Our cost-effective solution allows you to generate and organize documents by form no. without incurring additional fees. You can choose a plan that fits your budget, while still enjoying comprehensive features.

-

Can I customize my form no. for different documents?

Yes, airSlate SignNow allows you to customize your form no. based on your preferences or business needs. This flexibility ensures that each document retains a unique identifier that aligns with your organization's structure. Customization helps streamline your workflow and enhances overall document management.

-

What are the benefits of using form no. in airSlate SignNow?

Using form no. in airSlate SignNow simplifies document tracking and enhances collaboration among team members. It allows for better organization and retrieval of documents, ultimately contributing to increased efficiency. The clear identification of each form also helps minimize errors and confusion during the signing process.

-

How does airSlate SignNow integrate with other tools for form no. management?

airSlate SignNow seamlessly integrates with various third-party applications that enhance form no. management. This means you can connect to CRM systems, project management tools, and other software to streamline your document workflows. Our integration capabilities help ensure that your form no. remain consistent across different platforms.

-

What types of documents can I manage using a form no. in airSlate SignNow?

You can manage a variety of document types using form no. in airSlate SignNow, including contracts, agreements, and consent forms. The flexibility of our platform allows you to adapt to various business needs, ensuring all crucial documents are accessible. Each document will be easily identified with its assigned form no., facilitating better organization.

Get more for Form No 16

Find out other Form No 16

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free