It941 Form

What is the IT 941?

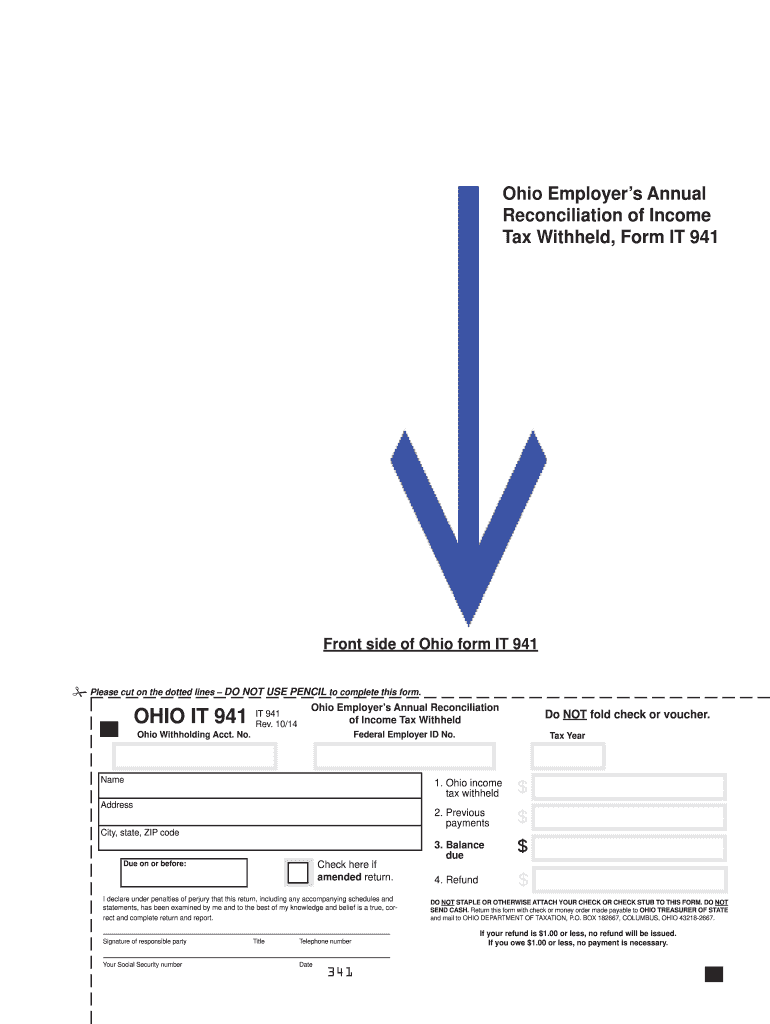

The IT 941 is a tax form used in Ohio for employers to report and remit income tax withheld from employees' wages. This form is particularly important for businesses operating within the state, as it ensures compliance with state tax laws. The IT 941 serves as a summary of the total wages paid and the amount of tax withheld during a specific reporting period, typically on a quarterly basis. Accurate completion of this form is crucial for maintaining proper tax records and avoiding penalties.

Steps to Complete the IT 941

Completing the IT 941 involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary information: Collect details about your business, including the Employer Identification Number (EIN), total wages paid, and the amount of tax withheld.

- Fill out the form: Enter the required information in the designated fields, ensuring that all figures are accurate and match your payroll records.

- Review the form: Double-check all entries for accuracy, as errors can lead to penalties or delays in processing.

- Submit the form: Choose your submission method, whether online, by mail, or in person, and ensure it is sent by the due date.

Legal Use of the IT 941

The IT 941 is legally binding when completed and submitted according to Ohio state regulations. To be considered valid, the form must be filled out accurately and submitted on time. Compliance with the Ohio Revised Code is essential, as failure to do so can result in penalties or interest on unpaid taxes. Additionally, using reliable electronic tools to eSign the form can enhance its legal standing, as these tools often provide secure signatures and compliance with relevant eSignature laws.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the IT 941 is crucial for compliance. The form is typically due quarterly, with specific deadlines for each quarter:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

Late submissions may incur penalties, so it is important to mark these dates on your calendar.

Required Documents

To complete the IT 941, certain documents are necessary to ensure accurate reporting. These include:

- Payroll records: Detailed records of employee wages and hours worked.

- Tax withholding documentation: Information on the amount of state income tax withheld from employee paychecks.

- Employer Identification Number (EIN): Essential for identifying your business for tax purposes.

Having these documents on hand will streamline the completion process and help avoid errors.

Form Submission Methods

The IT 941 can be submitted through various methods, allowing flexibility for employers. Options include:

- Online: Many employers prefer to file electronically through the Ohio Department of Taxation's website.

- Mail: Printable forms can be mailed to the appropriate tax office, ensuring they are postmarked by the due date.

- In-Person: Employers can also deliver the form directly to local tax offices if preferred.

Choosing the right submission method can help ensure timely processing and compliance with state requirements.

Quick guide on how to complete it941

Easily Prepare It941 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage It941 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Modify and eSign It941 Effortlessly

- Obtain It941 and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select how you wish to share your form — by email, SMS, or invitation link, or download it directly to your computer.

Forget the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign It941 to ensure excellent communication at any phase of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it941

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Ohio IT 941 and how can airSlate SignNow help?

Ohio IT 941 refers to a tax form used in Ohio for reporting and paying taxes. airSlate SignNow simplifies this process by allowing businesses to easily sign and send their Ohio IT 941 documents electronically, ensuring they stay compliant and organized.

-

Is airSlate SignNow a cost-effective solution for managing Ohio IT 941 forms?

Yes, airSlate SignNow offers a cost-effective solution for managing Ohio IT 941 forms. With flexible pricing plans, businesses can save time and money while ensuring their documents are securely signed and stored.

-

What features does airSlate SignNow offer for Ohio IT 941 document management?

airSlate SignNow includes features like template creation, bulk sending, and automated workflows specifically designed for Ohio IT 941 forms. These features enhance efficiency, reduce errors, and streamline the signing process.

-

How does airSlate SignNow ensure the security of Ohio IT 941 documents?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption protocols and complies with industry standards to protect Ohio IT 941 documents, ensuring that your sensitive information is safe.

-

Can airSlate SignNow integrate with other tools to assist with Ohio IT 941 filing?

Absolutely! airSlate SignNow can integrate with various accounting and tax software that support Ohio IT 941 filing. This integration allows for seamless data transfer and enhances your overall workflow.

-

What are the benefits of using airSlate SignNow for Ohio IT 941 forms?

Using airSlate SignNow for Ohio IT 941 forms provides several benefits, including reduced processing time, improved accuracy, and easier tracking. This helps businesses focus on their operations rather than paperwork.

-

Is there customer support available for questions related to Ohio IT 941 at airSlate SignNow?

Yes, airSlate SignNow offers dedicated customer support to assist with any questions about Ohio IT 941 or any other aspect of our service. Our team is ready to help ensure you have a smooth experience.

Get more for It941

- Revocation of general durable power of attorney utah form

- Essential legal life documents for newlyweds utah form

- Ut legal documents form

- Essential legal life documents for new parents utah form

- General power of attorney for care and custody of child children or protected person utah form

- Ut small form

- Utah procedures 497427732 form

- Revocation of power of attorney for care of child or children utah form

Find out other It941

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online