Ohio W9 Form

What is the Ohio W-9

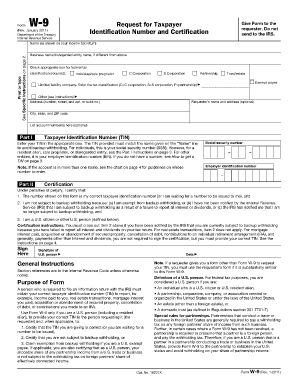

The Ohio W-9 form is a tax document used by individuals and businesses in the state of Ohio to provide their taxpayer identification information. This form is primarily utilized by those who are required to report income received from various sources, such as freelance work or contract services. The information collected on the Ohio W-9 includes the name, business name (if applicable), address, and taxpayer identification number (TIN) of the individual or entity. This form is essential for ensuring accurate tax reporting and compliance with IRS regulations.

Steps to complete the Ohio W-9

Completing the Ohio W-9 form involves several straightforward steps:

- Download the form: Obtain the Ohio W-9 form from a reliable source, ensuring you have the most current version.

- Fill in your information: Provide your name, business name (if applicable), and address in the designated fields.

- Enter your taxpayer identification number: This could be your Social Security number (SSN) or Employer Identification Number (EIN).

- Sign and date the form: Your signature certifies that the information provided is accurate and complete.

- Submit the form: Send the completed Ohio W-9 to the requester, typically the business or individual who needs it for tax reporting purposes.

Legal use of the Ohio W-9

The Ohio W-9 form is legally binding when filled out correctly. It serves as a declaration of your taxpayer identification information, which is crucial for accurate tax reporting. The form must be signed and dated to validate the information provided. Failure to comply with the legal requirements associated with the Ohio W-9 can lead to penalties, including backup withholding on payments made to you. Therefore, it is essential to ensure that all details are accurate and up to date.

How to obtain the Ohio W-9

Obtaining the Ohio W-9 form is a simple process. You can find the form available for download on various official tax websites or through the IRS website. It is important to ensure that you are using the most recent version of the form to comply with current tax regulations. If you prefer a physical copy, you may also request one from the business or individual that requires your taxpayer information.

Key elements of the Ohio W-9

The Ohio W-9 form includes several key elements that must be accurately completed:

- Name: The legal name of the individual or business entity.

- Business name: If applicable, the name under which the business operates.

- Address: The current mailing address where you can be reached.

- Taxpayer Identification Number: Your SSN or EIN, which is crucial for tax reporting.

- Signature and date: Your signature certifies the accuracy of the information provided.

Form Submission Methods

The completed Ohio W-9 form can be submitted through various methods, depending on the requester's preferences:

- Online submission: Many businesses allow electronic submission of the form via email or secure online portals.

- Mail: You can print the completed form and mail it directly to the requester.

- In-person delivery: If necessary, you may deliver the form in person to the requesting party.

Quick guide on how to complete ohio w9

Effortlessly prepare Ohio W9 on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Ohio W9 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to alter and electronically sign Ohio W9 with ease

- Obtain Ohio W9 and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mishandled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Ohio W9 and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio w9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a state of Ohio W9 form?

The state of Ohio W9 form is used by businesses and contractors to request the Taxpayer Identification Number (TIN) of an individual or company. Completing the state of Ohio W9 accurately ensures proper tax reporting and compliance. It’s essential for tax purposes, especially for those working in or with Ohio-based entities.

-

How can airSlate SignNow help with the state of Ohio W9 form?

airSlate SignNow simplifies the process of filling out and eSigning your state of Ohio W9 form. With its user-friendly interface, you can easily upload, edit, and send the form for signatures. This streamlines your workflow and ensures that all parties can complete the required paperwork efficiently.

-

Is there a cost associated with using airSlate SignNow for the state of Ohio W9?

Yes, airSlate SignNow offers various subscription plans that provide access to its features, including eSigning and document management. Pricing is competitive, designed to meet the needs of businesses of all sizes. A cost-effective solution, it allows users to efficiently manage their state of Ohio W9 forms without overspending.

-

What features does airSlate SignNow offer for managing state of Ohio W9 forms?

airSlate SignNow provides features like document templates, customizable fields, and secure eSigning for your state of Ohio W9 forms. You can also track the status of sent documents and receive notifications when they are signed. These features enhance productivity and ensure compliance with digital signing requirements.

-

Can I integrate airSlate SignNow with other software to manage my state of Ohio W9 forms?

Absolutely! airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and Dropbox. This helps you manage your state of Ohio W9 forms alongside your existing workflows, enhancing overall efficiency and data management.

-

What benefits does airSlate SignNow provide for businesses handling state of Ohio W9 forms?

Using airSlate SignNow for your state of Ohio W9 forms ensures quicker turnaround times and reduced paperwork hassles. The platform is designed to enhance collaboration between stakeholders while maintaining a secure environment for sensitive information. This ultimately contributes to better compliance and streamlined operations.

-

How secure is the airSlate SignNow platform for handling state of Ohio W9 forms?

airSlate SignNow prioritizes the security of your documents, including state of Ohio W9 forms, with advanced encryption and secure access controls. User data is protected at all stages, from document creation to signing. You can rely on airSlate SignNow to keep your sensitive information safe and secure.

Get more for Ohio W9

- Washington lease form

- Warning notice due to complaint from neighbors washington form

- Subordination agreement form 497429777

- Apartment rules and regulations washington form

- Agreed cancellation of lease washington form

- Amendment of residential lease washington form

- Agreement for payment of unpaid rent washington form

- Commercial lease assignment from tenant to new tenant washington form

Find out other Ohio W9

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile