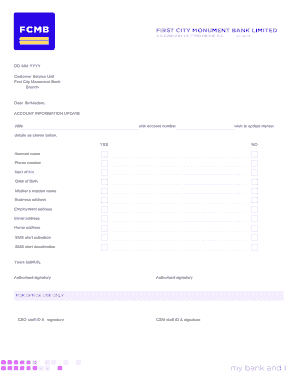

How to Upgrade My Fcmb Account Online Form

What is the flexx youth savings account tier 3 limit?

The flexx youth savings account tier 3 limit refers to the maximum balance that can be maintained in this specific tier of the account. Typically designed for young savers, this account encourages saving by offering competitive interest rates and features tailored to meet the needs of youth. Understanding the tier 3 limit is crucial for account holders to maximize their savings potential while adhering to the bank's policies.

Steps to complete the upgrade for the flexx youth savings account

Upgrading your flexx youth savings account involves a straightforward process. Here are the essential steps:

- Log in to your online banking account.

- Navigate to the account management section.

- Select the option to upgrade your account.

- Review the tier options and select tier 3.

- Submit any required documentation or information.

- Confirm your upgrade request.

Once submitted, you will receive a notification regarding the status of your upgrade. Ensure that all information is accurate to avoid delays.

Eligibility criteria for the flexx youth savings account tier 3

To qualify for the flexx youth savings account tier 3, certain eligibility criteria must be met. Generally, applicants must be within a specific age range, often between thirteen and twenty-five years old. Additionally, the account may require a minimum initial deposit and a commitment to maintain a certain balance. It is important to review the specific requirements set by the financial institution to ensure compliance.

Required documents for upgrading the flexx youth savings account

When upgrading to the flexx youth savings account tier 3, you may need to provide several documents. Commonly required items include:

- A valid government-issued ID, such as a driver's license or passport.

- Proof of address, like a utility bill or lease agreement.

- Social Security number or taxpayer identification number.

- Any additional forms specified by the bank for account upgrades.

Having these documents ready can streamline the upgrade process and ensure a smooth transition to the new account tier.

Legal use of the flexx youth savings account tier 3

The flexx youth savings account tier 3 must be utilized in accordance with applicable laws and regulations. This includes compliance with banking regulations governing youth accounts, such as restrictions on withdrawals and deposits. Understanding these legal requirements is essential for account holders to avoid penalties and ensure the account remains in good standing.

Examples of using the flexx youth savings account tier 3

Account holders can use the flexx youth savings account tier 3 for various financial activities. Examples include:

- Saving for college tuition or educational expenses.

- Setting aside funds for a first car or other major purchases.

- Building an emergency fund for unexpected expenses.

- Participating in savings challenges or programs offered by the bank.

These practical uses highlight the account's flexibility and support for young savers in achieving their financial goals.

Quick guide on how to complete how to upgrade my fcmb account online

Complete How To Upgrade My Fcmb Account Online seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed files, allowing you to locate the right form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage How To Upgrade My Fcmb Account Online on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to adjust and eSign How To Upgrade My Fcmb Account Online effortlessly

- Obtain How To Upgrade My Fcmb Account Online and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click Done to finalize your changes.

- Select your preferred method to send your form, through email, SMS, or invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign How To Upgrade My Fcmb Account Online and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to upgrade my fcmb account online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the flexx youth savings account tier 3 limit?

The flexx youth savings account tier 3 limit refers to the maximum balance young savers can maintain within this tier. This tier is designed to encourage savings among youth while offering competitive interest rates. Understanding the limit helps families plan better for their financial goals.

-

What benefits does the flexx youth savings account tier 3 limit provide?

The flexx youth savings account tier 3 limit provides a higher interest rate compared to lower tiers, incentivizing young savers to signNow their savings goals faster. Additionally, it encourages responsible financial habits at an early age, making it a great educational tool for children and teens.

-

Is there a monthly fee associated with the flexx youth savings account tier 3 limit?

No, the flexx youth savings account tier 3 limit comes with no monthly maintenance fees. This allows young savers to maximize their savings without incurring additional costs, making it a budget-friendly option for families.

-

Can the flexx youth savings account tier 3 limit be linked to other accounts?

Yes, the flexx youth savings account tier 3 limit can be easily linked to a parent or guardian's checking or savings account for seamless fund transfers. This feature greatly enhances accessibility and convenience for managing money between accounts.

-

What is the age requirement for opening a flexx youth savings account tier 3 limit?

To open a flexx youth savings account tier 3 limit, the individual must be between the ages of 13 and 18. This age requirement ensures that the account is tailored specifically for young savers, fostering financial literacy among teenagers.

-

How can I manage the flexx youth savings account tier 3 limit online?

Managing the flexx youth savings account tier 3 limit online is simple and user-friendly. Customers can access their accounts through our secure platform, allowing them to track balances, make deposits, and monitor interest accruals anytime, anywhere.

-

What features are included with the flexx youth savings account tier 3 limit?

The flexx youth savings account tier 3 limit includes features like competitive interest rates, online banking, and no maintenance fees. Additionally, it often comes with financial education resources to help young savers learn about budgeting and saving.

Get more for How To Upgrade My Fcmb Account Online

Find out other How To Upgrade My Fcmb Account Online

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney