S Corp Shareholder Basis Worksheet Excel Form

What is the S Corp Shareholder Basis Worksheet Excel

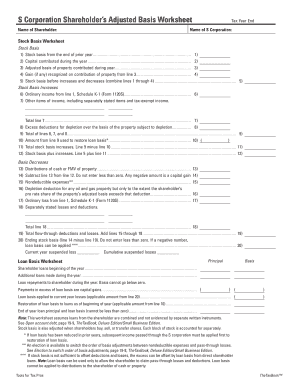

The S Corp Shareholder Basis Worksheet Excel is a crucial document used by shareholders of S corporations to track their investment in the company. This worksheet helps in calculating the adjusted basis of a shareholder's interest, which is essential for determining gain or loss on the sale of shares, as well as for reporting income and distributions accurately. It includes sections for contributions, distributions, and other adjustments that affect the shareholder's basis over time.

How to use the S Corp Shareholder Basis Worksheet Excel

Using the S Corp Shareholder Basis Worksheet Excel involves entering specific financial information related to your investment in the corporation. Start by inputting your initial investment amount, followed by any additional contributions made during the year. Next, record any distributions received, as these will reduce your basis. It's important to also include any adjustments for items such as losses or deductions that may affect your basis. The worksheet will automatically calculate your adjusted basis, providing a clear overview of your investment status.

Steps to complete the S Corp Shareholder Basis Worksheet Excel

Completing the S Corp Shareholder Basis Worksheet Excel requires several steps:

- Gather all relevant financial documents, including your investment records and any distribution statements.

- Open the Excel worksheet and input your initial investment amount in the designated field.

- Add any additional contributions made to the S corporation during the tax year.

- Record any distributions received from the corporation, noting that these will decrease your basis.

- Include any losses or deductions that may apply, as these will also adjust your basis.

- Review the calculated adjusted basis at the end of the worksheet to ensure accuracy.

Legal use of the S Corp Shareholder Basis Worksheet Excel

The S Corp Shareholder Basis Worksheet Excel is legally recognized as an important tool for shareholders to maintain accurate records of their investment. Properly completed worksheets can serve as documentation for tax filings and may be required in the event of an audit. It is essential to ensure that all entries are accurate and reflect the true financial activity related to the S corporation to comply with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of shareholder basis in S corporations. Shareholders must report their basis accurately to determine the tax implications of distributions and the sale of shares. The IRS requires that shareholders keep detailed records of their contributions, distributions, and any adjustments to basis. Following these guidelines helps ensure compliance and minimizes the risk of penalties.

Examples of using the S Corp Shareholder Basis Worksheet Excel

Examples of using the S Corp Shareholder Basis Worksheet Excel can help clarify its application. For instance, if a shareholder initially invests $10,000 in an S corporation and later contributes an additional $5,000, their basis would increase to $15,000. If the shareholder then receives a distribution of $3,000, the adjusted basis would decrease to $12,000. This example illustrates how contributions and distributions directly impact the shareholder's basis over time.

Quick guide on how to complete s corp shareholder basis worksheet excel

Complete S Corp Shareholder Basis Worksheet Excel effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without interruptions. Manage S Corp Shareholder Basis Worksheet Excel on any device using airSlate SignNow’s Android or iOS applications and simplify any documentation-related process today.

The easiest method to modify and electronically sign S Corp Shareholder Basis Worksheet Excel effortlessly

- Find S Corp Shareholder Basis Worksheet Excel and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from a device of your choice. Edit and electronically sign S Corp Shareholder Basis Worksheet Excel and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s corp shareholder basis worksheet excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an S corp shareholder basis worksheet Excel and why is it important?

An S corp shareholder basis worksheet Excel is a crucial tool for calculating and tracking a shareholder's basis in an S corporation. This information is important for determining tax liabilities and distributions. Accurate tracking can help you ensure compliance with IRS regulations and avoid potential penalties.

-

How can I obtain an S corp shareholder basis worksheet Excel?

You can effectively create an S corp shareholder basis worksheet Excel using templates available from airSlate SignNow. Our platform allows you to customize documents to meet your specific needs, making it easy to maintain accurate records as a shareholder. Signing up for airSlate SignNow provides you access to these valuable resources.

-

What features does airSlate SignNow offer for managing S corp shareholder basis?

AirSlate SignNow offers a variety of features to streamline the management of your S corp shareholder basis worksheet Excel. Our platform includes document templates, eSignature capabilities, and document sharing, enabling efficient collaboration among shareholders. Additionally, our secure cloud storage ensures easy access to your records anytime.

-

Is there a cost associated with using airSlate SignNow for S corp documents?

Yes, airSlate SignNow provides a flexible pricing model tailored to your business needs. Depending on the features you choose, various subscription options are available, including both monthly and annual plans. With pricing starting at just a few dollars a month, using the S corp shareholder basis worksheet Excel is a cost-effective solution for your business.

-

Can I integrate airSlate SignNow with other accounting software for S corp management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software solutions. This allows you to import and export your S corp shareholder basis worksheet Excel data effortlessly, enhancing productivity by reducing manual entry and ensuring accuracy across all your financial documents.

-

How does airSlate SignNow ensure the security of my S corp documents?

At airSlate SignNow, we prioritize your data security with advanced encryption and compliance standards. Our platform secures your S corp shareholder basis worksheet Excel documents during transmission and while stored in the cloud. You can trust us to keep your sensitive information safe and secure from unauthorized access.

-

Can I share my S corp shareholder basis worksheet Excel with team members?

Yes, sharing your S corp shareholder basis worksheet Excel with team members is easy with airSlate SignNow. You can securely share documents for collaboration, ensuring everyone has access to the most current data. This feature helps facilitate effective communication and teamwork within your organization.

Get more for S Corp Shareholder Basis Worksheet Excel

Find out other S Corp Shareholder Basis Worksheet Excel

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed