Form FTB 3582Payment Voucher for Individual E Filed Returns Form FTB 3582Payment Voucher for Individual E Filed Returns

Purpose of the California Form FTB 3582

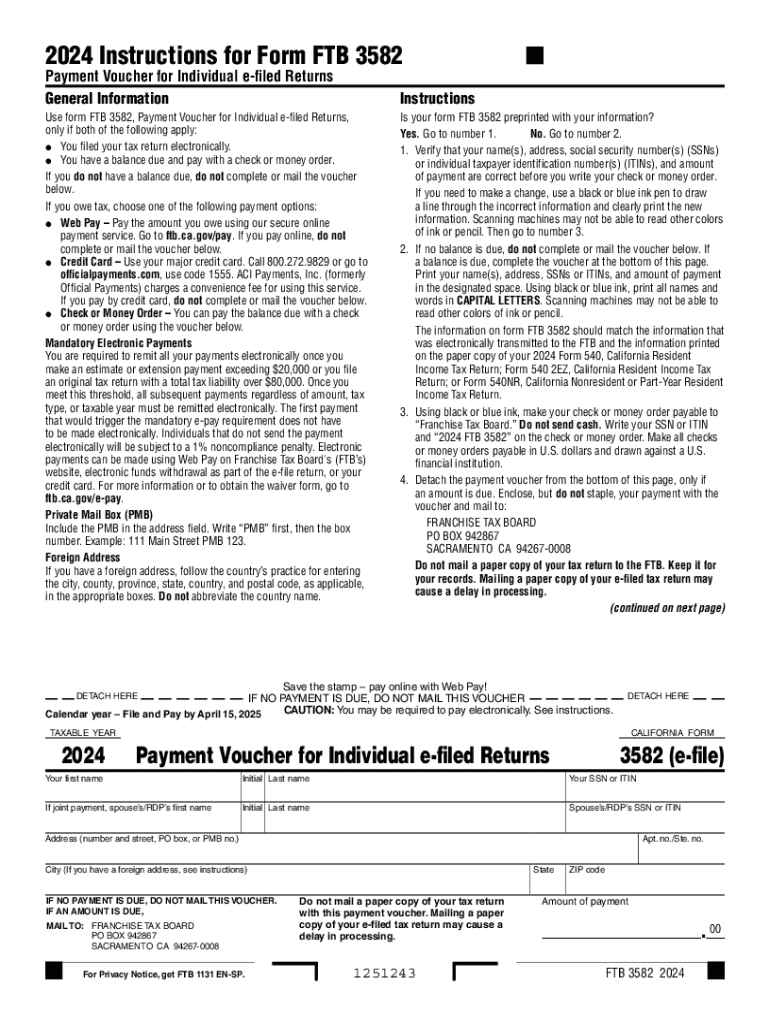

The California Form FTB 3582 serves as a payment voucher for individuals who are filing their tax returns electronically. This form is essential for ensuring that any tax payments owed to the California Franchise Tax Board (FTB) are processed correctly and on time. By using Form 3582, taxpayers can provide a clear record of their payment, which helps avoid any potential miscommunication with the FTB regarding their tax obligations.

How to Obtain the California Form FTB 3582

To obtain the California Form FTB 3582, individuals can visit the official website of the California Franchise Tax Board. The form is available for download in a PDF format, making it easy to access and print. Additionally, taxpayers can request a physical copy by contacting the FTB directly if they prefer not to download the form online.

Steps to Complete the California Form FTB 3582

Completing the California Form FTB 3582 involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Specify the tax year for which you are making the payment.

- Indicate the amount you are paying, ensuring it matches your tax return calculations.

- Provide any additional information requested on the form, such as your bank account details if you are opting for electronic payments.

- Review the completed form for accuracy before submitting it.

Key Elements of the California Form FTB 3582

The California Form FTB 3582 includes several key elements that are crucial for proper completion:

- Taxpayer Information: This section requires your name, address, and Social Security number.

- Payment Amount: Clearly state the total amount you are remitting.

- Tax Year: Indicate the specific tax year for which the payment is applicable.

- Signature: A signature is necessary to validate the form and confirm the payment.

Legal Use of the California Form FTB 3582

The California Form FTB 3582 is legally recognized as a valid method for making tax payments to the Franchise Tax Board. It ensures that payments are tracked and credited correctly against the taxpayer's account. Proper use of this form is essential for compliance with California tax laws, as failure to submit the form accurately may lead to penalties or interest on unpaid taxes.

Filing Deadlines for the California Form FTB 3582

It is vital for taxpayers to be aware of the filing deadlines associated with the California Form FTB 3582. Typically, the payment voucher should be submitted along with the electronic tax return or by the tax payment deadline. For most individuals, this is usually April 15 of the following year. However, taxpayers should check the FTB website for any updates or changes to these deadlines.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ftb 3582payment voucher for individual e filed returns form ftb 3582payment voucher for individual e filed returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the california form ftb 3582?

The california form ftb 3582 is a tax form used by California taxpayers to report certain tax credits and adjustments. It is essential for ensuring compliance with state tax regulations. Understanding this form can help you maximize your tax benefits.

-

How can airSlate SignNow help with the california form ftb 3582?

airSlate SignNow simplifies the process of completing and eSigning the california form ftb 3582. Our platform allows you to easily fill out the form, ensuring all necessary information is included. This streamlines your tax filing process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the california form ftb 3582?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage documents like the california form ftb 3582 without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the california form ftb 3582?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to manage the california form ftb 3582 efficiently. You can also track document status and receive notifications when your form is signed.

-

Can I integrate airSlate SignNow with other software for the california form ftb 3582?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for the california form ftb 3582. Whether you use CRM systems or accounting software, our integrations help streamline your document management process.

-

What are the benefits of using airSlate SignNow for the california form ftb 3582?

Using airSlate SignNow for the california form ftb 3582 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely while allowing for quick and easy access. This ultimately saves you time and effort during tax season.

-

Is airSlate SignNow user-friendly for completing the california form ftb 3582?

Yes, airSlate SignNow is designed with user-friendliness in mind. Our intuitive interface makes it easy for anyone to complete the california form ftb 3582 without prior experience. You can navigate through the process smoothly, ensuring a hassle-free experience.

Get more for Form FTB 3582Payment Voucher For Individual E filed Returns Form FTB 3582Payment Voucher For Individual E filed Returns

Find out other Form FTB 3582Payment Voucher For Individual E filed Returns Form FTB 3582Payment Voucher For Individual E filed Returns

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF