Consumerservices Early Warning Com Form

What is the Consumerservices Early Warning Com

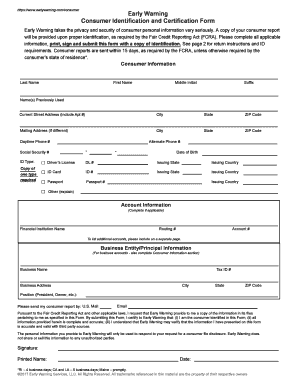

The Consumerservices Early Warning Com is a platform that provides consumers with access to their early warning consumer reports. These reports are essential for individuals to understand their financial standing and identify any potential issues that may affect their creditworthiness. Early warning services collect data from various financial institutions to create a comprehensive overview of a consumer's financial behavior, which can be crucial for loan approvals and other financial transactions.

How to obtain the Consumerservices Early Warning Com

To obtain your early warning consumer report from Consumerservices Early Warning Com, you typically need to visit their official website. Users are required to provide personal information, such as their name, address, and Social Security number, to verify their identity. Once the information is submitted, individuals can access their reports online. It is advisable to check the site for any specific requirements or additional documentation needed for verification.

Steps to complete the Consumerservices Early Warning Com

Completing the process for accessing your early warning consumer report involves several straightforward steps:

- Visit the official Consumerservices Early Warning Com website.

- Provide your personal information for identity verification.

- Submit any required documentation, if applicable.

- Review your early warning consumer report once it is generated.

- Take note of any discrepancies or issues that may need addressing.

Legal use of the Consumerservices Early Warning Com

The use of the Consumerservices Early Warning Com is governed by various legal frameworks that ensure the protection of consumer data. Under the Fair Credit Reporting Act (FCRA), consumers have the right to access their reports and dispute any inaccuracies. It is important to understand these rights to ensure that your report is used legally and ethically, especially when applying for loans or credit.

Key elements of the Consumerservices Early Warning Com

Key elements of the Consumerservices Early Warning Com include:

- Consumer identification information, which includes personal details.

- Financial behavior data that reflects payment history and account status.

- Alerts regarding any negative information that may impact credit scores.

- Options for consumers to dispute inaccuracies in their reports.

Examples of using the Consumerservices Early Warning Com

Consumers can use the early warning consumer report for various purposes, such as:

- Assessing their creditworthiness before applying for a mortgage or loan.

- Identifying potential identity theft or fraud by reviewing unfamiliar accounts.

- Understanding factors that may affect their credit score and taking corrective actions.

Quick guide on how to complete consumerservices early warning com

Effortlessly Prepare Consumerservices Early Warning Com on Any Device

Digital document management has gained signNow traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Consumerservices Early Warning Com on any device with the airSlate SignNow apps available for Android and iOS, and streamline any document-related task today.

How to Modify and Electronically Sign Consumerservices Early Warning Com with Ease

- Obtain Consumerservices Early Warning Com and click on Get Form to begin.

- Use the tools provided to complete your document.

- Select important sections of the document or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Consumerservices Early Warning Com to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the consumerservices early warning com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an early warning consumer report?

An early warning consumer report is a specialized report that outlines a consumer's credit history and other relevant financial data. It helps businesses make informed decisions regarding creditworthiness and risk assessment. Understanding these reports can empower businesses to improve their offerings and customer relations.

-

How does airSlate SignNow incorporate early warning consumer reports?

airSlate SignNow allows businesses to integrate early warning consumer reports into their document workflows seamlessly. By pulling this information into the eSigning process, businesses can ensure they are making educated decisions based on the latest consumer insights. This enhances the overall efficiency and compliance of document transactions.

-

What features does airSlate SignNow offer for managing early warning consumer reports?

airSlate SignNow offers features such as customizable templates, document tracking, and secure eSigning. These tools streamline the handling of early warning consumer reports, making it easier for businesses to gather and utilize critical consumer information efficiently. With these features, companies can manage their documentation with confidence.

-

Is there a cost associated with accessing early warning consumer reports through airSlate SignNow?

Yes, while airSlate SignNow provides cost-effective eSigning solutions, there may be additional fees associated with accessing specific data like early warning consumer reports. Pricing varies based on the volume of usage and the types of reports required. It is recommended to contact our sales team for detailed pricing and options.

-

What are the benefits of using early warning consumer reports in my business?

Using early warning consumer reports can signNowly reduce the risk of fraud and improve your credit assessment processes. With timely insights, you can make better lending decisions, ultimately leading to increased business performance. Moreover, it helps in building trust with customers, knowing you've taken responsible steps to assess their eligibility.

-

Can I integrate airSlate SignNow with other applications for accessing early warning consumer reports?

Yes, airSlate SignNow supports various integrations with popular applications that can facilitate access to early warning consumer reports. Tools like CRM systems and financial software can work alongside our platform, enhancing your overall productivity. Our API allows for flexible integration to tailor your workflow according to business needs.

-

How secure is the data when using airSlate SignNow and early warning consumer reports?

Data security is a top priority for airSlate SignNow. We implement industry-standard encryption and security measures to protect consumer information, including early warning consumer reports. Our compliance with legal regulations ensures your data is handled safely, giving you peace of mind during eSigning processes.

Get more for Consumerservices Early Warning Com

- Subcontractors agreement vermont form

- Vermont interested persons form

- Option to purchase addendum to residential lease lease or rent to own vermont form

- Vermont prenuptial premarital agreement with financial statements vermont form

- Vt premarital agreement form

- Amendment to prenuptial or premarital agreement vermont form

- Financial statements only in connection with prenuptial premarital agreement vermont form

- Revocation of premarital or prenuptial agreement vermont form

Find out other Consumerservices Early Warning Com

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter