Pa 4r Fillable Form

What is the PA 4R Fillable Form

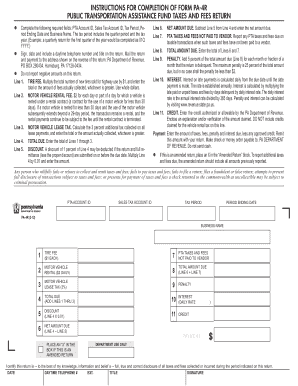

The PA 4R form, also known as the Revenue PA 4R form, is a tax document used in Pennsylvania for reporting various types of income and deductions. This form is essential for individuals and businesses to accurately report their earnings and ensure compliance with state tax regulations. It is designed to capture information related to Pennsylvania income tax obligations and is typically required for those who earn income in the state.

How to Use the PA 4R Fillable Form

Using the PA 4R fillable form is straightforward. First, download the form from a reliable source or access it through an electronic document management system. Once you have the form, fill in the required fields with accurate information regarding your income, deductions, and any applicable credits. Be sure to review the form for completeness and accuracy before submission. Utilizing electronic signature tools can streamline the signing process, ensuring that your form is submitted promptly and securely.

Steps to Complete the PA 4R Fillable Form

Completing the PA 4R fillable form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and other income statements.

- Open the fillable form on your computer or device.

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income and any deductions you are eligible for.

- Review the completed form for accuracy.

- Sign the form electronically if using an eSignature tool, or print and sign it manually.

- Submit the completed form to the Pennsylvania Department of Revenue, either online or by mail.

Legal Use of the PA 4R Fillable Form

The PA 4R fillable form is legally recognized as a valid document for tax reporting in Pennsylvania. To ensure its legal standing, it must be completed accurately and submitted within the designated filing deadlines. Compliance with state tax laws is crucial, as failure to submit the form correctly can lead to penalties or legal repercussions. Utilizing a trusted eSignature platform can enhance the form's legal validity by providing a secure and verifiable signature.

Filing Deadlines / Important Dates

Filing deadlines for the PA 4R form are critical to avoid penalties. Typically, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is essential to stay informed about any changes to these dates, as timely submission is crucial for compliance with Pennsylvania tax regulations.

Required Documents

When completing the PA 4R fillable form, certain documents are necessary to provide accurate information. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother completion process and ensure that all required information is accurately reported.

Quick guide on how to complete pa 4r fillable form

Easily Prepare Pa 4r Fillable Form on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents promptly without delays. Manage Pa 4r Fillable Form on any device using the airSlate SignNow Android or iOS applications and simplify your document-related workflows today.

How to Modify and Electronically Sign Pa 4r Fillable Form Effortlessly

- Find Pa 4r Fillable Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive details using tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, either by email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Pa 4r Fillable Form to ensure efficient communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa 4r fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pa 4r return process in airSlate SignNow?

The pa 4r return process in airSlate SignNow allows users to easily send and sign necessary documents electronically. This streamlines paperwork, making it simpler for businesses to manage their returns efficiently. Utilizing our platform ensures that your pa 4r return documents are signed quickly and securely, saving valuable time.

-

How does airSlate SignNow support the completion of a pa 4r return?

airSlate SignNow supports the completion of a pa 4r return by providing customizable templates and automated workflows. These features enable users to fill out forms accurately and reduce errors, enhancing overall efficiency. Our platform simplifies the entire process, ensuring seamless communication between all parties involved in the pa 4r return.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers affordable pricing plans tailored to fit businesses of all sizes looking to manage their pa 4r return processes. Our flexible plans provide access to essential features without breaking the bank. You can also take advantage of a free trial to explore how airSlate SignNow can optimize your pa 4r return submission.

-

Can I integrate airSlate SignNow with other software for my pa 4r return?

Yes, airSlate SignNow offers seamless integrations with a variety of software platforms, enhancing your ability to manage the pa 4r return process. Whether it's accounting software or project management tools, our integrations ensure that your workflow remains efficient. This connectivity helps streamline your operations and keeps your documents organized.

-

What are the key benefits of using airSlate SignNow for pa 4r returns?

Using airSlate SignNow for pa 4r returns brings numerous benefits, including increased efficiency and reduced turnaround time for document signing. Our user-friendly platform allows you to manage your returns digitally, promoting a paperless environment. Additionally, the security features protect your sensitive information throughout the pa 4r return process.

-

Is airSlate SignNow secure for handling pa 4r return documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your pa 4r return documents. This ensures that your data remains confidential and secure during the entire signing process. You can have peace of mind knowing that your important documents are safe.

-

How can I improve the efficiency of my pa 4r return submissions using airSlate SignNow?

To improve the efficiency of your pa 4r return submissions, leverage airSlate SignNow's customizable templates and automated workflows. Streamlining your document preparation and eSignature process allows for faster turnaround times and fewer manual errors. Utilizing these features can enhance your overall productivity and ensure timely submissions.

Get more for Pa 4r Fillable Form

- Legal last will and testament form for divorced person not remarried with adult children oregon

- Oregon legal form

- Legal last will and testament form for divorced person not remarried with no children oregon

- Legal last will and testament form for divorced person not remarried with minor children oregon

- Legal last will and testament form for divorced person not remarried with adult and minor children oregon

- Mutual wills package with last wills and testaments for married couple with adult children oregon form

- Mutual wills package with last wills and testaments for married couple with no children oregon form

- Mutual wills package with last wills and testaments for married couple with minor children oregon form

Find out other Pa 4r Fillable Form

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free