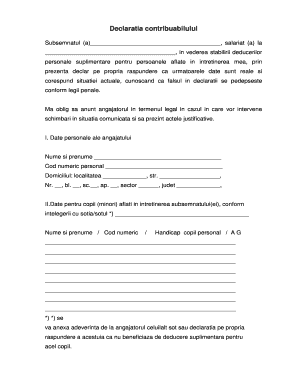

Model Declaratie Deducere Personala Form

What is the Model Declaratie Deducere Personala

The Model Declaratie Deducere Personala is a formal document used by taxpayers in the United States to claim personal deductions on their income tax returns. This form allows individuals to report eligible expenses that can reduce their taxable income, ultimately lowering their tax liability. The deducere personala is essential for ensuring that taxpayers can accurately reflect their financial situation and take advantage of available deductions. Understanding its purpose and requirements is crucial for effective tax planning and compliance.

Steps to Complete the Model Declaratie Deducere Personala

Completing the Model Declaratie Deducere Personala involves several key steps to ensure accuracy and compliance with tax regulations. First, gather all necessary documentation, including receipts and records of eligible expenses. Next, fill out the form by entering personal information, such as your name, address, and Social Security number. Then, itemize your deductions by listing each eligible expense and the corresponding amounts. After reviewing the completed form for errors, sign and date it to validate your submission. Finally, submit the form according to the specified guidelines, whether electronically or by mail.

Legal Use of the Model Declaratie Deducere Personala

The legal use of the Model Declaratie Deducere Personala is governed by IRS regulations, which outline the requirements for personal deductions. To be considered valid, the form must be completed accurately and submitted by the applicable filing deadline. It is essential to comply with the IRS guidelines to avoid penalties and ensure that the deductions claimed are legitimate. Additionally, maintaining proper documentation to support the deductions is crucial, as the IRS may request verification during audits.

Required Documents

To successfully complete the Model Declaratie Deducere Personala, several documents are required. These include:

- Receipts for all eligible expenses, such as medical bills, educational costs, and charitable contributions.

- Proof of income, including W-2 forms or 1099 statements.

- Previous tax returns, which can provide context for your current deductions.

- Any relevant financial statements that support your claims.

Having these documents ready will streamline the completion process and enhance the accuracy of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Model Declaratie Deducere Personala are critical to ensure compliance with IRS regulations. Typically, individual tax returns are due on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to be aware of any changes to these deadlines, as well as any extensions that may apply. Marking these dates on your calendar can help you stay organized and avoid late penalties.

Examples of Using the Model Declaratie Deducere Personala

There are various scenarios in which taxpayers might utilize the Model Declaratie Deducere Personala. For instance, a self-employed individual may claim deductions for business-related expenses, such as home office costs or travel expenses. A parent may use the form to report educational expenses for their children, while a caregiver might claim medical expenses incurred for a dependent. Each of these examples highlights the versatility of the form in accommodating different taxpayer situations.

Quick guide on how to complete model declaratie deducere personala 2022

Complete Model Declaratie Deducere Personala effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal sustainable substitute for traditional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and eSign your documents rapidly without delays. Manage Model Declaratie Deducere Personala on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and eSign Model Declaratie Deducere Personala without any hassle

- Find Model Declaratie Deducere Personala and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Model Declaratie Deducere Personala and guarantee seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the model declaratie deducere personala 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is deducere personala and how does it work with airSlate SignNow?

Deducere personala refers to personal deductions that can be claimed during tax filings. With airSlate SignNow, users can easily manage documents related to deducere personala, allowing them to streamline the signing process and ensure that all necessary forms are completed accurately and submitted on time.

-

How can airSlate SignNow help me with the deducere personala process?

airSlate SignNow provides tools for creating, sending, and signing documents specifically related to deducere personala. This ensures that you can efficiently handle all paperwork, track submissions, and keep everything organized for your tax claims.

-

What are the pricing options for using airSlate SignNow for deducere personala?

airSlate SignNow offers various pricing plans to cater to different business needs, including options specifically suited for handling deducere personala documentation. By choosing a plan that fits your requirements, you can enjoy a cost-effective solution for your personal deduction management.

-

Are there any special features in airSlate SignNow for deducere personala documents?

Yes, airSlate SignNow includes features designed to simplify the deducere personala documentation process, such as customizable templates, automated reminders, and secure storage. These features enhance efficiency and help ensure compliance with tax regulations.

-

Can airSlate SignNow integrate with other software I use for deducere personala?

Absolutely! airSlate SignNow offers a range of integrations with popular accounting and software tools that facilitate managing deducere personala. This allows you to synchronize information seamlessly and maintain a smooth workflow across all applications.

-

Is airSlate SignNow user-friendly for managing deducere personala?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it simple for everyone, regardless of technical expertise, to manage their deducere personala documents. The intuitive interface ensures a smooth experience from document creation to digital signing.

-

What benefits can I expect from using airSlate SignNow for deducere personala?

Using airSlate SignNow for deducere personala can save you time, reduce paperwork, and enhance the security of your documents. Additionally, the platform's automation features help minimize errors, ensuring that your deductions are handled efficiently.

Get more for Model Declaratie Deducere Personala

- Petition for divorceverification family lawdocx david rogers no08d form

- Wwwuslegalformscomform library505292 medicalget medical card and gp visit card application form mc1

- Fugitive from justice waiver of extradition cr 755 form

- Claims ampamp benefitsmichigan plannersgroup insurance brokers form

- Fillable online applicable state and federal laws respecting form

- Igetc form los angeles mission college

- Fillable online revenue ky all kentucky wage earners are form

- Prc fax template form

Find out other Model Declaratie Deducere Personala

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later