Form 15272

What is the Form 15272

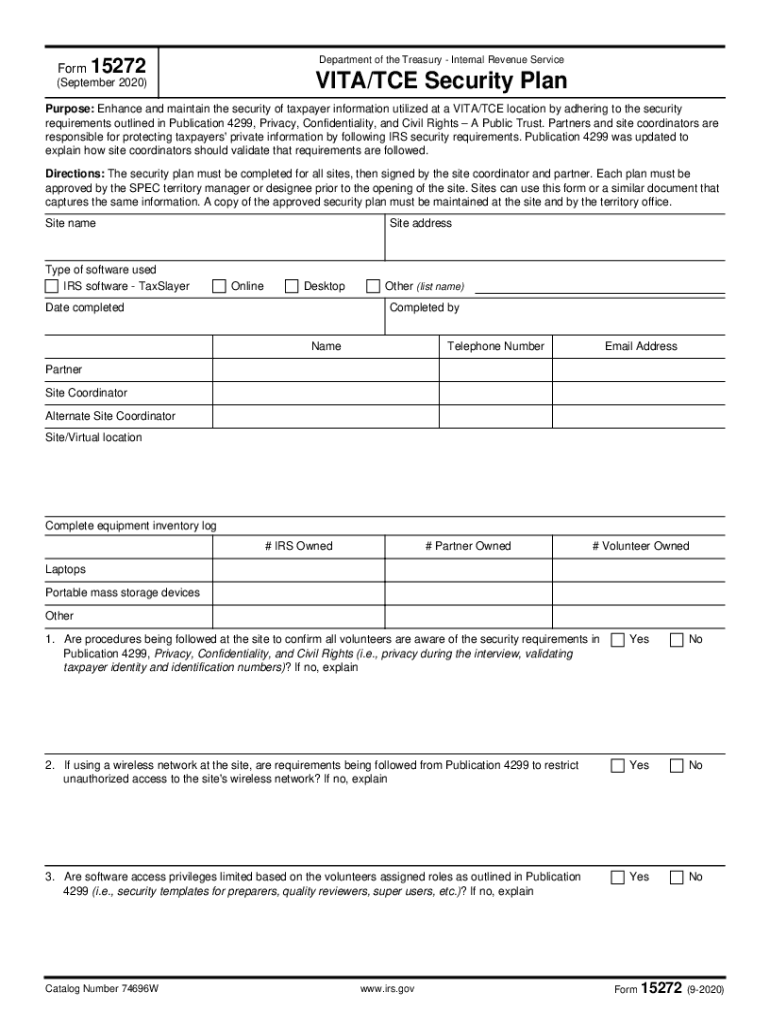

The Form 15272 is a document used for the vita tce security plan, primarily associated with the Internal Revenue Service (IRS). This form is essential for individuals and businesses looking to ensure compliance with specific security protocols while handling sensitive information. It serves as a formal request or declaration regarding the security measures that need to be adhered to when managing taxpayer data. Understanding the purpose and requirements of the Form 15272 is crucial for maintaining legal compliance and protecting personal information.

How to use the Form 15272

Using the Form 15272 involves several steps to ensure that all necessary information is accurately provided. First, gather all relevant data, including personal identification details and any specific security measures that apply to your situation. Next, fill out the form carefully, ensuring that all sections are completed as required. Once the form is filled, it must be reviewed for accuracy before submission. Utilizing digital tools for this process can streamline the experience, making it easier to manage and submit securely.

Steps to complete the Form 15272

Completing the Form 15272 involves a systematic approach:

- Gather necessary documents and information required for the form.

- Carefully read the instructions provided with the form to understand each section.

- Fill in your personal information, ensuring accuracy in details such as name, address, and identification numbers.

- Provide any additional information related to the vita tce security plan as required.

- Review the completed form for any errors or omissions.

- Submit the form via the designated method, ensuring that it is sent securely.

Legal use of the Form 15272

The legal use of the Form 15272 is governed by specific regulations and guidelines set forth by the IRS. To ensure that the form is legally binding, it must be completed accurately and submitted in accordance with the established deadlines. Compliance with eSignature laws is also critical, as electronic signatures must meet certain criteria to be considered valid. Utilizing a reputable digital platform can help ensure that your submission adheres to these legal standards.

Key elements of the Form 15272

Several key elements are essential when working with the Form 15272:

- Identification Information: Accurate personal and business details.

- Security Measures: Specific protocols related to the vita tce security plan.

- Signature: A valid signature is required to authenticate the form.

- Submission Method: Understanding how and where to submit the form is crucial for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 15272 can vary based on specific circumstances and requirements. It is important to stay informed about any relevant dates to ensure timely submission. Missing a deadline may result in penalties or complications with compliance. Regularly checking the IRS guidelines and updates can help you stay on track with important filing dates related to the Form 15272.

Quick guide on how to complete form 15272

Complete Form 15272 seamlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the functionalities you need to create, modify, and eSign your documents rapidly without delays. Handle Form 15272 on any device with airSlate SignNow applications for Android or iOS, enhancing any document-centric process today.

The easiest way to edit and eSign Form 15272 effortlessly

- Find Form 15272 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for such tasks.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or sharing link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 15272 to ensure seamless communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 15272

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 15272 and how do I use it with airSlate SignNow?

Form 15272 is a commonly used document for various business transactions and is easily supported by airSlate SignNow. With our platform, you can upload, customize, and eSign form 15272 quickly, ensuring a seamless workflow for your document management needs.

-

Is airSlate SignNow a cost-effective solution for managing form 15272?

Yes, airSlate SignNow offers a cost-effective solution for managing form 15272. Our pricing plans are designed to suit businesses of all sizes, allowing you to access essential features for document signing without breaking the bank.

-

What features does airSlate SignNow offer for form 15272?

AirSlate SignNow provides several features specifically for form 15272, including customizable templates, secure eSignature options, and document tracking. These features enhance the signing experience, making it efficient and user-friendly.

-

Can I integrate form 15272 with other applications using airSlate SignNow?

Indeed, airSlate SignNow allows seamless integrations with various applications, enhancing your workflow for form 15272. You can connect it with platforms like Google Drive, Salesforce, and others to streamline your document management process.

-

What are the benefits of using airSlate SignNow for form 15272?

Using airSlate SignNow for form 15272 streamlines your document process, reduces processing time, and eliminates paperwork. Additionally, electronic signatures increase security and compliance, making it a reliable choice for businesses.

-

Is there support available for issues related to form 15272 in airSlate SignNow?

Yes, airSlate SignNow offers comprehensive customer support for any issues you may encounter with form 15272. Our support team is available through various channels to ensure you receive assistance quickly and effectively.

-

How secure is my information when handling form 15272 with airSlate SignNow?

Your information is highly secure when using airSlate SignNow for form 15272. We utilize bank-level encryption and adhere to strict security protocols to protect your data throughout the signing process.

Get more for Form 15272

Find out other Form 15272

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed