TC 40CB, Renter Refund Application Forms & Publications

What is the TC 40CB, Renter Refund Application Forms & Publications

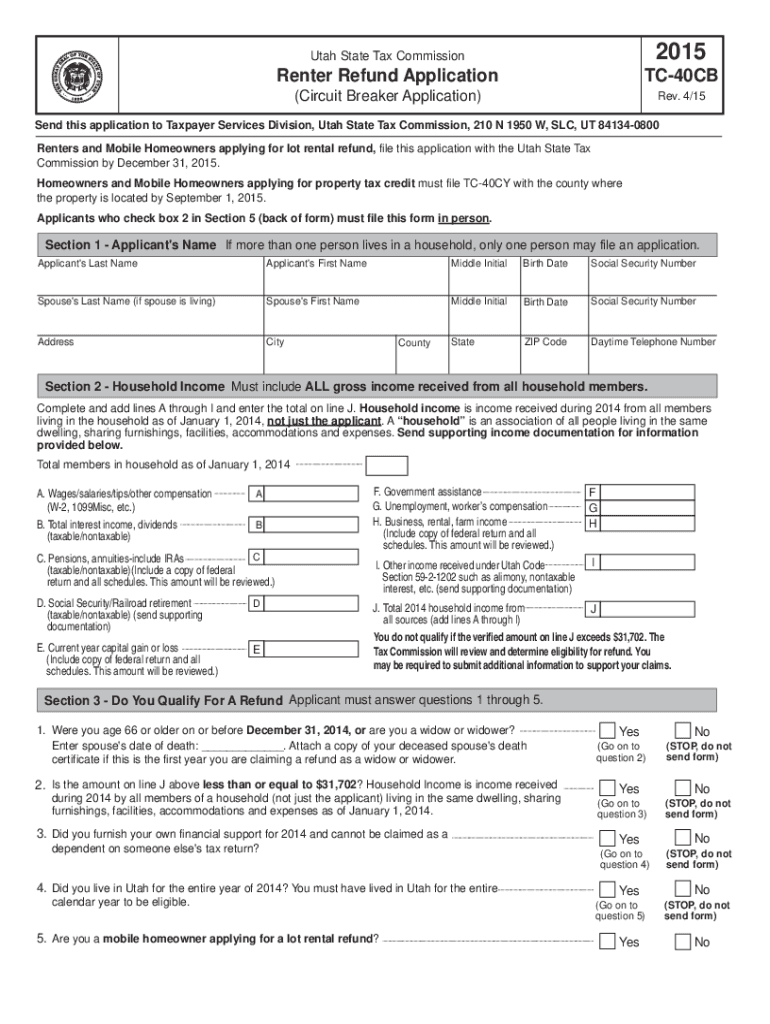

The TC 40CB, Renter Refund Application Forms & Publications is a document used by renters in the United States to apply for a refund based on specific criteria set forth by state regulations. This form is essential for individuals seeking financial relief related to their rental payments, often in connection with state tax credits or rebates. Understanding the purpose and requirements of this form is crucial for ensuring that applicants can successfully navigate the refund process.

How to use the TC 40CB, Renter Refund Application Forms & Publications

Utilizing the TC 40CB involves several straightforward steps. First, gather all necessary information related to your rental history, including lease agreements and payment records. Next, download the form from the appropriate state agency's website or obtain it through authorized channels. Fill out the form accurately, ensuring that all required fields are completed. Once the form is filled, you can submit it according to the submission guidelines provided, which may include options for online submission, mailing, or in-person delivery.

Steps to complete the TC 40CB, Renter Refund Application Forms & Publications

Completing the TC 40CB requires careful attention to detail. Follow these steps for a successful application:

- Review the eligibility criteria to ensure you qualify for a refund.

- Collect all necessary documentation, including proof of residency and rental payments.

- Fill out the TC 40CB form, ensuring all information is accurate and complete.

- Double-check the form for any errors or omissions.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Legal use of the TC 40CB, Renter Refund Application Forms & Publications

The legal use of the TC 40CB is governed by state laws regarding rental refunds and tax credits. It is important to ensure that the application complies with these regulations to avoid potential penalties. The form must be signed and dated appropriately, and any supporting documentation must be included to substantiate the claims made in the application. Adhering to legal requirements not only facilitates a smoother application process but also enhances the likelihood of receiving the refund.

Eligibility Criteria

To qualify for a refund using the TC 40CB, applicants must meet specific eligibility criteria. Generally, these criteria include being a resident of the state, having a valid rental agreement, and demonstrating that rental payments were made during the specified period. Additional requirements may vary by state, so it is essential to consult the guidelines associated with the TC 40CB form to ensure compliance.

Required Documents

When completing the TC 40CB, certain documents are typically required to support your application. These may include:

- A copy of your lease agreement.

- Proof of rental payments, such as bank statements or receipts.

- Identification documents to verify residency and identity.

Having these documents ready can streamline the application process and help avoid delays.

Quick guide on how to complete tc 40cb renter refund application forms ampamp publications

Complete TC 40CB, Renter Refund Application Forms & Publications effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle TC 40CB, Renter Refund Application Forms & Publications on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign TC 40CB, Renter Refund Application Forms & Publications with ease

- Find TC 40CB, Renter Refund Application Forms & Publications and click Get Form to begin.

- Utilize the resources we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and holds the same legal standing as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign TC 40CB, Renter Refund Application Forms & Publications and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 40cb renter refund application forms ampamp publications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are TC 40CB, Renter Refund Application Forms & Publications?

The TC 40CB, Renter Refund Application Forms & Publications are essential documents designed to help renters in filing for refunds on their rental expenses. These forms provide necessary guidance and detailed instructions to ensure that your application is completed correctly for maximum benefits. To access the forms, simply visit the appropriate government website or utilize our platform for easy retrieval.

-

How can I fill out the TC 40CB, Renter Refund Application Forms & Publications?

Filling out the TC 40CB, Renter Refund Application Forms & Publications can be straightforward using digital tools like airSlate SignNow. Our platform allows you to input your information seamlessly, ensuring that all required fields are completed accurately. Additionally, you can eSign and submit your forms directly through our service, saving you time and hassle.

-

Is there a cost associated with the TC 40CB, Renter Refund Application Forms & Publications?

Accessing the TC 40CB, Renter Refund Application Forms & Publications is typically free; however, utilizing airSlate SignNow for document signing may incur a nominal fee. Our service offers various pricing plans to suit different needs, ensuring that you have a cost-effective solution for managing your eSigning and document workflow. Always check for the latest pricing and offers on our website.

-

What are the benefits of using airSlate SignNow for TC 40CB, Renter Refund Application Forms & Publications?

Using airSlate SignNow for TC 40CB, Renter Refund Application Forms & Publications provides numerous benefits, such as ease of eSigning and document management. Our platform streamlines the application process, reduces errors, and helps you track submissions effectively. This can lead to faster processing times and a better experience when applying for your refunds.

-

What features does airSlate SignNow offer for managing the TC 40CB application?

airSlate SignNow offers features specifically designed to enhance your experience with the TC 40CB, Renter Refund Application Forms & Publications. You can create templates, request signatures, and track document status in real-time. These features simplify the process and ensure that you stay organized throughout the application process.

-

Can I integrate airSlate SignNow with other tools for TC 40CB processing?

Yes, airSlate SignNow easily integrates with various productivity tools and applications to facilitate the processing of TC 40CB, Renter Refund Application Forms & Publications. Whether you use CRMs, cloud storage solutions, or other software, our platform is designed for seamless integration, enhancing your workflow and efficiency. Check our integration options to find the tools that work best for you.

-

How secure is airSlate SignNow when handling TC 40CB documents?

Security is a top priority at airSlate SignNow, especially when it comes to handling sensitive TC 40CB, Renter Refund Application Forms & Publications. Our platform employs advanced encryption and compliance measures to protect your documents and personal information. You can trust that your data is safe while using our efficient eSigning services.

Get more for TC 40CB, Renter Refund Application Forms & Publications

Find out other TC 40CB, Renter Refund Application Forms & Publications

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation