Schedule SE Form 1040 IRS Gov Internal Revenue Service Apps Irs

What is the Schedule SE Form 1040?

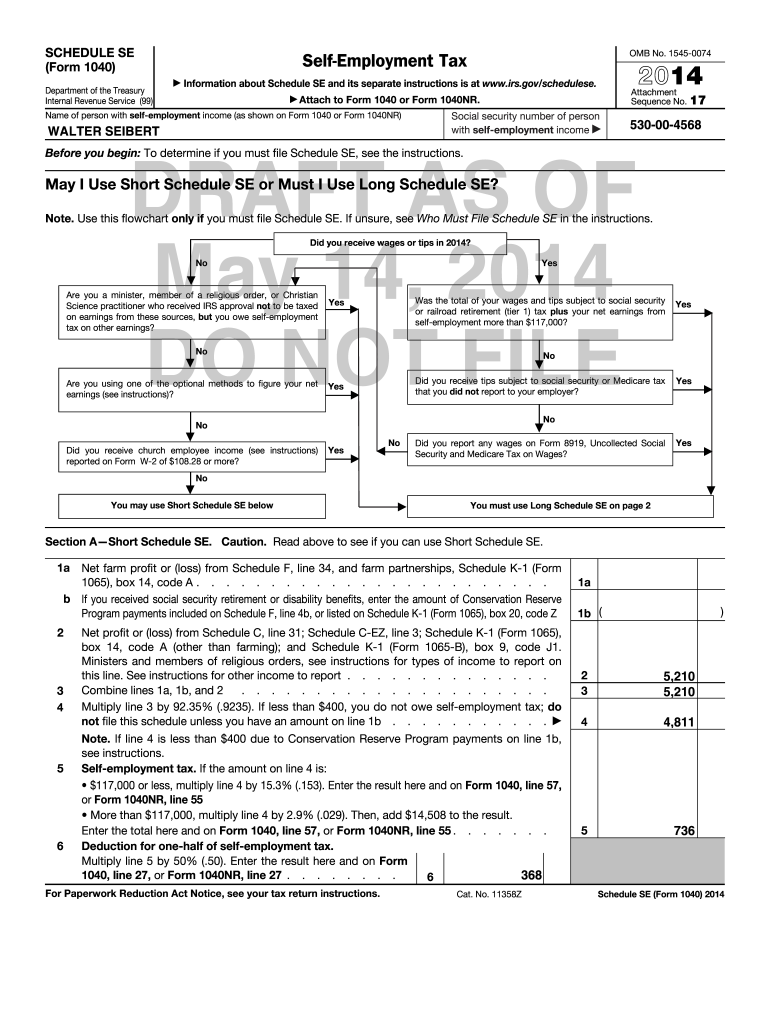

The Schedule SE form, officially known as the IRS Schedule SE, is a supplemental form used by self-employed individuals to calculate their self-employment tax. This tax is essential for funding Social Security and Medicare. The form is filed alongside the IRS Form 1040, which is the standard individual income tax return form. Understanding this form is crucial for those who earn income through self-employment, as it helps determine the amount owed to the federal government based on net earnings.

How to Use the Schedule SE Form 1040

Using the Schedule SE form involves several steps. First, gather all necessary financial documents, including income statements and records of business expenses. Next, fill out the form by reporting your net earnings from self-employment. The form will guide you through calculating your self-employment tax based on these earnings. It is important to ensure accuracy, as errors can lead to penalties or delays in processing your tax return. Once completed, attach the Schedule SE to your Form 1040 before submitting it to the IRS.

Steps to Complete the Schedule SE Form 1040

Completing the Schedule SE form requires careful attention to detail. Follow these steps:

- Step 1: Begin by entering your name and Social Security number at the top of the form.

- Step 2: Report your net earnings from self-employment on Line 2. This figure is typically derived from your business income minus allowable expenses.

- Step 3: Calculate your self-employment tax using the provided instructions. This will involve applying the appropriate tax rate to your net earnings.

- Step 4: Transfer the calculated self-employment tax to your Form 1040.

- Step 5: Review the form for accuracy and completeness before submission.

Legal Use of the Schedule SE Form 1040

The Schedule SE form is legally binding when completed accurately and submitted to the IRS. It is essential to comply with all IRS guidelines to ensure that your tax return is valid. The form must be signed and dated, affirming that the information provided is true and accurate to the best of your knowledge. Failure to adhere to these legal requirements may result in penalties or audits by the IRS.

Key Elements of the Schedule SE Form 1040

Several key elements are crucial when filling out the Schedule SE form:

- Net Earnings: This is the foundation of the self-employment tax calculation.

- Tax Calculation: The form includes specific lines for calculating the self-employment tax based on your net earnings.

- Signature: A valid signature is required to certify the accuracy of the information provided.

- Instructions: Detailed instructions accompany the form to assist in accurate completion.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Schedule SE form. Typically, the deadline for submitting your Form 1040, along with the Schedule SE, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you require more time, you can file for an extension, but be mindful that this does not extend the time to pay any taxes owed.

Quick guide on how to complete 2011 schedule se form 1040 irsgov internal revenue service apps irs

Complete Schedule SE Form 1040 IRS gov Internal Revenue Service Apps Irs effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule SE Form 1040 IRS gov Internal Revenue Service Apps Irs on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Schedule SE Form 1040 IRS gov Internal Revenue Service Apps Irs with ease

- Obtain Schedule SE Form 1040 IRS gov Internal Revenue Service Apps Irs and then click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device of your choice. Alter and eSign Schedule SE Form 1040 IRS gov Internal Revenue Service Apps Irs to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Internal Revenue Service (IRS): How do you attach a W2 form to your tax return?

A number of answers — including one from a supposed IRS employee — say not to physically attach them, but just to include the W-2 in the envelope.In fact, the 1040 instructions say to “attach” the W-2 to the front of the return, and the Form 1040 itself —around midway down the left-hand side — says to “attach” Form W-2 here; throwing it in the envelope is not “attaching.” Anything but a staple risks having the forms become separated, just like connecting the multiple pages of the return, scheduled, etc.

-

Internal Revenue Service (IRS): If I'm filing my tax returns, should I also mail all the 1099-INT and 1099-MISC forms that each organization is sending to me along with Form 1040?

The IRS does not want the forms from you. It gets the information directly from the payers. The reason you have to send the W-2 if you file a paper return is that W-2 forms go to the Social Security Administration, not the IRS. Later in the year, the IRS gets the information but not in time to compare against your tax return.Of course, you should keep a copy of all the forms for at least three years. Five is better just in case the IRS wants to claim your return is fraudulent. (I have all of my tax information for at least the past 15 years. Before that, it’s a little spotty but I have scanned copies of most documents going back to the mid-1990s.) These days most of the tax forms are available electronically or you can get a scanner to use a home. Just make certain you have timely backups of your computer in case it’s stolen or crashes.

-

Internal Revenue Service (IRS): If I'm filing my tax returns, should I also mail all the W4 forms that each organization is sending to me along with Form 1040?

If you are mailing your return, you are required to attach all Form W-2s plus any Form W-2Gs and Form 1099-Rs that show federal income tax withheld. You don't have to attach any other income documents.Form W-4 is given to your employer to tell him how much tax to withhold from your paycheck.

-

Internal Revenue Service (IRS): I want to file my own taxes this year and am new to America. How and which forms would I need to use to file (I live in columbus, Ohio)?

I suggest you spend some time with a competent tax advisor in Columbus before filing. Also take a look at Publication 519 (2011), U.S. Tax Guide for Aliens if you are not yet a US citizen. Whether and what you have to file depends primarily on your status (citizen/resident alien/nonresident alien), the source of your income, and the amount of your income. If you are a US citizen, or if you qualify as a resident alien, you will be taxed on your worldwide income and will normally file Form 1040. If you do not qualify as a resident alien and you are not a US citizen, but you had US source income (basically anything you earned while living and working in the US), you will file Form 1040NR. You will normally have to file an Ohio state tax return (IT 1040) if you had income while living and working in the state of Ohio - see Ohio Department of Taxation > Forms.

Create this form in 5 minutes!

How to create an eSignature for the 2011 schedule se form 1040 irsgov internal revenue service apps irs

How to generate an electronic signature for your 2011 Schedule Se Form 1040 Irsgov Internal Revenue Service Apps Irs online

How to create an electronic signature for the 2011 Schedule Se Form 1040 Irsgov Internal Revenue Service Apps Irs in Google Chrome

How to generate an electronic signature for signing the 2011 Schedule Se Form 1040 Irsgov Internal Revenue Service Apps Irs in Gmail

How to make an eSignature for the 2011 Schedule Se Form 1040 Irsgov Internal Revenue Service Apps Irs from your smart phone

How to generate an eSignature for the 2011 Schedule Se Form 1040 Irsgov Internal Revenue Service Apps Irs on iOS

How to make an eSignature for the 2011 Schedule Se Form 1040 Irsgov Internal Revenue Service Apps Irs on Android

People also ask

-

What is the purpose of the IRS gov Form 1040?

The IRS gov Form 1040 is the standard individual income tax form used by U.S. taxpayers to file their annual income tax returns. It allows individuals to report their income, deductions, and credits, determining their tax obligations. Using airSlate SignNow can simplify the process of signing and submitting your 1040 forms digitally.

-

How can airSlate SignNow help with IRS gov Form 1040 submissions?

airSlate SignNow streamlines the process of filling out and eSigning your IRS gov Form 1040. Our platform offers an intuitive interface that allows you to upload, edit, and send documents securely. By using our services, you can ensure your forms are completed and submitted in compliance with IRS regulations.

-

What features does airSlate SignNow provide for IRS gov Form 1040 users?

With airSlate SignNow, you get features tailored for IRS gov Form 1040, such as secure eSignature capabilities, document templates, and collaboration tools. These features simplify the tax filing process, allowing you to manage your forms efficiently and reduce errors. Additionally, you can track the status of your documents in real-time.

-

Is airSlate SignNow a cost-effective solution for filing IRS gov Form 1040?

Yes, airSlate SignNow provides an affordable solution for individuals and businesses needing to file IRS gov Form 1040. Our pricing plans are designed to be budget-friendly while offering comprehensive features to meet your signing and document management needs. Investing in our service ensures you save time and reduce the hassle of paperwork.

-

Can I integrate airSlate SignNow with other applications for IRS gov Form 1040 management?

Absolutely! airSlate SignNow can be integrated with various applications and platforms, making the management of your IRS gov Form 1040 even easier. Whether you're using accounting software or cloud storage solutions, our platform can connect seamlessly to enhance your workflow and streamline the tax preparation process.

-

What benefits does eSigning IRS gov Form 1040 using airSlate SignNow offer?

eSigning your IRS gov Form 1040 using airSlate SignNow offers signNow benefits including time savings, enhanced security, and convenience. You can complete your tax documents from anywhere, eliminating the need for physical signatures and reducing delays. Furthermore, our audit trail ensures your documents are secure and verifiable.

-

How secure is the information I submit through airSlate SignNow for IRS gov Form 1040?

The security of your information is a top priority for airSlate SignNow. Our platform utilizes advanced encryption and compliance measures to protect your sensitive data when submitting IRS gov Form 1040. You can trust that your documents and personal information are kept confidential and secure throughout the eSigning process.

Get more for Schedule SE Form 1040 IRS gov Internal Revenue Service Apps Irs

Find out other Schedule SE Form 1040 IRS gov Internal Revenue Service Apps Irs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors