Qsehra Plan Document Template Form

What is the Qsehra Plan Document Template

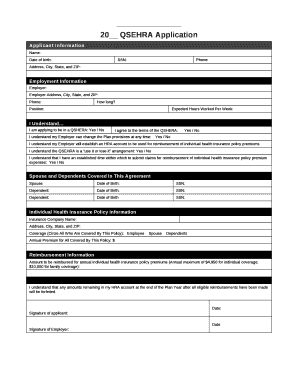

The Qsehra plan document template is a structured form designed to facilitate the implementation of Qualified Small Employer Health Reimbursement Arrangements (Qsehra). This document outlines the terms and conditions under which employers can reimburse their employees for qualified medical expenses. It serves as a formal agreement between the employer and employees, ensuring compliance with IRS regulations while providing clarity on reimbursement procedures.

How to use the Qsehra Plan Document Template

To effectively use the Qsehra plan document template, employers should first customize the template to reflect their specific reimbursement policies and employee eligibility criteria. This includes detailing the types of expenses that qualify for reimbursement and the process employees must follow to submit their claims. Employers should also ensure that the document is easily accessible to all employees and provide guidance on how to complete it correctly.

Steps to complete the Qsehra Plan Document Template

Completing the Qsehra plan document template involves several key steps:

- Review the template for necessary fields, including employer and employee information.

- Specify the eligible medical expenses that can be reimbursed under the plan.

- Outline the claims submission process, including deadlines and required documentation.

- Include a section for employee signatures to confirm their understanding and acceptance of the plan.

- Store the completed document securely, ensuring it is easily retrievable for future reference.

Legal use of the Qsehra Plan Document Template

The legal use of the Qsehra plan document template is crucial for compliance with IRS guidelines. Employers must ensure that the plan adheres to the stipulations set forth in the Internal Revenue Code. This includes maintaining accurate records of reimbursements and ensuring that the plan is offered on a non-discriminatory basis. Proper legal use helps protect both the employer and employees from potential tax liabilities.

Key elements of the Qsehra Plan Document Template

Key elements of the Qsehra plan document template include:

- Employer and employee identification information.

- Description of eligible medical expenses.

- Reimbursement limits and guidelines.

- Claims submission procedures and deadlines.

- Signatures of both employer and employee to validate the agreement.

IRS Guidelines

IRS guidelines for Qsehra plans are essential for employers to follow. These guidelines outline the requirements for establishing a Qsehra, including the maximum reimbursement limits and the necessity for a written plan document. Employers must familiarize themselves with these guidelines to ensure compliance and avoid penalties associated with improper plan administration.

Eligibility Criteria

Eligibility criteria for participating in a Qsehra plan typically include:

- Employees must work for a small employer that offers the Qsehra.

- Employees must not be enrolled in a group health plan.

- Employees must provide proof of eligible medical expenses incurred during the plan year.

Quick guide on how to complete qsehra plan document template

Prepare Qsehra Plan Document Template seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents swiftly without delays. Manage Qsehra Plan Document Template on any device using airSlate SignNow's Android or iOS apps and enhance any document-related process today.

How to modify and eSign Qsehra Plan Document Template effortlessly

- Find Qsehra Plan Document Template and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to submit your form: via email, text message (SMS), invite link, or download it to your computer.

Wave goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Qsehra Plan Document Template to maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the qsehra plan document template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a QSEHRA plan document?

A QSEHRA plan document is a formal record that outlines the details of a Qualified Small Employer Health Reimbursement Arrangement. This document serves as a crucial guideline for both employers and employees, detailing reimbursement policies and eligible expenses related to health care costs.

-

How can airSlate SignNow help with QSEHRA plan document management?

airSlate SignNow simplifies the process of managing QSEHRA plan documents by allowing businesses to create, send, and electronically sign documents efficiently. The user-friendly interface ensures that employers can easily generate compliant QSEHRA documents while streamlining communication with employees.

-

What features does airSlate SignNow offer for QSEHRA plan documents?

With airSlate SignNow, you can create customizable templates for QSEHRA plan documents, automate workflows, and track document status in real-time. The platform also ensures compliance through secure e-signatures and robust document storage options.

-

Is there a cost associated with using airSlate SignNow for QSEHRA plan documents?

Yes, airSlate SignNow operates on a subscription-based pricing model that is cost-effective for businesses of all sizes. The price depends on the plan you choose, but it typically includes features that support the management of QSEHRA plan documents without breaking the bank.

-

How does airSlate SignNow ensure the security of my QSEHRA plan documents?

airSlate SignNow prioritizes security by employing advanced encryption standards for both data in transit and at rest. Users can trust that their QSEHRA plan documents are protected, with features such as password protection and audit trails that enhance document security.

-

Can I integrate airSlate SignNow with other tools for managing QSEHRA plan documents?

Absolutely! airSlate SignNow offers integrations with various software solutions, enhancing your ability to manage QSEHRA plan documents seamlessly. This includes CRM systems, accounting software, and human resource management tools that can simplify your workflows.

-

What are the benefits of having a QSEHRA plan document?

A well-structured QSEHRA plan document offers several benefits, including clarity for employees regarding their health reimbursement options and protection for employers against potential penalties. It also facilitates smoother employer-employee communications regarding health care spending.

Get more for Qsehra Plan Document Template

- Ps form 6401

- Ippd form for nurses

- Blank pan card pdf form

- Moon phases worksheet pdf answer key form

- Mind map from text list veterinary invoice templat form

- Instrument prepared by name address form

- Statement of sole responsibility marriage act forms central

- Transportation credit application sj transportation form

Find out other Qsehra Plan Document Template

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer