PIT PV New Mexico Personal Income Tax TaxFormFinder Org

Understanding the PIT PV New Mexico Personal Income Tax

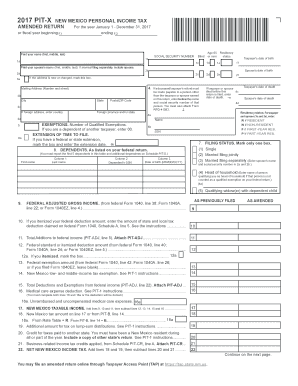

The PIT PV, or Personal Income Tax for New Mexico, is a tax form used by residents to report their income and calculate their tax liability. This form is essential for individuals who earn income in New Mexico, as it ensures compliance with state tax regulations. The PIT PV is specifically designed to capture various income sources, including wages, self-employment income, and investment earnings. Understanding this form is crucial for accurate tax filing and avoiding potential penalties.

Steps to Complete the PIT PV New Mexico Personal Income Tax

Completing the PIT PV involves several steps to ensure accurate reporting. Start by gathering all necessary documentation, such as W-2 forms, 1099s, and records of any other income sources. Next, follow these steps:

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring you include any taxable income.

- Calculate your deductions and credits, which can help reduce your taxable income.

- Determine your tax liability based on the income reported and applicable tax rates.

- Review your completed form for accuracy before submission.

Legal Use of the PIT PV New Mexico Personal Income Tax

The PIT PV is legally recognized as a valid document for reporting income and calculating tax obligations in New Mexico. To ensure its legal standing, it must be completed accurately and submitted within the designated filing deadlines. The form is compliant with state tax laws and regulations, making it a crucial element in fulfilling your tax responsibilities. Proper use of the PIT PV can help prevent issues with tax authorities and ensure that taxpayers meet their legal obligations.

Filing Deadlines and Important Dates

Timely filing of the PIT PV is essential to avoid penalties and interest. The standard filing deadline for the PIT PV is typically April 15 of each year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes in deadlines, especially during tax season, to ensure compliance and avoid late fees.

Required Documents for the PIT PV New Mexico Personal Income Tax

To complete the PIT PV accurately, several documents are required. These include:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

Having these documents ready will streamline the filing process and help ensure accurate reporting.

Who Issues the PIT PV New Mexico Personal Income Tax

The PIT PV is issued by the New Mexico Taxation and Revenue Department. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. They provide resources and guidance for individuals completing the PIT PV, including instructions and support for any questions that may arise during the filing process. Understanding the role of this agency can help taxpayers navigate their obligations more effectively.

Quick guide on how to complete pit pv new mexico personal income tax taxformfinderorg

Complete PIT PV New Mexico Personal Income Tax TaxFormFinder org seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without interruptions. Handle PIT PV New Mexico Personal Income Tax TaxFormFinder org on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign PIT PV New Mexico Personal Income Tax TaxFormFinder org effortlessly

- Find PIT PV New Mexico Personal Income Tax TaxFormFinder org and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your edits.

- Choose how you wish to submit your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Adapt and eSign PIT PV New Mexico Personal Income Tax TaxFormFinder org to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pit pv new mexico personal income tax taxformfinderorg

How to create an electronic signature for the Pit Pv New Mexico Personal Income Tax Taxformfinderorg in the online mode

How to generate an electronic signature for your Pit Pv New Mexico Personal Income Tax Taxformfinderorg in Chrome

How to generate an eSignature for signing the Pit Pv New Mexico Personal Income Tax Taxformfinderorg in Gmail

How to generate an electronic signature for the Pit Pv New Mexico Personal Income Tax Taxformfinderorg from your smart phone

How to create an electronic signature for the Pit Pv New Mexico Personal Income Tax Taxformfinderorg on iOS

How to make an electronic signature for the Pit Pv New Mexico Personal Income Tax Taxformfinderorg on Android

People also ask

-

What is the PIT PV New Mexico Personal Income Tax TaxFormFinder org and how can it help me?

The PIT PV New Mexico Personal Income Tax TaxFormFinder org provides a centralized platform for accessing and filing your state income tax forms. By using this resource, you can ensure that you are compliant with New Mexico's tax regulations while streamlining the document submission process.

-

How can airSlate SignNow assist with the PIT PV New Mexico Personal Income Tax TaxFormFinder org forms?

airSlate SignNow offers a simple and efficient way to eSign and send your PIT PV New Mexico Personal Income Tax TaxFormFinder org documents. With our user-friendly interface, you can quickly upload your forms, add electronic signatures, and share them securely with tax authorities or advisors.

-

Are there any costs associated with using the PIT PV New Mexico Personal Income Tax TaxFormFinder org?

While the PIT PV New Mexico Personal Income Tax TaxFormFinder org may provide free access to the forms, using airSlate SignNow to manage your documentation may involve a subscription fee. However, our service is designed to be cost-effective, saving you time and resources in the long run.

-

What features does airSlate SignNow offer for PIT PV New Mexico Personal Income Tax TaxFormFinder org users?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, specifically designed to enhance your experience with PIT PV New Mexico Personal Income Tax TaxFormFinder org forms. These tools help you manage your tax documents effectively and ensure they are completed accurately.

-

Can I integrate airSlate SignNow with other software for the PIT PV New Mexico Personal Income Tax TaxFormFinder org?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your workflow for PIT PV New Mexico Personal Income Tax TaxFormFinder org documentation. Whether you use CRM systems, accounting tools, or cloud storage services, our integrations allow for a streamlined process.

-

What are the benefits of using airSlate SignNow for PIT PV New Mexico Personal Income Tax TaxFormFinder org?

Using airSlate SignNow for your PIT PV New Mexico Personal Income Tax TaxFormFinder org documents offers numerous benefits, including increased efficiency, enhanced security, and reduced paperwork. Our platform simplifies the eSigning process, allowing you to focus more on your business while ensuring compliance with tax regulations.

-

Is airSlate SignNow secure for handling PIT PV New Mexico Personal Income Tax TaxFormFinder org documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your PIT PV New Mexico Personal Income Tax TaxFormFinder org documents. With features like encryption and secure access controls, you can trust that your sensitive information is safe throughout the signing and submission process.

Get more for PIT PV New Mexico Personal Income Tax TaxFormFinder org

- State and consumer services agency department of consumer affairs governor edmund g pharmacy ca form

- Cdph 8631 form

- App water treatment form

- State of california secretary of state registration of trademark form

- De1378n form

- Lic 9215 form

- Dmv pull notice form

- Certification of sales under special conditions 794877309 form

Find out other PIT PV New Mexico Personal Income Tax TaxFormFinder org

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast