Property Tax Name Change Application Form PDF

What is the Property Tax Name Change Application Form PDF

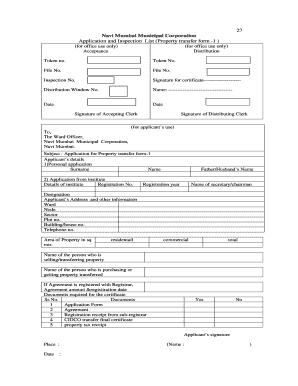

The Property Tax Name Change Application Form PDF is a legal document used by property owners to request a change in the name associated with their property tax records. This form is essential for ensuring that property ownership is accurately reflected in tax assessments and records. It is often required when there is a change in ownership due to marriage, divorce, inheritance, or other legal reasons. Completing this form properly is crucial for maintaining compliance with local tax regulations.

How to Obtain the Property Tax Name Change Application Form PDF

To obtain the Property Tax Name Change Application Form PDF, individuals can typically visit their local tax assessor's office website or the official state or county government website. Many jurisdictions provide downloadable versions of this form online. Alternatively, individuals can request a physical copy by visiting the tax assessor's office in person or by calling their office to ask for the form to be mailed. It is important to ensure that the correct version of the form is obtained, as requirements may vary by location.

Steps to Complete the Property Tax Name Change Application Form PDF

Completing the Property Tax Name Change Application Form PDF involves several key steps:

- Gather necessary information: Collect all relevant details, including the current property owner’s name, the new name to be registered, and property identification numbers.

- Fill out the form: Carefully enter the required information in the designated fields. Ensure accuracy to avoid delays in processing.

- Provide supporting documents: Attach any required documentation that supports the name change, such as marriage certificates, divorce decrees, or court orders.

- Review the form: Double-check all entries for completeness and accuracy before submission.

- Submit the form: Follow the submission guidelines provided, which may include online submission, mailing the form, or delivering it in person to the tax office.

Legal Use of the Property Tax Name Change Application Form PDF

The legal use of the Property Tax Name Change Application Form PDF is governed by state and local laws. This form serves as an official request to update tax records, and its proper completion is necessary for legal recognition of the name change. Failure to submit this form may result in continued billing under the previous name, leading to potential legal complications. It is advisable to consult local tax regulations or a legal professional to ensure compliance with all requirements.

Required Documents for the Property Tax Name Change Application

When submitting the Property Tax Name Change Application Form PDF, certain documents may be required to support the name change request. Commonly required documents include:

- Proof of identity, such as a driver's license or passport.

- Legal documentation supporting the name change, such as a marriage certificate or court order.

- Current property tax bill or deed to the property.

It is important to check with the local tax assessor’s office for any additional requirements specific to your jurisdiction.

Form Submission Methods

The Property Tax Name Change Application Form PDF can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online: Many jurisdictions allow for electronic submission through their official websites.

- Mail: Completed forms can often be sent via postal service to the appropriate tax office.

- In-Person: Individuals may also have the option to deliver the form directly to the tax assessor's office.

It is essential to verify the preferred submission method for your specific area to ensure timely processing.

Quick guide on how to complete property tax name change application form pdf

Complete Property Tax Name Change Application Form Pdf effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Property Tax Name Change Application Form Pdf on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric tasks today.

The simplest way to modify and electronically sign Property Tax Name Change Application Form Pdf with ease

- Find Property Tax Name Change Application Form Pdf and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Property Tax Name Change Application Form Pdf and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property tax name change application form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the application form for property tax name change?

The application form for property tax name change is a document that allows property owners to update the name associated with their property tax account. This process is essential for reflecting any legal name changes, ensuring that tax records remain accurate and up to date.

-

How do I fill out the application form for property tax name change?

Filling out the application form for property tax name change is straightforward. You need to provide essential details such as your current property information, the name change details, and any required supporting documents. airSlate SignNow provides user-friendly templates to guide you through this process efficiently.

-

Is there a fee associated with the application form for property tax name change?

Fees for the application form for property tax name change can vary by jurisdiction. Generally, there may be a nominal fee to process your request, which can be quickly paid online. Be sure to check with your local tax authority for specific pricing details.

-

Can I submit the application form for property tax name change online?

Yes, you can submit the application form for property tax name change online using the airSlate SignNow platform. Our solution allows you to eSign and submit documents securely, making the process faster and more convenient.

-

What features does airSlate SignNow offer for handling the application form for property tax name change?

airSlate SignNow offers features like customizable templates, electronic signatures, and secure document storage, specifically designed to simplify the application form for property tax name change. These features streamline the signing process and ensure that your documents are safely stored and easily retrievable.

-

How long does it take to process the application form for property tax name change?

The processing time for the application form for property tax name change can vary depending on local regulations. Typically, it takes anywhere from a few days to a couple of weeks. Using airSlate SignNow can help speed up the process with efficient submission methods.

-

What are the benefits of using airSlate SignNow for property tax name changes?

Using airSlate SignNow for property tax name changes comes with numerous benefits, including faster processing times, reduced paper usage, and enhanced security for your sensitive information. This platform allows you to complete the application form for property tax name change with ease.

Get more for Property Tax Name Change Application Form Pdf

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497322440 form

- Ohio marital property form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497322442 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497322443 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497322444 form

- Ohio dissolution package to dissolve corporation ohio form

- Ohio dissolution package to dissolve limited liability company llc ohio form

- Living trust for husband and wife with no children ohio form

Find out other Property Tax Name Change Application Form Pdf

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed