Deceased Taxpayer Refund Check Claim Form 2018-2026

What is the Deceased Taxpayer Refund Check Claim Form

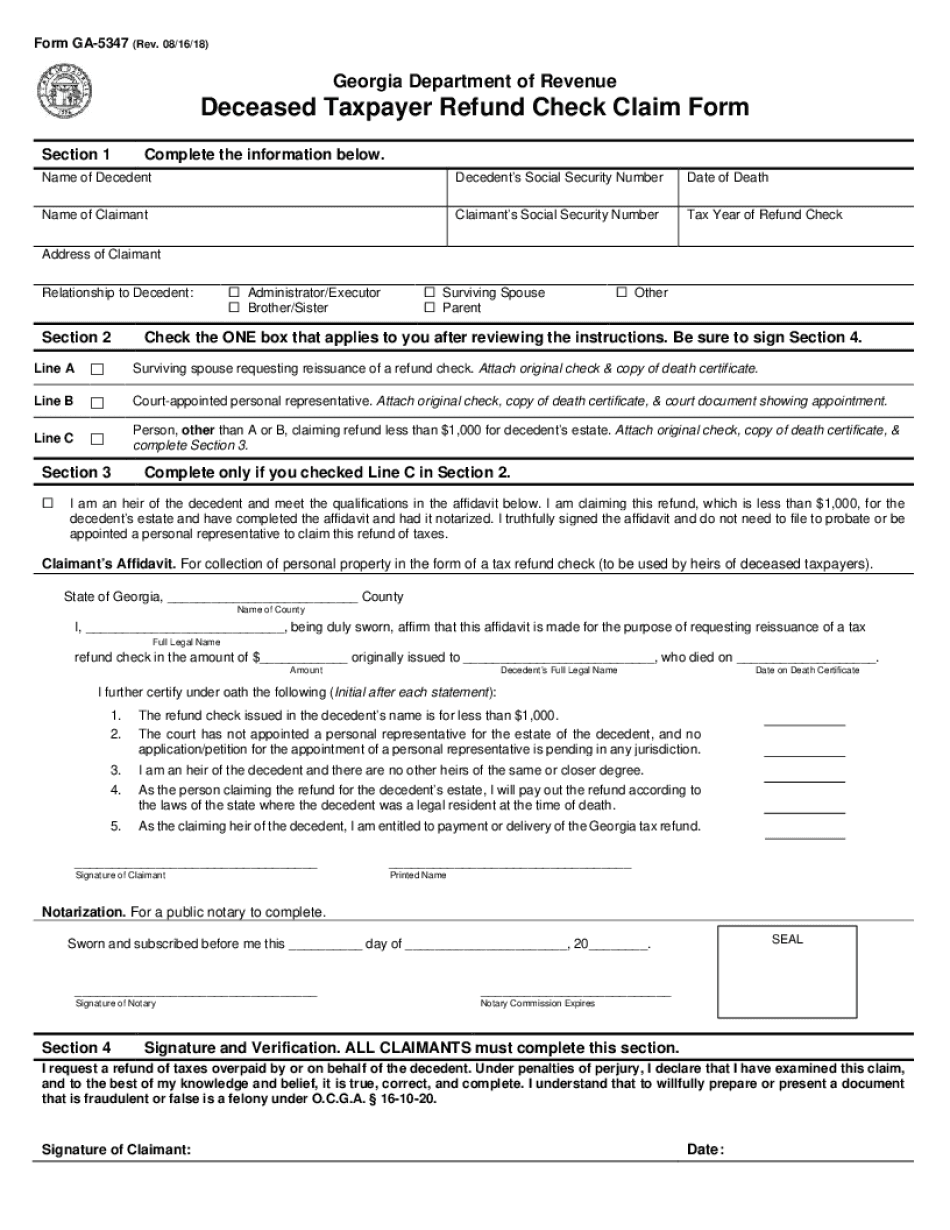

The Deceased Taxpayer Refund Check Claim Form, commonly referred to as the GA 5347, is a crucial document for individuals seeking to claim a tax refund on behalf of a deceased taxpayer. This form is specifically designed to facilitate the process of recovering any outstanding refunds that the deceased may have been entitled to. It is essential for heirs or legal representatives to understand the significance of this form in ensuring that the deceased's financial matters are settled appropriately.

How to use the Deceased Taxpayer Refund Check Claim Form

Using the GA 5347 form involves several key steps to ensure that the claim is processed efficiently. First, the claimant must complete the form with accurate details regarding the deceased taxpayer, including their name, Social Security number, and the tax year for which the refund is being claimed. It is important to provide any required documentation that supports the claim, such as a copy of the death certificate and proof of the claimant’s relationship to the deceased. Once completed, the form can be submitted to the appropriate tax authority for processing.

Steps to complete the Deceased Taxpayer Refund Check Claim Form

Completing the GA 5347 form requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including the death certificate and any relevant tax returns.

- Fill out the form with accurate information about the deceased, including their full name and Social Security number.

- Provide information regarding the refund being claimed, specifying the tax year.

- Include your information as the claimant, ensuring that you indicate your relationship to the deceased.

- Review the form for accuracy and completeness before submission.

Required Documents

When submitting the GA 5347 form, certain documents are essential to support the claim. These typically include:

- A copy of the deceased taxpayer's death certificate.

- Proof of the claimant's relationship to the deceased, such as a marriage certificate or birth certificate.

- Any previous tax returns filed by the deceased, if available.

Form Submission Methods

The GA 5347 form can be submitted through various methods, depending on the requirements of the relevant tax authority. Common submission methods include:

- Online submission through the tax authority's official website.

- Mailing the completed form and supporting documents to the designated address.

- In-person submission at local tax office locations, if applicable.

IRS Guidelines

It is important for claimants to adhere to IRS guidelines when using the GA 5347 form. The IRS provides specific instructions on how to complete the form, what documents are necessary, and the timeline for processing claims. Familiarizing oneself with these guidelines can help ensure that the claim is valid and processed without unnecessary delays.

Quick guide on how to complete deceased taxpayer refund check claim form

Complete Deceased Taxpayer Refund Check Claim Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Deceased Taxpayer Refund Check Claim Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign Deceased Taxpayer Refund Check Claim Form with ease

- Find Deceased Taxpayer Refund Check Claim Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with specialized tools that airSlate SignNow provides for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional pen-and-ink signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it directly to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Deceased Taxpayer Refund Check Claim Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct deceased taxpayer refund check claim form

Create this form in 5 minutes!

How to create an eSignature for the deceased taxpayer refund check claim form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is GA 5347 in relation to airSlate SignNow?

GA 5347 is a specific feature or designation utilized within airSlate SignNow to enhance document signing and workflow processes. This functionality allows users to manage signatures and documents efficiently, ensuring compliance and document security.

-

How does airSlate SignNow pricing work for GA 5347 users?

airSlate SignNow offers flexible pricing options tailored to suit the needs of GA 5347 users. This pricing structure enables businesses to select the plan that best fits their volume of document signings while enjoying the comprehensive features associated with GA 5347.

-

What are the key features of airSlate SignNow related to GA 5347?

GA 5347 encompasses various features including customizable templates, team collaboration tools, and secure electronic signatures. These features streamline the document signing process and empower users to handle multiple workflows efficiently.

-

What are the benefits of using airSlate SignNow for GA 5347?

Using airSlate SignNow under GA 5347 allows businesses to reduce operational costs and improve transaction speed. The platform's user-friendly interface also ensures that even those with minimal tech skills can efficiently manage document workflows.

-

Can airSlate SignNow integrate with other applications for GA 5347?

Yes, airSlate SignNow can seamlessly integrate with many popular applications, enhancing the GA 5347 user experience. This interoperability helps businesses to synchronize data between systems and streamline their overall workflow.

-

Is airSlate SignNow secure for transactions related to GA 5347?

Absolutely! airSlate SignNow prioritizes security for all transactions, including those involving GA 5347. The platform employs industry-standard encryption and compliance measures to ensure that all documents are safely processed.

-

How does GA 5347 improve document workflow management?

GA 5347 enhances document workflow management by providing automated processes and real-time tracking of document statuses. This results in increased efficiency, reduced errors, and expedited document completion times.

Get more for Deceased Taxpayer Refund Check Claim Form

Find out other Deceased Taxpayer Refund Check Claim Form

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer