T5018 Statement Contract Payments Etat Form

What is the T5018 Statement Contract Payments?

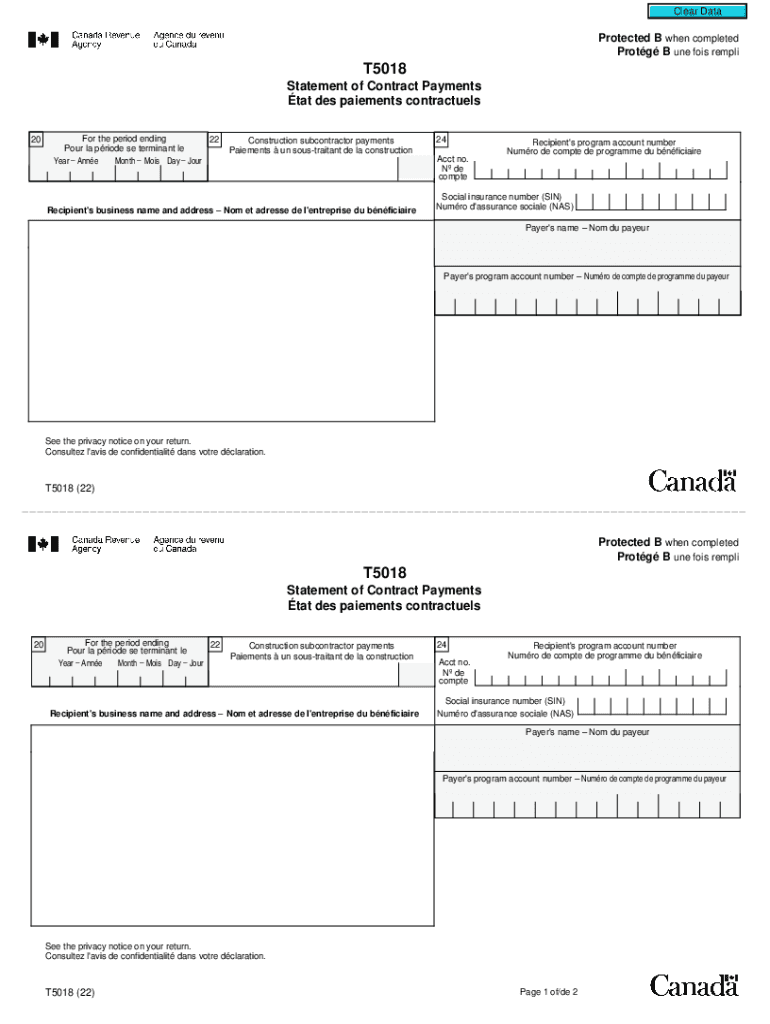

The T5018 Statement Contract Payments is a tax form used in Canada to report payments made to subcontractors in the construction industry. This form is essential for ensuring compliance with tax regulations and provides the Canada Revenue Agency (CRA) with necessary information regarding payments made by businesses. The T5018 helps to track income and allows subcontractors to report their earnings accurately. It is crucial for both payers and payees to understand the implications of this form, as it plays a significant role in tax reporting and compliance.

How to Use the T5018 Statement Contract Payments

Using the T5018 Statement Contract Payments involves several key steps. First, businesses must gather all relevant payment information for subcontractors throughout the tax year. This includes the total amount paid to each subcontractor and their contact details. Next, businesses need to complete the T5018 form accurately, ensuring that all information is correct and complete. Once filled out, the form must be submitted to the CRA by the specified deadline. Additionally, a copy of the T5018 should be provided to each subcontractor for their records, as they will need it for their tax filings.

Steps to Complete the T5018 Statement Contract Payments

Completing the T5018 Statement Contract Payments requires attention to detail. Follow these steps:

- Gather all payment records for subcontractors, including invoices and receipts.

- Fill out the T5018 form with accurate information, including the name, address, and total payments made to each subcontractor.

- Review the form for any errors or omissions to ensure compliance with CRA requirements.

- Submit the completed T5018 form to the CRA by the due date, which is typically at the end of February following the tax year.

- Provide a copy of the T5018 to each subcontractor for their tax records.

Legal Use of the T5018 Statement Contract Payments

The T5018 Statement Contract Payments serves a legal purpose by ensuring that both payers and payees comply with tax laws. It is a legal requirement for businesses in the construction industry to report payments made to subcontractors. Failure to file the T5018 can result in penalties and interest charges from the CRA. This form also helps to establish a clear record of payments, which can be crucial in case of audits or disputes regarding income reporting. Therefore, understanding the legal implications of the T5018 is vital for businesses and subcontractors alike.

Filing Deadlines for the T5018 Statement Contract Payments

Filing deadlines for the T5018 Statement Contract Payments are crucial for compliance. The form must be submitted to the Canada Revenue Agency by the end of February following the tax year in which the payments were made. For example, for payments made in 2022, the T5018 must be filed by February 28, 2023. It is important for businesses to mark this deadline on their calendars to avoid late filing penalties. Additionally, a copy of the T5018 must be provided to each subcontractor by the same deadline, ensuring they have the necessary documentation for their tax filings.

Penalties for Non-Compliance with the T5018 Statement Contract Payments

Non-compliance with the T5018 Statement Contract Payments can lead to significant penalties. If a business fails to file the T5018 on time or provides inaccurate information, the Canada Revenue Agency may impose fines. These penalties can vary based on the severity of the non-compliance, including late filing fees and interest on unpaid taxes. It is essential for businesses to adhere to filing requirements and ensure accuracy to avoid these financial repercussions. Understanding the potential penalties can motivate businesses to prioritize compliance with the T5018 regulations.

Quick guide on how to complete t5018 statement contract payments etat

Effortlessly Manage T5018 Statement Contract Payments Etat on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly and efficiently. Manage T5018 Statement Contract Payments Etat on any device with the airSlate SignNow apps for Android or iOS and streamline your document processes today.

The easiest way to edit and eSign T5018 Statement Contract Payments Etat effortlessly

- Find T5018 Statement Contract Payments Etat and click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign T5018 Statement Contract Payments Etat and ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t5018 statement contract payments etat

Create this form in 5 minutes!

How to create an eSignature for the t5018 statement contract payments etat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA T5018 form and why is it important?

The CA T5018 form is crucial for businesses that deal with subcontractors, as it provides the Canada Revenue Agency (CRA) with essential details about payments made to contractors. Submitting the CA T5018 form ensures compliance with tax obligations and helps avoid potential penalties from the CA T5018 revenue agency.

-

How can airSlate SignNow assist with CA T5018 documentation?

airSlate SignNow simplifies the process of generating and eSigning CA T5018 forms, allowing businesses to efficiently manage their contractor payments and documentation. With our cost-effective solution, you can streamline your interactions and ensure that all submissions meet the requirements of the CA T5018 revenue agency.

-

What pricing plans does airSlate SignNow offer for managing CA T5018 forms?

airSlate SignNow offers various pricing plans that accommodate businesses of all sizes. Each plan provides access to features that can help you manage CA T5018 forms while maintaining compliance with the CA T5018 revenue agency, ensuring you're getting the best value for your needs.

-

Can I integrate airSlate SignNow with other applications for easier CA T5018 management?

Yes, airSlate SignNow offers integrations with popular applications such as CRM systems and accounting software. These integrations streamline your workflow for managing CA T5018 documentation and enhance compliance with the CA T5018 revenue agency.

-

How does eSigning with airSlate SignNow benefit me concerning CA T5018 forms?

eSigning with airSlate SignNow allows for quick and secure signing of CA T5018 forms, eliminating the need for physical paperwork. This digital process is not only efficient but also ensures that your documents meet the standards required by the CA T5018 revenue agency.

-

What features does airSlate SignNow provide to help with CA T5018 submissions?

airSlate SignNow includes features like customizable templates, automated reminders, and secure storage to assist in managing CA T5018 submissions. These tools simplify the filing process and ensure that you remain compliant with the CA T5018 revenue agency's regulations.

-

Is airSlate SignNow secure for handling sensitive CA T5018 information?

Absolutely, airSlate SignNow prioritizes security and implements robust measures to protect sensitive information, including that related to CA T5018 forms. Our compliance with regulations ensures your data is secure when sharing with the CA T5018 revenue agency.

Get more for T5018 Statement Contract Payments Etat

Find out other T5018 Statement Contract Payments Etat

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe