Form H1 Lirs

What is the Form H1 LIRS

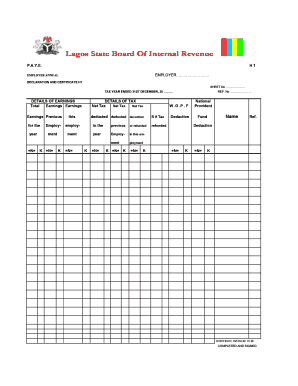

The Form H1 LIRS is a crucial document used for annual employer declarations in the United States. It serves as a means for employers to report employee earnings and tax withholdings to the relevant tax authorities. This form is particularly important for compliance with federal tax regulations, ensuring that employers accurately report their payroll information. The H1 declaration form is essential for maintaining transparency in employment and tax practices.

How to Use the Form H1 LIRS

Using the Form H1 LIRS involves several steps to ensure accurate completion. Employers must gather all necessary information regarding their employees, including names, Social Security numbers, and total earnings for the reporting period. Once this data is compiled, it should be entered into the form accurately. After filling out the form, employers must submit it to the appropriate tax authority, either electronically or via mail, depending on the specific guidelines provided by the IRS.

Steps to Complete the Form H1 LIRS

Completing the Form H1 LIRS requires careful attention to detail. Follow these steps for proper completion:

- Gather all employee information, including personal details and earnings.

- Access the Form H1 LIRS from the official source.

- Fill in the required fields accurately, ensuring all data is correct.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified filing method, either online or by mail.

Legal Use of the Form H1 LIRS

The legal use of the Form H1 LIRS is governed by federal tax laws. Employers are required to file this form to comply with tax regulations, and failure to do so can result in penalties. The form must be completed with accurate information to avoid legal repercussions. It is advisable for employers to keep copies of submitted forms for their records, as they may be required for audits or other legal inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Form H1 LIRS are critical for compliance. Employers must be aware of the specific dates by which the form must be submitted to avoid penalties. Typically, the deadline aligns with the end of the tax year, and any late submissions may incur fines. It is essential to stay updated on any changes to these deadlines, as they can vary based on legislative updates or IRS announcements.

Form Submission Methods (Online / Mail / In-Person)

The Form H1 LIRS can be submitted through various methods, providing flexibility for employers. Options include:

- Online submission via the IRS e-filing system, which is often the fastest method.

- Mailing a paper copy of the completed form to the designated tax authority.

- In-person submission at local tax offices, if applicable.

Employers should choose the method that best suits their needs while ensuring compliance with submission guidelines.

Quick guide on how to complete form h1 lirs

Complete Form H1 Lirs effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form H1 Lirs on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Form H1 Lirs without stress

- Find Form H1 Lirs and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight necessary sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form H1 Lirs and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form h1 lirs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form H1 in airSlate SignNow?

Form H1 is a document type commonly used in various industries. In airSlate SignNow, users can create, send, and eSign Form H1 for streamlined workflows. Understanding what form H1 is will help you leverage its capabilities for efficient document management.

-

How does airSlate SignNow handle Form H1 securely?

Security is a top priority for airSlate SignNow. When dealing with Form H1, all documents are encrypted and comply with industry standards. This means your sensitive information remains protected throughout the signing process.

-

What features does airSlate SignNow offer for Form H1?

airSlate SignNow includes various features tailored for Form H1, such as customizable templates, automated workflows, and real-time tracking. These features streamline the signing process, making it easier for businesses to manage Form H1 efficiently.

-

Can I integrate Form H1 with other applications using airSlate SignNow?

Yes, airSlate SignNow supports integrations with numerous applications. Whether you need to automate the handling of Form H1 or connect it to your existing CRM, seamless integrations can enhance your workflow without complications.

-

What are the pricing options for using airSlate SignNow to manage Form H1?

airSlate SignNow offers a variety of pricing plans to suit different business needs. Depending on your organization’s requirements for managing Form H1, you can choose a plan that provides the best value without breaking your budget.

-

How can airSlate SignNow improve my workflow with Form H1?

Using airSlate SignNow to manage Form H1 can signNowly enhance your workflow efficiency. By automating the signing process and reducing paperwork, you can save time and focus on more critical tasks within your business.

-

Is airSlate SignNow easy to use for creating Form H1?

Absolutely! airSlate SignNow is designed with user-friendliness in mind. Even if you're unfamiliar with digital document signing, you can quickly learn how to create and send Form H1 with its intuitive interface.

Get more for Form H1 Lirs

Find out other Form H1 Lirs

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later