Liberty Tax Net Profit from Business Worksheet Form

What is the Liberty Tax Net Profit From Business Worksheet?

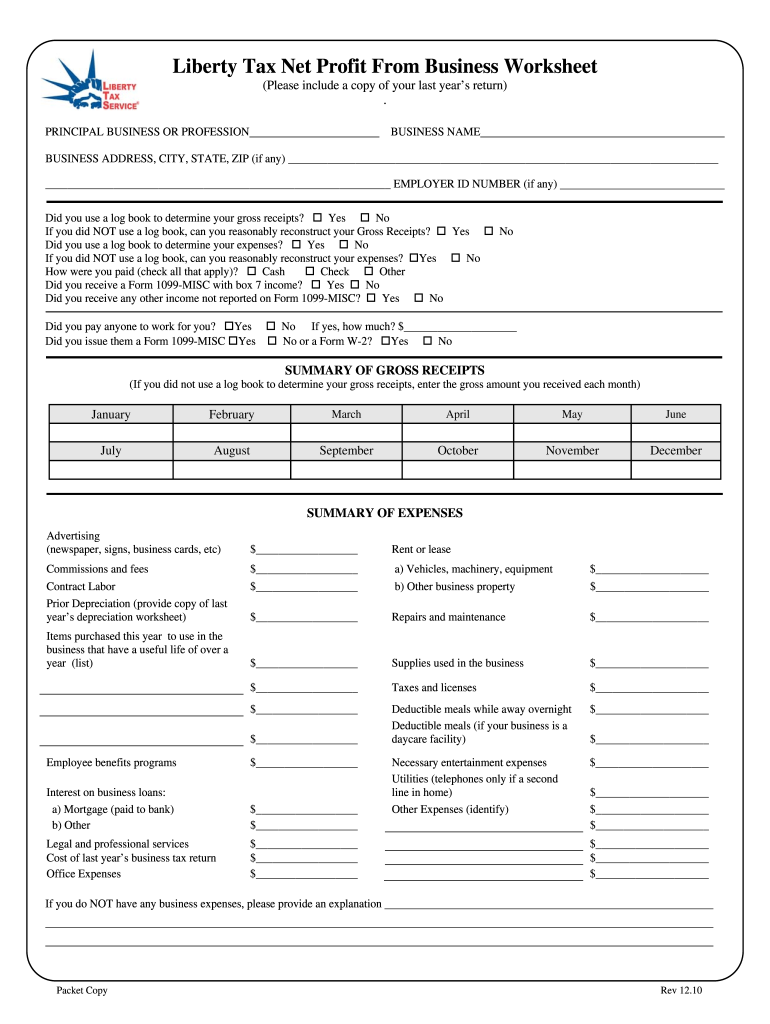

The Liberty Tax Net Profit From Business Worksheet is a crucial document used by self-employed individuals and business owners to calculate their net profit for tax purposes. This worksheet helps in determining the income earned from business activities, allowing taxpayers to report accurate figures on their tax returns. It is essential for ensuring compliance with IRS regulations and for maximizing potential deductions.

How to Use the Liberty Tax Net Profit From Business Worksheet

Using the Liberty Tax Net Profit From Business Worksheet involves several steps. First, gather all relevant financial documents, including income statements and expense records. Next, input your total income from business activities in the designated section of the worksheet. After that, list all allowable business expenses, such as operational costs, supplies, and other deductions. Finally, subtract total expenses from total income to arrive at your net profit, which will be reported on your tax return.

Steps to Complete the Liberty Tax Net Profit From Business Worksheet

Completing the Liberty Tax Net Profit From Business Worksheet requires careful attention to detail. Follow these steps:

- Collect all income and expense documentation related to your business.

- Fill in the total income earned during the tax year.

- List all eligible business expenses, ensuring you have receipts or records to support each entry.

- Calculate your net profit by subtracting total expenses from total income.

- Review the worksheet for accuracy before submitting it with your tax return.

Legal Use of the Liberty Tax Net Profit From Business Worksheet

The Liberty Tax Net Profit From Business Worksheet is legally recognized as a valid document for tax reporting when completed accurately. It is essential for taxpayers to adhere to IRS guidelines when filling out this form, as inaccuracies can lead to penalties or audits. Using this worksheet helps ensure that all income and deductions are properly documented, supporting compliance with tax laws.

Required Documents for the Liberty Tax Net Profit From Business Worksheet

To complete the Liberty Tax Net Profit From Business Worksheet, certain documents are required. These include:

- Income statements detailing all revenue generated from business activities.

- Receipts or invoices for business-related expenses.

- Bank statements that reflect business transactions.

- Previous tax returns, if applicable, for reference.

IRS Guidelines for the Liberty Tax Net Profit From Business Worksheet

The IRS provides specific guidelines regarding the use of the Liberty Tax Net Profit From Business Worksheet. Taxpayers must ensure that all income is reported accurately and that only legitimate business expenses are deducted. Familiarity with IRS publications and instructions related to self-employment income can help taxpayers navigate the requirements effectively, reducing the risk of errors and ensuring compliance.

Quick guide on how to complete liberty tax net profit from business worksheet

Complete Liberty Tax Net Profit From Business Worksheet effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Liberty Tax Net Profit From Business Worksheet on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Liberty Tax Net Profit From Business Worksheet with ease

- Obtain Liberty Tax Net Profit From Business Worksheet and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or conceal sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues of missing or lost files, tedious form searching, or errors requiring new document prints. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Modify and electronically sign Liberty Tax Net Profit From Business Worksheet, ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the liberty tax net profit from business worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is liberty tax net and how does it work?

Liberty tax net is an online platform designed to simplify the tax filing process by allowing users to eSign and send important documents securely. With airSlate SignNow, businesses can leverage the features of liberty tax net to manage their tax documents efficiently, ensuring compliance and accuracy.

-

Is there a free trial available for liberty tax net?

Yes, airSlate SignNow offers a free trial for users to explore the features of liberty tax net without any upfront costs. This allows potential customers to see how the solution can meet their tax needs before making a financial commitment.

-

What are the key features of liberty tax net?

The key features of liberty tax net include secure eSigning, document templates, workflow automation, and seamless integrations with popular applications. These features help streamline the tax preparation process, making it easier for businesses to handle their documentation efficiently.

-

How can liberty tax net benefit my small business?

Using liberty tax net can signNowly benefit your small business by reducing the time and effort spent on tax management. With tools for electronic signatures and document sharing, airSlate SignNow enables faster, more accurate filings, ultimately saving you money and enhancing productivity.

-

What pricing options are available for liberty tax net?

Liberty tax net offers flexible pricing plans to cater to different business needs, ensuring there is a suitable option for everyone. airSlate SignNow provides competitive rates based on the number of users and required features, allowing businesses to scale as they grow.

-

Can liberty tax net integrate with other software?

Absolutely! Liberty tax net integrates seamlessly with multiple applications, enhancing your existing workflows. With airSlate SignNow, you can connect to various tools such as CRMs, accounting software, and document management systems, streamlining your tax processes.

-

How secure is liberty tax net for document handling?

Security is a top priority for liberty tax net. airSlate SignNow employs robust security measures, including encryption and secure data storage, to ensure that your sensitive tax documents are protected from unauthorized access and data bsignNowes.

Get more for Liberty Tax Net Profit From Business Worksheet

- Safrican form

- Residential leasedoc real property law section quick hits residential transactions program bill of sale form

- Ui16 form

- Pmbok 6th edition pdf download form

- 15g form pdf

- Form kyc version 3 2014 ioc bpc hpc

- Reimbursement request form 320752780

- Complete print sign and mail fax or emailfor form

Find out other Liberty Tax Net Profit From Business Worksheet

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation