Bank of Baroda Mortgage Loan Application Form PDF

What is the Bank Of Baroda Mortgage Loan Application Form Pdf

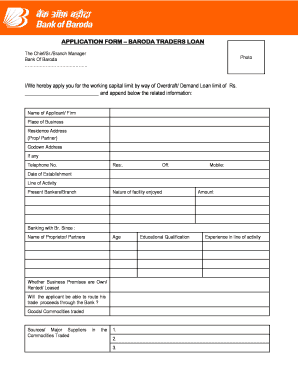

The Bank of Baroda Mortgage Loan Application Form PDF is a crucial document required for individuals seeking to apply for a mortgage loan from the Bank of Baroda. This form collects essential information about the applicant, including personal details, financial status, and property information. It is designed to facilitate the loan approval process by providing the bank with a comprehensive view of the applicant's financial health and the property being financed. Completing this form accurately is vital for a smooth application process.

Steps to Complete the Bank Of Baroda Mortgage Loan Application Form Pdf

Filling out the Bank of Baroda Mortgage Loan Application Form PDF involves several important steps:

- Gather Required Information: Collect all necessary documents, including proof of identity, income statements, and property documents.

- Fill in Personal Details: Provide accurate personal information such as name, address, and contact details.

- Financial Information: Include details about your income, existing loans, and liabilities to give a clear picture of your financial situation.

- Property Details: Describe the property you intend to purchase or refinance, including its location, type, and value.

- Review and Sign: Carefully review the completed form for accuracy and sign where required to confirm the information is correct.

How to Obtain the Bank Of Baroda Mortgage Loan Application Form Pdf

The Bank of Baroda Mortgage Loan Application Form PDF can be obtained through several avenues:

- Official Website: Visit the Bank of Baroda's official website to download the form directly from their mortgage loan section.

- Bank Branch: Visit a local Bank of Baroda branch to request a physical copy of the application form from a bank representative.

- Customer Service: Contact the bank's customer service for assistance in obtaining the form via email or postal service.

Key Elements of the Bank Of Baroda Mortgage Loan Application Form Pdf

The Bank of Baroda Mortgage Loan Application Form PDF includes several key elements that applicants must complete:

- Applicant Information: Name, address, contact details, and identification numbers.

- Employment Details: Current employer information, job title, and duration of employment.

- Financial Information: Monthly income, other sources of income, and monthly expenses.

- Property Information: Details about the property being financed, including its address, type, and estimated value.

- Loan Amount Requested: Specify the amount of loan you wish to apply for.

Legal Use of the Bank Of Baroda Mortgage Loan Application Form Pdf

The Bank of Baroda Mortgage Loan Application Form PDF is legally binding once completed and signed. It serves as a formal request for a mortgage loan and must comply with relevant legal standards. The form includes declarations that the information provided is true and accurate, which is crucial for the bank's assessment process. Ensuring compliance with legal requirements helps protect both the applicant and the bank during the loan approval process.

Form Submission Methods

Applicants can submit the Bank of Baroda Mortgage Loan Application Form PDF through various methods:

- Online Submission: Some applicants may have the option to submit the form electronically through the bank's online portal.

- In-Person Submission: Bring the completed form to a local Bank of Baroda branch for submission to a bank officer.

- Mail Submission: Send the completed form via postal service to the designated address provided by the bank.

Quick guide on how to complete bank of baroda mortgage loan application form pdf

Effortlessly Complete Bank Of Baroda Mortgage Loan Application Form Pdf on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Manage Bank Of Baroda Mortgage Loan Application Form Pdf on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based process today.

The Easiest Way to Edit and Electronically Sign Bank Of Baroda Mortgage Loan Application Form Pdf with Ease

- Obtain Bank Of Baroda Mortgage Loan Application Form Pdf and click Get Form to begin.

- Use the tools we offer to fill in your form.

- Highlight key sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or through an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Bank Of Baroda Mortgage Loan Application Form Pdf to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank of baroda mortgage loan application form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bank of baroda loan form and how can I obtain it?

The bank of baroda loan form is an essential document required to apply for a loan from Bank of Baroda. You can typically obtain the form from the official Bank of Baroda website or at any branch. It's also recommended to check for any online options that may streamline the process.

-

What types of loans can I apply for using the bank of baroda loan form?

Using the bank of baroda loan form, you can apply for a variety of loans, including personal loans, home loans, and vehicle loans. Each loan category may have specific requirements, so it’s advisable to consult the official Bank of Baroda website for detailed information before submitting your application.

-

Are there any fees associated with the bank of baroda loan form?

While the bank of baroda loan form itself is typically free to obtain, there may be processing fees and other applicable charges associated with the loan application. Always review the terms and conditions to ensure you are aware of any potential costs prior to submitting the form.

-

What features does the airSlate SignNow integration offer for signing the bank of baroda loan form?

The airSlate SignNow integration allows you to electronically sign the bank of baroda loan form quickly and securely. This service enhances convenience and efficiency, enabling you to complete your loan application without the need for physical paperwork.

-

How does airSlate SignNow benefit users filling out the bank of baroda loan form?

Using airSlate SignNow to complete the bank of baroda loan form enhances user experience through its user-friendly interface. It streamlines the signing process and provides you with the ability to track your document's status, ensuring that you are always updated on your loan application progress.

-

Can I save my progress on the bank of baroda loan form using airSlate SignNow?

Yes, airSlate SignNow allows you to save your progress while filling out the bank of baroda loan form. You can return to your application at a later time, ensuring that you can provide all necessary details without feeling rushed.

-

Is the bank of baroda loan form available in multiple languages?

The bank of baroda loan form is often available in multiple languages to cater to diverse customer needs. Be sure to check the official Bank of Baroda website to see if the form is accessible in your preferred language.

Get more for Bank Of Baroda Mortgage Loan Application Form Pdf

Find out other Bank Of Baroda Mortgage Loan Application Form Pdf

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now