Salvation Army Donation Receipt Form

What is the Salvation Army Donation Receipt

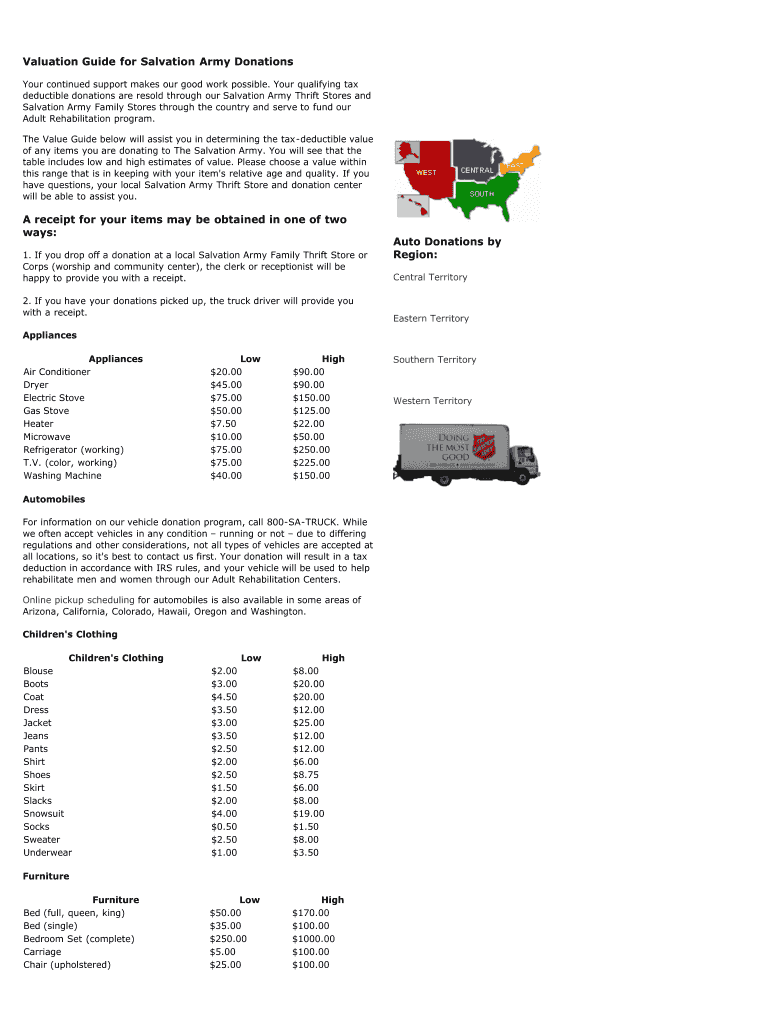

The Salvation Army donation receipt is an official document provided by the Salvation Army to acknowledge the receipt of charitable contributions. This receipt serves as proof of donation for tax purposes, allowing donors to claim tax deductions on their contributions. It typically includes details such as the donor's name, the date of the donation, a description of the donated items, and the estimated value of those items. Understanding this receipt is essential for individuals who wish to maximize their tax benefits while supporting a charitable cause.

How to Obtain the Salvation Army Donation Receipt

To obtain a Salvation Army donation receipt, donors can follow a straightforward process. When making a donation, whether it be clothing, household items, or monetary contributions, donors should request a receipt at the time of the donation. For in-person donations, the receipt is usually provided immediately. For online donations, donors may receive a digital receipt via email. If a receipt is lost or not received, donors can contact their local Salvation Army branch to request a duplicate receipt, ensuring they have the necessary documentation for tax purposes.

Steps to Complete the Salvation Army Donation Receipt

Completing a Salvation Army donation receipt involves a few simple steps. First, ensure you have all necessary information, including your name, address, and details about the donated items. Next, accurately describe each item donated and provide an estimated value for each. It is important to keep a copy of the completed receipt for your records. If you are filling out the receipt digitally, using a reliable eSigning platform can enhance the process by ensuring that your document is securely signed and stored.

Key Elements of the Salvation Army Donation Receipt

A valid Salvation Army donation receipt should contain several key elements to ensure it meets IRS requirements. These include:

- Donor Information: The name and address of the donor.

- Date of Donation: The specific date when the donation was made.

- Description of Items: A detailed list of the items donated.

- Estimated Value: A reasonable estimate of the fair market value of the donated items.

- Organization Details: The name and address of the Salvation Army branch receiving the donation.

Legal Use of the Salvation Army Donation Receipt

The Salvation Army donation receipt is legally recognized as a valid document for tax purposes. To ensure compliance with IRS regulations, it is important that the receipt includes all required information. Donors should retain the receipt for their records, as it may be requested during tax audits. The receipt not only serves as proof of donation but also helps donors substantiate their claims for tax deductions, making it a critical component of charitable giving.

IRS Guidelines

According to IRS guidelines, donors can claim tax deductions for charitable contributions if they have proper documentation. The Salvation Army donation receipt meets these documentation requirements, provided it includes essential details such as the date of the donation and a description of the items. For donations exceeding a certain value, additional documentation may be required, such as an appraisal for high-value items. Familiarizing oneself with IRS guidelines can help ensure that all necessary steps are taken to maximize tax benefits from charitable contributions.

Quick guide on how to complete salvation army donation receipt

Complete Salvation Army Donation Receipt with ease on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Salvation Army Donation Receipt on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest method to modify and eSign Salvation Army Donation Receipt seamlessly

- Obtain Salvation Army Donation Receipt and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors necessitating new document prints. airSlate SignNow fulfills all your document management needs in a few clicks from any device you choose. Modify and eSign Salvation Army Donation Receipt while ensuring excellent communication during every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the salvation army donation receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Salvation Army receipt?

A Salvation Army receipt is a document provided to donors when they make a contribution of items or money to the Salvation Army. This receipt serves as proof of donation and can be used for tax deduction purposes. With airSlate SignNow, you can easily eSign and store your Salvation Army receipts securely.

-

How can I get a Salvation Army receipt for my donation?

To obtain a Salvation Army receipt, you simply need to donate items or funds to a local Salvation Army center. After making your donation, request a receipt, which can often be provided on-site or sent to you electronically. Using airSlate SignNow, you can manage and eSign your Salvation Army receipts efficiently.

-

Can I use a Salvation Army receipt for tax deductions?

Yes, you can use a Salvation Army receipt for tax deductions. It is important to keep this receipt as proof of your charitable contributions when filing your taxes. AirSlate SignNow makes it easy to store and manage all your donation receipts, including those from the Salvation Army.

-

What features does airSlate SignNow offer for managing Salvation Army receipts?

AirSlate SignNow offers features such as eSigning, document storage, and easy sharing options to manage your Salvation Army receipts effectively. You can securely store all your receipts in one place, making it easier to track and access them whenever needed. Plus, with our user-friendly interface, managing donations has never been easier.

-

Is airSlate SignNow a cost-effective solution for managing receipts?

Yes, airSlate SignNow is a cost-effective solution for managing receipts, including Salvation Army receipts. Our pricing plans are designed to fit a variety of budgets, making it easier for businesses and individuals to maintain organized records of their donations. With our affordable options, you can streamline your document management without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for managing donations?

Absolutely! AirSlate SignNow can easily integrate with various applications such as accounting software and customer relationship management (CRM) tools. This enables you to manage your donation records and Salvation Army receipts seamlessly alongside your other business operations. Integration simplifies workflow and enhances productivity.

-

Are there any limitations on the number of Salvation Army receipts I can manage with airSlate SignNow?

With airSlate SignNow, there are no specific limitations on the number of Salvation Army receipts you can manage. Our platform allows you to store as many documents as you need, providing flexibility for your donation records. Enjoy peace of mind knowing all your receipts are securely stored and easily accessible at any time.

Get more for Salvation Army Donation Receipt

- Notice of assignment to living trust south dakota form

- Revocation of living trust south dakota form

- Letter to lienholder to notify of trust south dakota form

- South dakota timber sale contract south dakota form

- South dakota forest products timber sale contract south dakota form

- South dakota easement form

- Assumption agreement of mortgage and release of original mortgagors south dakota form

- Small estate heirship affidavit for estates under 50000 south dakota form

Find out other Salvation Army Donation Receipt

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast