Vat Return Form

What is the VAT Return Form?

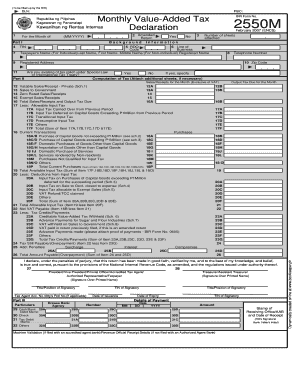

The VAT return form is a crucial document used by businesses to report their value-added tax (VAT) obligations to the Internal Revenue Service (IRS). This form details the amount of VAT collected from customers and the VAT paid on purchases. It serves as a summary of a business's VAT transactions during a specific period, ensuring compliance with tax regulations. Understanding the VAT return form is essential for accurate tax reporting and avoiding potential penalties.

Steps to Complete the VAT Return Form

Completing the VAT return form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial records, including sales invoices and purchase receipts. Next, calculate the total VAT collected from sales and the total VAT paid on purchases. Afterward, input these figures into the appropriate sections of the form. It is important to double-check all calculations and ensure that the information matches your financial records. Finally, sign and date the form before submission.

How to Obtain the VAT Return Form

The VAT return form can typically be obtained from the IRS website or through your tax professional. Many businesses also opt to use digital platforms that offer downloadable versions of the form in PDF format. This allows for easy access and the ability to fill out the form electronically. Ensure that you are using the most current version of the VAT return form to avoid any compliance issues.

Legal Use of the VAT Return Form

The VAT return form holds legal significance as it is required for tax compliance in the United States. To ensure its legal validity, it must be completed accurately and submitted by the designated deadline. Using a reliable e-signature solution can enhance the legal standing of the submitted form, as it provides a digital certificate confirming the identity of the signer. Compliance with eSignature regulations, such as the ESIGN Act, further solidifies the form's legal use.

Form Submission Methods

There are several methods available for submitting the VAT return form. Businesses can choose to file the form online through the IRS e-filing system, which is often the fastest and most efficient method. Alternatively, the form can be mailed directly to the IRS or submitted in person at designated IRS offices. Each method has its own advantages, and businesses should select the one that best fits their needs and capabilities.

Penalties for Non-Compliance

Failing to submit the VAT return form on time or providing inaccurate information can result in significant penalties. The IRS may impose fines based on the severity of the non-compliance, which can include late fees and interest on unpaid taxes. It is essential for businesses to stay informed about filing deadlines and ensure that all information reported on the VAT return form is accurate to avoid these penalties.

Quick guide on how to complete vat return form 39629290

Complete Vat Return Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers a stellar eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the needed form and securely save it online. airSlate SignNow provides all the features you require to create, alter, and eSign your documents promptly without complications. Handle Vat Return Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and eSign Vat Return Form with ease

- Obtain Vat Return Form and then click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize essential parts of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal authority as a conventional wet ink signature.

- Verify the details and then click on the Done button to preserve your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Vat Return Form while ensuring outstanding communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat return form 39629290

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT return form and why is it important?

A VAT return form is a document that businesses submit to the tax authorities detailing the amount of VAT they have collected and paid over a specific period. It's important because it helps ensure compliance with tax regulations and allows businesses to claim back any VAT overpaid, ultimately impacting their bottom line.

-

How can airSlate SignNow help with submitting VAT return forms?

airSlate SignNow streamlines the process of preparing and submitting VAT return forms with its easy-to-use eSigning solution. You can quickly send your VAT return forms for signature, reducing delays and ensuring timely submission to tax authorities.

-

Is there a cost associated with using airSlate SignNow for VAT return forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and includes features that simplify managing VAT return forms, making it a cost-effective solution for companies of all sizes.

-

What features does airSlate SignNow offer for handling VAT return forms?

airSlate SignNow provides features such as document templates, eSigning capabilities, and secure storage to enhance the management of VAT return forms. These features help ensure that the forms are completed efficiently and securely.

-

Are there any integrations available for VAT return forms with airSlate SignNow?

Yes, airSlate SignNow integrates with various accounting and tax software, enabling seamless management of your VAT return forms. This ensures that your financial data flows smoothly between platforms, saving you time and minimizing errors.

-

Can I track the status of my VAT return forms with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking capabilities for your VAT return forms, allowing you to see when documents are sent, viewed, and signed. This transparency helps you manage your submissions more effectively and stay organized.

-

What are the benefits of using airSlate SignNow for VAT return forms?

Using airSlate SignNow for VAT return forms offers several benefits, including reduced processing time, increased accuracy, and improved compliance with tax regulations. Its user-friendly interface also ensures that businesses can manage forms efficiently without a steep learning curve.

Get more for Vat Return Form

Find out other Vat Return Form

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will