Vat100 Form PDF

What is the VAT100 Form PDF

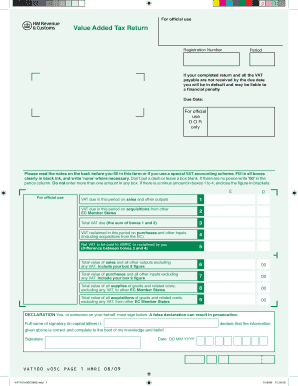

The VAT100 form is a document used by businesses in the United Kingdom to report and pay Value Added Tax (VAT) to Her Majesty's Revenue and Customs (HMRC). This form is essential for businesses that are VAT registered, as it provides a summary of the VAT charged on sales and the VAT paid on purchases during a specific accounting period. The VAT100 form PDF allows for easy digital access and completion, making it convenient for users to manage their VAT obligations online.

How to Use the VAT100 Form PDF

Using the VAT100 form PDF involves several straightforward steps. First, download the form from a reliable source. Once downloaded, fill in the required fields, which typically include your business details, VAT registration number, and financial figures for the reporting period. After completing the form, it is crucial to review all entries for accuracy. Once verified, the form can be submitted electronically or printed for mailing, depending on your preferred submission method.

Steps to Complete the VAT100 Form PDF

Completing the VAT100 form PDF requires careful attention to detail. Here are the essential steps:

- Download the VAT100 form PDF from a trusted source.

- Open the form using a PDF reader that allows for editing.

- Enter your business information, including name, address, and VAT registration number.

- Input the total sales and purchases for the reporting period.

- Calculate the VAT due and any VAT reclaimable.

- Review the information for accuracy.

- Save the completed form and choose your submission method.

Legal Use of the VAT100 Form PDF

The VAT100 form PDF is legally binding when completed and submitted according to HMRC regulations. It must be filled out accurately to ensure compliance with tax laws. Electronic submissions are considered valid under the Electronic Signatures in Global and National Commerce (ESIGN) Act, provided that the necessary electronic signature requirements are met. This includes using a reliable eSignature platform that maintains compliance with relevant legal frameworks.

Filing Deadlines / Important Dates

Filing deadlines for the VAT100 form are crucial for compliance. Businesses must submit their VAT returns quarterly or annually, depending on their registration. The deadlines are typically one month and seven days after the end of the accounting period. For example, if your accounting period ends on March 31, the VAT100 form must be submitted by May 7. It is essential to keep track of these dates to avoid penalties and interest on late submissions.

Form Submission Methods (Online / Mail / In-Person)

The VAT100 form can be submitted through various methods, providing flexibility for businesses. The primary submission methods include:

- Online: The most efficient method, allowing for immediate processing and confirmation.

- Mail: Print the completed form and send it to HMRC via postal service.

- In-Person: Some businesses may opt to deliver the form directly to a local HMRC office.

Quick guide on how to complete vat100 form pdf

Effortlessly prepare Vat100 Form Pdf on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, enabling you to access the right forms and securely store them online. airSlate SignNow equips you with all the tools necessary to quickly create, edit, and eSign your documents without delays. Manage Vat100 Form Pdf on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Vat100 Form Pdf with minimal effort

- Find Vat100 Form Pdf and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form navigation, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and eSign Vat100 Form Pdf and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat100 form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for completing a UK HMRC tax return using airSlate SignNow?

Completing a UK HMRC tax return with airSlate SignNow is straightforward. Users can upload their documents, fill them out electronically, and eSign them securely. This process ensures that your tax return is submitted on time while remaining compliant with HMRC regulations.

-

What are the pricing options for using airSlate SignNow for UK HMRC tax returns?

airSlate SignNow offers flexible pricing plans to cater to various business needs, including those preparing UK HMRC tax returns. You can choose from monthly or annual subscriptions, which provide full access to features and unlimited signing. This cost-effective solution helps you manage your tax documents without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for my UK HMRC tax return?

Yes, airSlate SignNow can be easily integrated with popular accounting software to streamline your UK HMRC tax return process. This integration helps ensure that your financial data is accurate and up-to-date, making it easier to complete your tax return efficiently.

-

What features does airSlate SignNow offer for managing UK HMRC tax returns?

airSlate SignNow offers various features tailored for managing UK HMRC tax returns, including document templates, automated workflows, and secure eSignature capabilities. These features simplify the tax return process, allowing you to focus on other essential aspects of your business.

-

How secure is airSlate SignNow for handling sensitive UK HMRC tax return data?

airSlate SignNow prioritizes the security of your data, including sensitive information related to UK HMRC tax returns. With end-to-end encryption, secure cloud storage, and compliance with GDPR and eIDAS regulations, you can trust that your documents are protected at all stages.

-

Can I track the status of my UK HMRC tax return documents in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your documents, including those related to UK HMRC tax returns. You can easily see when documents are viewed, signed, or completed, ensuring you stay informed throughout the tax return process.

-

What benefits does airSlate SignNow offer for small businesses dealing with UK HMRC tax returns?

For small businesses, airSlate SignNow simplifies the management of UK HMRC tax returns with its user-friendly interface and affordable pricing. This cloud-based solution reduces paper clutter, enhances productivity, and ensures compliance, making tax filing more efficient and less stressful.

Get more for Vat100 Form Pdf

- Printable funeral planning checklist pdf form

- Cash app bank statement pdf form

- Redpoint county mutual login form

- Horizon west middle school form

- Tinnitus questionnaire form

- New zealand work visa application form

- Building permit application traduo em portugus form

- Computer service contract template form

Find out other Vat100 Form Pdf

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors