Zenith Bank Domiciliary Account Form

What is the Zenith Bank Domiciliary Account

The Zenith Bank domiciliary account is a specialized bank account that allows individuals and businesses to hold and manage foreign currencies. This type of account is particularly useful for those who receive or make payments in currencies other than the U.S. dollar. It provides customers with the flexibility to conduct international transactions seamlessly while protecting against fluctuations in exchange rates.

Typically, this account can hold various currencies, including the British pound, Euro, and other major currencies. It also offers features such as online banking, which enables users to manage their funds conveniently from anywhere.

How to Obtain the Zenith Bank Domiciliary Account

To open a Zenith Bank domiciliary account, individuals must meet specific eligibility criteria set by the bank. Generally, this includes being at least eighteen years old and providing valid identification. Applicants are required to submit necessary documentation, such as proof of address and a completed application form.

It is advisable to visit the nearest Zenith Bank branch or their official website for detailed information on the required documents and the application process. Customers can also inquire about any initial deposit requirements, which may vary depending on the currency chosen.

Steps to Complete the Zenith Bank Domiciliary Account

Completing the process for a Zenith Bank domiciliary account involves several steps:

- Gather required documents, including identification and proof of address.

- Visit a Zenith Bank branch or access their online platform.

- Fill out the domiciliary account application form accurately.

- Submit the application along with the required documents.

- Deposit the minimum required amount, if applicable.

- Receive confirmation and account details once the application is approved.

Legal Use of the Zenith Bank Domiciliary Account

The Zenith Bank domiciliary account can be used legally for various purposes, including receiving international remittances, making payments for goods and services abroad, and holding foreign currency. It is essential for account holders to comply with relevant regulations and guidelines, which may include reporting requirements for large transactions.

Understanding the legal framework surrounding foreign currency accounts is crucial for ensuring compliance and avoiding potential penalties. Customers should stay informed about any changes in regulations that may affect their account usage.

Required Documents

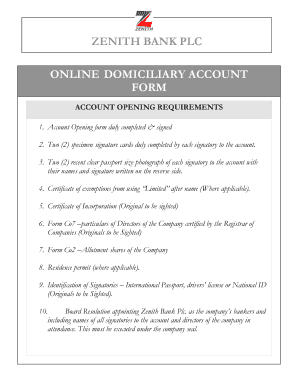

To successfully open a Zenith Bank domiciliary account, applicants must provide several key documents:

- Valid government-issued identification (e.g., passport, driver's license).

- Proof of address (e.g., utility bill, lease agreement).

- Completed application form, which can be obtained from the bank.

- Initial deposit, if required, in the chosen currency.

Ensuring that all documents are accurate and up-to-date will facilitate a smoother application process.

Eligibility Criteria

Eligibility for opening a Zenith Bank domiciliary account typically includes the following criteria:

- Must be at least eighteen years of age.

- Must provide valid identification and proof of address.

- Must be a resident or citizen of the United States.

- Must comply with any additional requirements set by the bank.

Meeting these criteria is essential for a successful application and account approval.

Quick guide on how to complete zenith bank domiciliary account

Complete Zenith Bank Domiciliary Account effortlessly on any device

Online document management has gained signNow popularity among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents rapidly without delays. Handle Zenith Bank Domiciliary Account on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Zenith Bank Domiciliary Account effortlessly

- Locate Zenith Bank Domiciliary Account and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Zenith Bank Domiciliary Account and ensure outstanding communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the zenith bank domiciliary account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the zenith bank domiciliary account transfer charges?

Zenith Bank domiciliary account transfer charges vary based on the transaction type and amount. Typically, these charges can include fixed fees for international transfers and additional costs based on the currency conversion rate. It’s advisable to check with Zenith Bank’s official website or customer service for the most accurate and up-to-date information.

-

How can I minimize the zenith bank domiciliary account transfer charges?

To minimize zenith bank domiciliary account transfer charges, consider making larger transfers to spread the costs over a larger amount. Additionally, using their online banking platform may offer reduced fees compared to in-branch transactions. Always review the pricing structure before proceeding with your transaction.

-

What features does the zenith bank domiciliary account offer?

The zenith bank domiciliary account offers several features, such as holding multiple currencies, easy international transfers, and competitive exchange rates. These features help streamline your financial transactions while ensuring that you are aware of the applicable zenith bank domiciliary account transfer charges. This account is ideal for individuals and businesses dealing in foreign currencies.

-

Are there benefits to opening a zenith bank domiciliary account?

Yes, there are numerous benefits to opening a zenith bank domiciliary account. This includes the ability to conduct transactions in foreign currencies, which can be valuable for international trade or travel. Furthermore, understanding zenith bank domiciliary account transfer charges can help you efficiently manage your finances, making it a strategic choice.

-

Can I integrate my zenith bank domiciliary account with other financial tools?

Zenith Bank allows for integration with various financial tools, which can enhance your banking experience. Tools such as accounting software or e-signature platforms like airSlate SignNow can help in managing transactions and documents while keeping an eye on zenith bank domiciliary account transfer charges. Always inquire about the specific compatibility features offered by Zenith Bank.

-

How long do transactions take with a zenith bank domiciliary account?

Transactions with a zenith bank domiciliary account typically take 1-3 business days, depending on the recipient's bank and country. It's essential to factor in any potential delays when considering zenith bank domiciliary account transfer charges and processing times. Contact Zenith Bank for the latest information on transaction timelines.

-

What types of transactions incur zenith bank domiciliary account transfer charges?

Zenith bank domiciliary account transfer charges apply to various transactions including international transfers, currency exchanges, and withdrawals. The charges depend on the specifics of each transaction and are outlined in the bank's fee schedule. Understanding these charges can help you plan your transactions better.

Get more for Zenith Bank Domiciliary Account

- Quadrennial exempt status form m 3 city of bridgeport ct bridgeportct

- Application for admission to practice as an attorney nycourts form

- Form 3 38

- New york information sheet

- Change name on ny state form

- Alarms administration appeals request form city of stamford

- City of waterbury employee personal data change form waterburyct

- Bonfire permit form city of lewes

Find out other Zenith Bank Domiciliary Account

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free