150 101 173 Oregon Oregon Gov Oregon Form

What is the 150 101 173 Oregon Gov Oregon

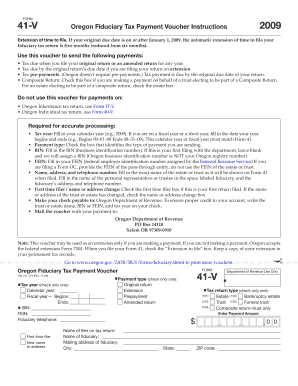

The 150 101 173 form is a specific document used by the state of Oregon, primarily for tax-related purposes. This form is integral for individuals and businesses to report their income, deductions, and credits accurately. It is essential for compliance with state tax laws and helps ensure that taxpayers meet their obligations. Understanding the purpose and requirements of this form is crucial for anyone involved in financial reporting within Oregon.

How to use the 150 101 173 Oregon Gov Oregon

Using the 150 101 173 form involves several steps to ensure that all necessary information is accurately reported. Taxpayers should first gather all relevant financial documents, including income statements and deduction records. Next, fill out the form carefully, ensuring that all sections are completed in accordance with state guidelines. Once completed, the form can be submitted either electronically or via mail, depending on the preferences and capabilities of the taxpayer.

Steps to complete the 150 101 173 Oregon Gov Oregon

Completing the 150 101 173 form requires attention to detail. Follow these steps:

- Gather all necessary documentation, such as W-2s, 1099s, and receipts for deductions.

- Access the form through the Oregon government website or other authorized sources.

- Fill out personal information, including name, address, and Social Security number.

- Report income accurately, including wages, interest, and any other sources.

- Detail deductions and credits you are eligible for, ensuring you have supporting documentation.

- Review the completed form for accuracy before submission.

- Submit the form electronically or by mail, following the specified guidelines.

Legal use of the 150 101 173 Oregon Gov Oregon

The legal use of the 150 101 173 form is governed by Oregon state tax laws. It is essential for taxpayers to use this form correctly to avoid legal repercussions, such as penalties or audits. Filing the form accurately ensures compliance with state regulations and helps maintain good standing with the Oregon Department of Revenue. Taxpayers should keep a copy of the submitted form and any supporting documents for their records.

Required Documents

To complete the 150 101 173 form, several documents are typically required, including:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation for any deductions claimed, such as receipts for business expenses.

- Proof of any tax credits for which you may be eligible.

Form Submission Methods

The 150 101 173 form can be submitted through various methods to accommodate different preferences:

- Online: Many taxpayers opt to file electronically through the Oregon Department of Revenue's online portal.

- By Mail: Taxpayers can print the completed form and send it to the designated address provided by the state.

- In-Person: Some individuals may choose to submit their forms in person at local tax offices.

Quick guide on how to complete 150 101 173 oregon oregon gov oregon

Finalize [SKS] seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers a commendable eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copy versions. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 150 101 173 Oregon Oregon Gov Oregon

Create this form in 5 minutes!

How to create an eSignature for the 150 101 173 oregon oregon gov oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 150 101 173 Oregon Oregon Gov Oregon?

airSlate SignNow is a powerful platform that enables businesses to easily send and eSign documents. It helps streamline processes and improve efficiency, which is crucial for organizations managing compliance with 150 101 173 Oregon Oregon Gov Oregon regulations.

-

How much does airSlate SignNow cost for businesses in Oregon?

Pricing for airSlate SignNow varies based on the features and number of users. Businesses in Oregon can choose plans that cater to their needs while ensuring compliance with 150 101 173 Oregon Oregon Gov Oregon, providing cost-effective solutions for eSignature requirements.

-

What key features does airSlate SignNow offer?

airSlate SignNow provides various features including document generation, eSigning, and real-time tracking. These features are designed to meet both general and specific needs in alignment with 150 101 173 Oregon Oregon Gov Oregon guidelines.

-

How can airSlate SignNow benefit my organization?

Using airSlate SignNow can signNowly enhance your organization’s operational efficiency and reduce turnaround times for document signing. This benefit is particularly important for compliance with 150 101 173 Oregon Oregon Gov Oregon, ensuring that you meet regulatory requirements efficiently.

-

Does airSlate SignNow integrate with other tools?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing workflow automation. This capability is beneficial for Oregon-based businesses complying with 150 101 173 Oregon Oregon Gov Oregon, allowing smoother operations and document management.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures to safeguard your sensitive documents throughout the signing process. This commitment to security aligns with the compliance standards set out by 150 101 173 Oregon Oregon Gov Oregon, ensuring your data remains protected.

-

Can I use airSlate SignNow for remote signing?

Yes, airSlate SignNow is designed for remote signing, allowing users to sign documents from anywhere. This feature is especially useful for businesses in Oregon adhering to 150 101 173 Oregon Oregon Gov Oregon, as it supports flexible work arrangements without compromising compliance.

Get more for 150 101 173 Oregon Oregon Gov Oregon

Find out other 150 101 173 Oregon Oregon Gov Oregon

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement