PA Corporate Net Income Tax Report RCT 101 Form

What is the PA Corporate Net Income Tax Report RCT 101

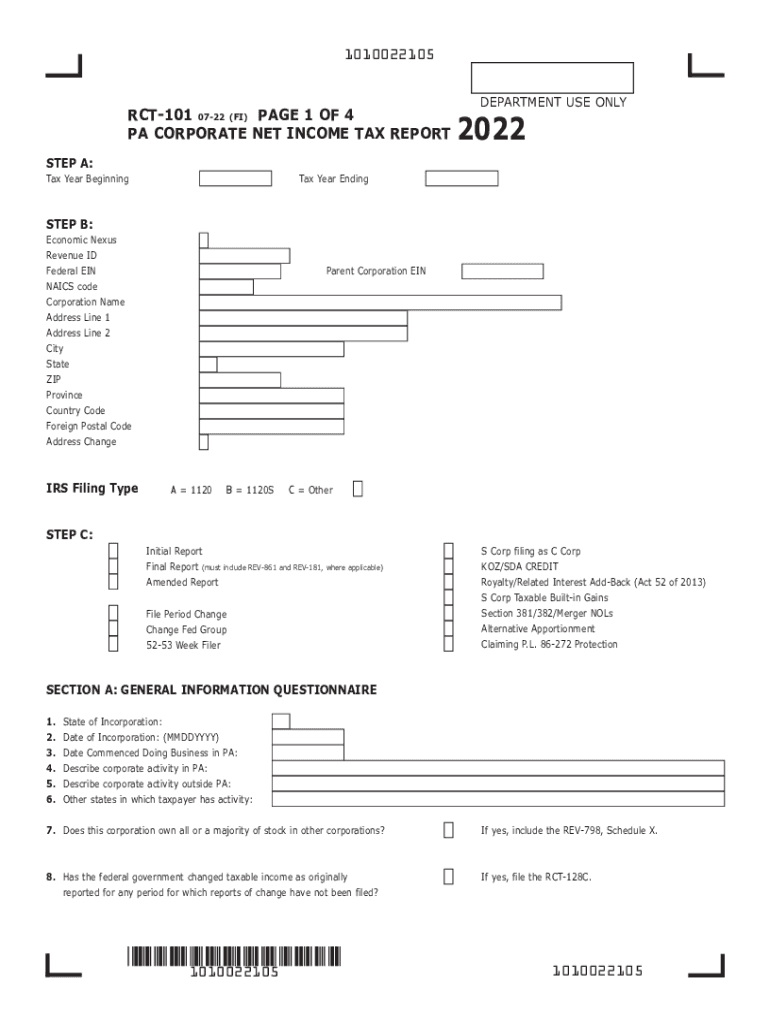

The PA Corporate Net Income Tax Report RCT 101 is a crucial document for corporations operating in Pennsylvania. This form is used to report the income, deductions, and tax liability of corporations subject to Pennsylvania's corporate net income tax. It ensures compliance with state tax regulations and provides the Pennsylvania Department of Revenue with essential information regarding a corporation's financial activities within the state.

Steps to complete the PA Corporate Net Income Tax Report RCT 101

Completing the 2022 PA RCT 101 involves several important steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Calculate total income and allowable deductions as per Pennsylvania tax laws.

- Fill out the RCT 101 form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline, either electronically or by mail.

Key elements of the PA Corporate Net Income Tax Report RCT 101

Understanding the key elements of the RCT 101 is essential for accurate reporting. The form typically includes:

- Identification information for the corporation, such as name, address, and federal employer identification number (EIN).

- Income calculations, including gross receipts and net income.

- Details of deductions and credits applicable to the corporation.

- Tax computation based on the net income reported.

- Signature and date section for authorized representatives.

Legal use of the PA Corporate Net Income Tax Report RCT 101

The RCT 101 serves as a legally binding document that corporations must submit to comply with Pennsylvania tax laws. Proper completion and timely submission of this form are essential to avoid penalties and ensure that the corporation meets its tax obligations. The information provided in the RCT 101 can also be subject to audit by the Pennsylvania Department of Revenue, highlighting the importance of accuracy and honesty in reporting.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the RCT 101. The typical due date for the 2022 form is the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by April 15, 2023. It is crucial to stay informed about any changes to filing deadlines or extensions that may be applicable.

Form Submission Methods (Online / Mail / In-Person)

The RCT 101 can be submitted using various methods to accommodate different preferences:

- Online submission through the Pennsylvania Department of Revenue's e-filing system, which is often the fastest method.

- Mailing a paper copy of the completed form to the appropriate address provided by the Department of Revenue.

- In-person submission at designated Pennsylvania Department of Revenue offices, though this method may require an appointment.

Quick guide on how to complete 2022 pa corporate net income tax report rct 101

Prepare PA Corporate Net Income Tax Report RCT 101 effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow provides all the tools needed to generate, amend, and eSign your documents swiftly without delays. Manage PA Corporate Net Income Tax Report RCT 101 on any device using airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to modify and eSign PA Corporate Net Income Tax Report RCT 101 with ease

- Obtain PA Corporate Net Income Tax Report RCT 101 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign PA Corporate Net Income Tax Report RCT 101 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2022 pa corporate net income tax report rct 101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 PA RCT 101 and how does it relate to airSlate SignNow?

The 2022 PA RCT 101 is a tax form used by Pennsylvania businesses to report their corporate net income and capital stock or franchise tax. airSlate SignNow provides a streamlined solution to easily eSign and send this document, ensuring compliance with state requirements while saving valuable time.

-

How can airSlate SignNow help me with the 2022 PA RCT 101?

With airSlate SignNow, you can electronically sign and share your 2022 PA RCT 101 quickly and securely. The platform allows you to track the document status, ensuring that you meet filing deadlines without hassles, making tax season less stressful.

-

Is airSlate SignNow cost-effective for handling the 2022 PA RCT 101?

Yes, airSlate SignNow offers competitive pricing plans that make it an affordable option for businesses of all sizes. By choosing our services for managing your 2022 PA RCT 101, you can save on costs compared to traditional signing methods, enhancing your budget efficiency.

-

What features of airSlate SignNow are beneficial for signing the 2022 PA RCT 101?

Key features of airSlate SignNow include customizable templates, secure cloud storage, and real-time tracking. These functionalities make it easy to prepare, sign, and store the 2022 PA RCT 101, ensuring you have everything organized and accessible when needed.

-

Can I integrate airSlate SignNow with other tools for the 2022 PA RCT 101?

Absolutely, airSlate SignNow seamlessly integrates with various applications, facilitating a smooth workflow for your 2022 PA RCT 101. Whether you're using accounting software or project management tools, our integrations enhance productivity and help manage your documents efficiently.

-

What are the benefits of using airSlate SignNow for the 2022 PA RCT 101?

Using airSlate SignNow for the 2022 PA RCT 101 provides multiple benefits, including increased speed in document handling and improved accuracy through electronic signing. Additionally, it offers enhanced security to protect sensitive information and reduces paper waste, contributing to a greener environment.

-

Is there customer support available for assistance with the 2022 PA RCT 101?

Yes, airSlate SignNow offers comprehensive customer support to help you with any queries related to the 2022 PA RCT 101. Our dedicated team is available through multiple channels, ensuring you receive the assistance you need promptly for a seamless experience.

Get more for PA Corporate Net Income Tax Report RCT 101

- Gas cylinder inventory in excel form

- Us passport application blank form

- Ratio and proportion word problems worksheet with answers form

- Nck1 form

- Seasonal lawn care contract form

- Georgia death certificate pdf form

- Docslib orgdoc9174077state of south dakota in the circuit court ss county of form

- Marketing statement of work template form

Find out other PA Corporate Net Income Tax Report RCT 101

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter