T5018 Fillable 2022-2026

What is the T5018 Fillable?

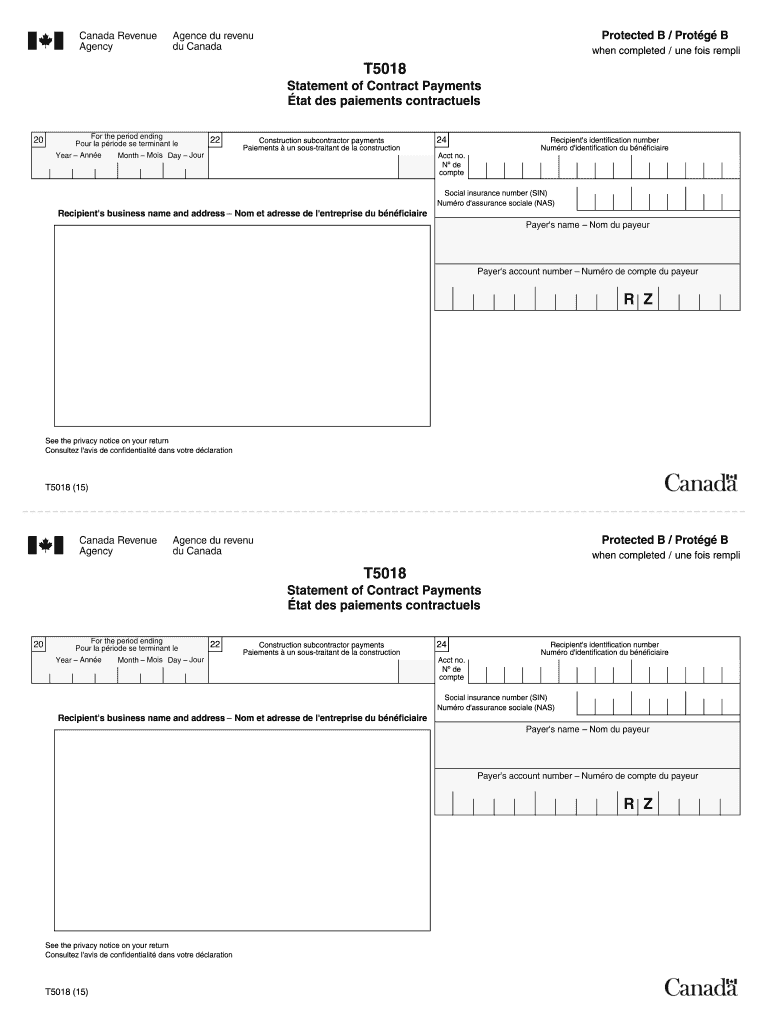

The T5018 form, also known as the Statement of Contract Payments, is a tax document used in Canada. It is primarily issued by businesses to report payments made to subcontractors for construction services. This form is essential for both the payer and the recipient, as it helps ensure accurate reporting of income for tax purposes. The T5018 fillable version allows users to complete the form digitally, making it easier to fill out and submit.

Steps to Complete the T5018 Fillable

Completing the T5018 fillable form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the names, addresses, and tax identification numbers of both the contractor and subcontractor. Next, accurately report the total amount paid to each subcontractor during the tax year. It is crucial to double-check all entries for correctness. Once completed, the form can be saved as a PDF for submission.

Legal Use of the T5018 Fillable

The T5018 fillable form serves a legal purpose by documenting payments made to subcontractors, which helps both parties comply with tax regulations. It is important for businesses to issue this form to avoid potential penalties from tax authorities. The digital version maintains the same legal standing as a paper form, provided it meets the necessary electronic signature requirements.

Filing Deadlines / Important Dates

Filing deadlines for the T5018 form are critical for compliance. Generally, businesses must issue the T5018 to subcontractors by the end of February following the tax year. Additionally, the form must be submitted to the Canada Revenue Agency (CRA) by the end of March. Staying aware of these deadlines helps avoid late filing penalties and ensures that all parties are meeting their tax obligations.

Who Issues the Form?

The T5018 form is typically issued by businesses in the construction industry that make payments to subcontractors. This includes various types of entities, such as sole proprietors, partnerships, and corporations. It is the responsibility of the payer to accurately complete and distribute the T5018 to ensure proper reporting of income for all parties involved.

Examples of Using the T5018 Fillable

Using the T5018 fillable form can vary depending on the nature of the business. For example, a general contractor may use the T5018 to report payments made to various subcontractors for electrical, plumbing, or roofing work. Another example could involve a landscaping company issuing the T5018 to report payments made to subcontractors for specialized services. These examples illustrate the form's versatility in documenting payments across different sectors of the construction industry.

Quick guide on how to complete t5018 fillable

Complete T5018 Fillable effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage T5018 Fillable on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The easiest method to alter and eSign T5018 Fillable without hassle

- Find T5018 Fillable and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign T5018 Fillable and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t5018 fillable

Create this form in 5 minutes!

How to create an eSignature for the t5018 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t5018 form and why is it important?

The t5018 form is a tax document used by businesses in Canada to report payments made to subcontractors. It is crucial for ensuring compliance with tax regulations and accurately reflecting income for tax purposes. Understanding how to fill out and submit the t5018 form can save businesses from potential penalties.

-

How does airSlate SignNow help with the t5018 form?

airSlate SignNow offers a seamless way to create, send, and eSign the t5018 form electronically. With its intuitive platform, users can easily manage their documents, ensuring they are filled out correctly and submitted on time. This efficiency can greatly reduce administrative burdens.

-

Is there a fee associated with submitting the t5018 form through airSlate SignNow?

Using airSlate SignNow includes various pricing plans that cater to different business needs. The cost covers not only the eSigning of documents, including the t5018 form, but also access to a range of features aimed at enhancing document management efficiency. Explore our plans to find the right fit for your business.

-

Can I integrate the t5018 form into other software with airSlate SignNow?

Yes, airSlate SignNow offers integrations with various software, enabling you to streamline your workflow when handling the t5018 form. Whether you're using accounting software or project management tools, these integrations allow for a smoother process. This compatibility enhances overall productivity.

-

What are the benefits of using airSlate SignNow for the t5018 form?

Using airSlate SignNow for the t5018 form offers numerous benefits, such as increased speed and improved accuracy in document processing. The platform also provides a secure environment for storing sensitive information and helps maintain compliance with tax regulations. Its convenience makes it a preferred choice for businesses.

-

How secure is my information when using airSlate SignNow for the t5018 form?

airSlate SignNow prioritizes the security of your information, employing industry-standard encryption to protect data while handling the t5018 form. We also comply with regulations to ensure your documents are secure during the signing process. Your confidence in our platform's safety is paramount.

-

Can I track the status of the t5018 form once sent through SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of the t5018 form after it has been sent. You can easily see when it has been viewed, signed, and completed. This transparency helps ensure that all deadlines are met.

Get more for T5018 Fillable

- Sampark lisbon form

- Chevy blazer repair manual download form

- Nypd affidavit of co habitant form

- Koordinierung der systeme der sozialen sicherheit a1 form

- Request for price quote email sample pdf form

- Wavecrest management application pdf form

- Org library volunteer application form name date address telephone home telephone cell e elpl

- 12000 gallon tank chart 320302651 form

Find out other T5018 Fillable

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online