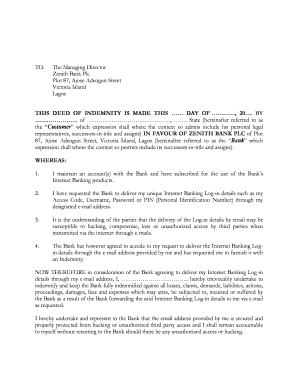

Paytm Indemnity Form

What is the Paytm Indemnity Form

The Paytm indemnity form is a legal document designed to protect both the user and the financial institution in the event of a wrongful transaction. This form is particularly relevant when a user has made an incorrect transfer or payment via NEFT (National Electronic Funds Transfer). By completing this form, the user agrees to indemnify the bank against any claims arising from the erroneous transaction, ensuring that the bank is not held liable for any losses incurred as a result of the mistake.

How to use the Paytm Indemnity Form

Using the Paytm indemnity form involves several key steps. First, you need to accurately fill out the form with your details, including your name, account number, and specifics of the transaction in question. Next, you must provide a clear explanation of the error that occurred. After completing the form, you should sign it electronically or physically, depending on the submission method. Finally, submit the form to Paytm or your bank as per their guidelines to initiate the indemnity process.

Steps to complete the Paytm Indemnity Form

Completing the Paytm indemnity form requires careful attention to detail. Follow these steps:

- Gather necessary information, including transaction details and personal identification.

- Access the form, either through the Paytm app or the official website.

- Fill in your personal information accurately, ensuring all fields are completed.

- Clearly describe the nature of the wrongful transaction.

- Review the form for accuracy before signing.

- Submit the form according to the instructions provided by Paytm or your bank.

Legal use of the Paytm Indemnity Form

The legal use of the Paytm indemnity form is governed by various regulations that ensure its enforceability. It must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which validates electronic signatures, and the Uniform Electronic Transactions Act (UETA). These laws confirm that the indemnity form, when signed electronically, holds the same legal weight as a traditional paper document. This compliance is crucial for both the user and the bank to protect their rights and obligations.

Key elements of the Paytm Indemnity Form

Several key elements must be included in the Paytm indemnity form to ensure its effectiveness and legality:

- Personal Information: Full name, address, and contact details of the user.

- Account Information: Bank account number and any relevant transaction identifiers.

- Transaction Details: Date, amount, and nature of the erroneous transaction.

- Indemnity Clause: A statement agreeing to indemnify the bank against any claims related to the transaction.

- Signature: An electronic or handwritten signature confirming the user's agreement.

How to obtain the Paytm Indemnity Form

The Paytm indemnity form can be obtained through multiple channels. Users can download the form directly from the Paytm app or website. Alternatively, they may contact customer service for assistance in acquiring the form. It is essential to ensure that you are using the most current version of the form to avoid any complications during the submission process.

Quick guide on how to complete paytm indemnity form

Manage Paytm Indemnity Form seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can receive the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Paytm Indemnity Form on any system with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to edit and electronically sign Paytm Indemnity Form effortlessly

- Find Paytm Indemnity Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then press the Done button to store your modifications.

- Select your preferred method to share your form—via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or out-of-place files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Paytm Indemnity Form and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the paytm indemnity form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a wrong neft indemnity letter?

A wrong neft indemnity letter is a document used to protect parties involved in a NEFT transaction that has encountered issues, such as incorrect details. It serves as a formal agreement that indemnifies the bank or financial institution from liabilities related to the transaction. Understanding this document is critical for businesses using airSlate SignNow for their eSignature needs.

-

How can airSlate SignNow help with wrong neft indemnity letters?

airSlate SignNow allows users to create, send, and eSign wrong neft indemnity letters effortlessly. With our intuitive platform, businesses can streamline the process, ensuring all parties involved can quickly review and sign the indemnity letter. This efficiency minimizes delays and enhances transaction security.

-

Is there a cost associated with using airSlate SignNow for creating a wrong neft indemnity letter?

Yes, there is a cost associated with using airSlate SignNow, but we offer competitive pricing plans that cater to various business needs. Our pricing includes several features like unlimited signing and document storage, making it a cost-effective solution for managing wrong neft indemnity letters. Additionally, you can start with a free trial to explore our functionalities.

-

What features does airSlate SignNow offer for wrong neft indemnity letters?

airSlate SignNow provides a range of features for handling wrong neft indemnity letters, including customizable templates, secure cloud storage, and automated notifications. Our electronic signature capabilities ensure that documents are signed quickly and securely, reducing the time spent on paperwork. These features enhance your overall document management process.

-

Can I integrate airSlate SignNow with other software for managing wrong neft indemnity letters?

Absolutely! airSlate SignNow offers various integrations with popular business applications such as CRM and accounting software. This allows businesses to seamlessly manage their workflow, including the handling of wrong neft indemnity letters, without having to switch between different platforms. Integration improves efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for wrong neft indemnity letters?

Using airSlate SignNow for wrong neft indemnity letters comes with multiple benefits, including enhanced security, cost savings, and faster turnaround times. Our solution ensures that your documents are legally binding and secure, providing peace of mind. Moreover, automation reduces administrative burdens, allowing your team to focus on more pressing tasks.

-

Can wrong neft indemnity letters be signed on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is optimized for mobile devices, enabling users to sign wrong neft indemnity letters anytime and anywhere. Our mobile application ensures that you have all the features of the desktop version at your fingertips, making the signing process convenient and efficient for on-the-go professionals. This flexibility enhances productivity and responsiveness.

Get more for Paytm Indemnity Form

- Complaint against owner of golf course by patron of driving range struck by golf club form

- Complaint by golfer against another golfer who struck him in the eye with a golf ball causing injury to eye form

- Complaint by a baseball game spectator struck by bat thrown by player form

- Addendum agreement sale form

- Motion extend form

- Lottery pool agreement template form

- Alliance agreement form

- Notice of lien of garageman and sale form

Find out other Paytm Indemnity Form

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile